Wells Fargo 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

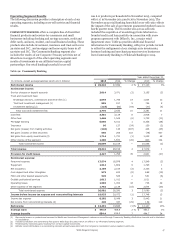

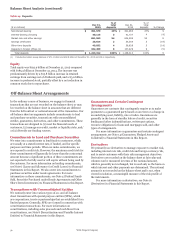

Earnings Performance (continued)

Table 9e: Retail Brokerage Advisory Account Client Assets

(in billions)

Client

directed (1)

Financial

advisor

directed (2)

Separate

accounts (3)

Mutual fund

advisory (4)

Total advisory

client assets

Balance, December 31, 2012 $ 119.3 54.5 77.1 46.8 297.7

Inflows (5)

Outflows (6)

Market impact (7)

42.8

(31.2)

13.6

16.8

(11.7)

12.0

24.0

(15.7)

14.5

13.3

(8.7)

7.4

96.9

(67.3)

47.5

Balance, December 31, 2013 $ 144.5 71.6 99.9 58.8 374.8

Inflows (5)

Outflows (6)

Market impact (7)

41.6

(31.8)

5.5

18.4

(13.4)

8.8

23.1

(18.3)

6.0

14.6

(9.7)

3.2

97.7

(73.2)

23.5

Balance, December 31, 2014 $ 159.8 85.4 110.7 66.9 422.8

Inflows (5)

Outflows (6)

Market impact (7)

38.7

(37.3)

(6.5)

20.7

(17.5)

3.3

21.6

(20.5)

(1.4)

10.4

(12.2)

(2.2)

91.4

(87.5)

(6.8)

Balance, December 31, 2015 $ 154.7 91.9 110.4 62.9 419.9

(1) Investment advice and other services are provided to client, but decisions are made by the client and the fees earned are based on a percentage of the advisory account

assets, not the number and size of transactions executed by the client.

(2) Professionally managed portfolios with fees earned based on respective strategies and as a percentage of certain client assets.

(3) Professional advisory portfolios managed by Wells Fargo asset management advisors or third-party asset managers. Fees are earned based on a percentage of certain client

assets.

(4) Program with portfolios constructed of load-waived, no-load and institutional share class mutual funds. Fees are earned based on a percentage of certain client assets.

(5) Inflows include new advisory account assets, contributions, dividends and interest.

(6) Outflows include withdrawals, closed accounts’ assets and client management fees.

(7) Market impact reflects gains and losses on portfolio investments.

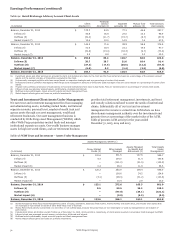

Trust and Investment Client Assets Under Management provides total retirement management, investments, and trust

We earn trust and investment management fees from managing and custody solutions tailored to meet the needs of institutional

and administering assets, including mutual funds, institutional clients. Substantially all of our trust and investment

separate accounts, personal trust, employee benefit trust and management fee income is earned from AUM where we have

agency assets through our asset management, wealth and discretionary management authority over the investments and

retirement businesses. Our asset management business is generate fees as a percentage of the market value of the AUM.

conducted by Wells Fargo Asset Management (WFAM), which Table 9f presents AUM activity for the years ended

offers Wells Fargo proprietary mutual funds and manages December 31, 2015, 2014 and 2013.

institutional separate accounts. Our wealth business manages

assets for high net worth clients, and our retirement business

Table 9f: WIM Trust and Investment – Assets Under Management

Assets Managed by WFAM (1)

(in billions)

Money Market

Funds (2)

Other Assets

Managed

Assets Managed

by Wealth and

Retirement (3)

Total Assets

Under

Management

Balance, December 31, 2012

Inflows (4)

Outflows (5)

Market impact (6)

$ 120.6

5.4

—

0.2

331.5

104.0

(101.0)

26.4

147.6

31.4

(31.5)

11.9

599.7

140.8

(132.5)

38.5

Balance, December 31, 2013 $ 126.2 360.9 159.4 646.5

Inflows (4) — 100.6 34.2 134.8

Outflows (5) (3.1) (99.3) (31.2) (133.6)

Market impact (6) — 10.4 2.9 13.3

Balance, December 31, 2014 $ 123.1 372.6 165.3 661.0

Inflows (4) 0.5 93.5 36.2 130.2

Outflows (5) — (97.0) (34.1) (131.1)

Market impact (6) — (3.0) (5.3) (8.3)

Balance, December 31, 2015 $ 123.6 366.1 162.1 651.8

(1) Assets managed by Wells Fargo Asset Management consist of equity, alternative, balanced, fixed income, money market, and stable value, and include client assets that

are managed or sub-advised on behalf of other Wells Fargo lines of business.

(2) Money Market fund activity is presented on a net inflow or net outflow basis, because the gross flows are not meaningful nor used by management as an indicator of

performance.

(3) Includes $8.2 billion, $8.9 billion and $8.7 billion as of December 31, 2015, 2014 and 2013, respectively, of client assets invested in proprietary funds managed by WFAM.

(4) Inflows include new managed account assets, contributions, dividends and interest.

(5) Outflows include withdrawals, closed accounts’ assets and client management fees.

(6) Market impact reflects gains and losses on portfolio investments.

Wells Fargo & Company

52