Wells Fargo 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 Annual Report|

Earning lifelong relationships,

one customer at a time, is fundamental

to achieving our vision, which is to

“satisfy our customers’ financial needs

and help them succeed financially.”

Whether we’re helping a student open

a first checking account, a young

family purchase a home, a business

owner expand, or a retiree manage

investments, we are on our customers’

side, oering them the products

and services they want and need.

We believe the best way we can

earn our customers’ business is

to listen and understand their needs.

Consider Biltmore, one of America’s

most beautiful historic estates

and a popular tourist attraction,

built by George Vanderbilt in 1895

in the Blue Ridge Mountains

of North Carolina. At the turn

of the 20th century, the Vanderbilt

family used Wells Fargo for transport

along the East Coast, and they later

formed a banking relationship with

us. Through listening to and working

with The Biltmore Company, we have

provided loans and financial services

to help the business grow. Today,

Biltmore draws more than 1.4 million

visitors annually and includes not

only an inn and hotel, but also

a village with restaurants and retail

shops, a winery, branded retail

products, and a solar farm.

Earning relationships and helping

customers like The Biltmore Company

are the core of our business. We are

honored to have relationships with

one in three U.S. households. We lend

more money to help individuals and

families buy homes than any other

American company. We are the nation’s

top lender to small businesses, based

on Community Reinvestment Act data.

We are the largest lender

to mid-sized companies, and we

help large companies with their

domestic and global needs through

our oces in 36 countries.

Our leading position across many

of our businesses is important because

it reflects how well we are serving our

customers — individuals, households,

businesses, and corporations —

who make up the “real economy.”

We never take for granted the trust

our customers have placed in us,

and we understand the important

role we play in helping grow the U.S.

economy. If we serve our customers

well and manage our business

eectively and eciently, we also

will grow and succeed as a company.

As we like to say, we never put the

stagecoach ahead of the horses!

We never take for

granted the trust

our customers have

placed in us, and

we understand the

important role we

play in helping grow

the U.S. economy.

Financial results

Our focus on customers, as well

as our diversified business model

and strong risk discipline, helped

us to produce another solid year

of financial performance in 2015,

even as we navigated the pressures

of low interest rates and global

economic volatility.

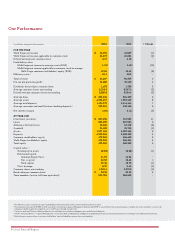

Wells Fargo generated $86.1 billion

in revenue in 2015, up 2 percent from

2014. Our time-tested business model

— which produced a balanced mix

of net interest income and noninterest

income across more than 90 businesses

— allowed us to deliver consistent

performance despite the challenging

environment.

Our 2015 net income was $22.9 billion,

and our diluted earnings per common

share of $4.12 represented a $0.02

increase from 2014. Our 2015 return

on assets was 1.31 percent, and our

return on equity was 12.60 percent.

At year-end, our total deposits reached

a record $1.2 trillion, up 5 percent from

the prior year, driven by both consumer

and commercial growth. Total loans

finished 2015 at $916.6 billion,

up 6 percent from 2014, making our

loan portfolio the largest among U.S.

banks. We saw growth in commercial

loans, residential mortgages, credit

cards, and automobile lending while

maintaining our strong credit and

pricing discipline.

In fact, the credit quality of our

portfolio proved to be about as good as

I’ve seen in my 34 years at Wells Fargo.

Credit losses of $2.9 billion improved

2 percent from 2014. Net charge-os

as a percentage of average loans

remained near historic lows —

0.33 percent in 2015, compared

with 0.35 percent in 2014.

We also continued to strengthen

our balance sheet in 2015 and ended

the year with our highest-ever levels

of capital and liquidity. We finished

2015 with total equity of $193.9 billion,

Common Equity Tier 1 capital

of $142.4 billion, and a Common

Equity Tier 1 ratio (fully phased-in)

of 10.77 percent.1

1 For more information on our regulatory capital and related ratios, please see the “Financial Review — Capital Management” section in this Report.