Wells Fargo 2015 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

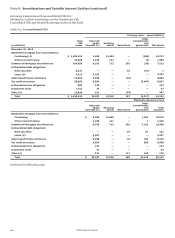

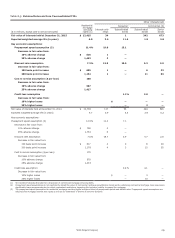

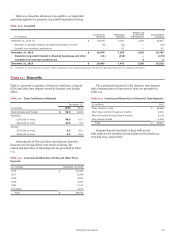

Note 8: Securitizations and Variable Interest Entities (continued)

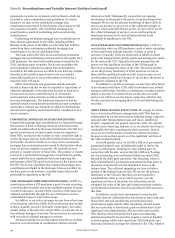

In addition to residential mortgage servicing rights (MSRs)

included in the previous table, we have a small portfolio of

commercial MSRs with a fair value of $1.7 billion and

$1.6 billion at December 31, 2015 and 2014, respectively. The

nature of our commercial MSRs, which are carried at LOCOM, is

different from our residential MSRs. Prepayment activity on

serviced loans does not significantly impact the value of

commercial MSRs because, unlike residential mortgages,

commercial mortgages experience significantly lower

prepayments due to certain contractual restrictions, impacting

the borrower’s ability to prepay the mortgage. Additionally, for

our commercial MSR portfolio, we are typically master/primary

servicer, but not the special servicer, who is separately

responsible for the servicing and workout of delinquent and

foreclosed loans. It is the special servicer, similar to our role as

servicer of residential mortgage loans, who is affected by higher

servicing and foreclosure costs due to an increase in delinquent

and foreclosed loans. Accordingly, prepayment speeds and costs

to service are not key assumptions for commercial MSRs as they

do not significantly impact the valuation. The primary economic

driver impacting the fair value of our commercial MSRs is

forward interest rates, which are derived from market

observable yield curves used to price capital markets

instruments. Market interest rates most significantly affect

interest earned on custodial deposit balances. The sensitivity of

the current fair value to an immediate adverse 25% change in the

assumption about interest earned on deposit balances at

December 31, 2015, and 2014, results in a decrease in fair value

of $150 million and $185 million, respectively. See Note 9

(Mortgage Banking Activities) for further information on our

commercial MSRs.

We also have a loan to an unconsolidated third party VIE

that we extended in fourth quarter 2014 in conjunction with our

sale of government guaranteed student loans. The loan is carried

at amortized cost and approximates fair value at December 31,

2015 and 2014. The carrying amount of the loan at December 31,

2015 and 2014, was $4.9 billion and $6.5 billion, respectively.

The estimated fair value of the loan is considered a Level 3

measurement that is determined using discounted cash flows

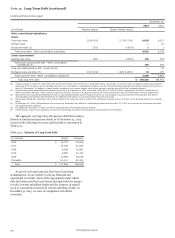

Table 8.6: Off-Balance Sheet Loans Sold or Securitized

that are based on changes in the discount rate due to changes in

the risk premium component (credit spreads). The primary

economic assumption impacting the fair value of our loan is the

discount rate. Changes in the credit loss assumption are not

expected to affect the estimated fair value of the loan due to the

government guarantee of the underlying collateral. The

sensitivity of the current fair value to an immediate adverse

increase of 200 basis points in the risk premium component of

the discount rate assumption is a decrease in fair value of

$82 million and $130 million at December 31, 2015 and 2014,

respectively. For more information on the student loan sale, see

the discussion on Asset-Based Finance Structures earlier in this

Note.

The sensitivities in the preceding paragraphs and table are

hypothetical and caution should be exercised when relying on

this data. Changes in value based on variations in assumptions

generally cannot be extrapolated because the relationship of the

change in the assumption to the change in value may not be

linear. Also, the effect of a variation in a particular assumption

on the value of the other interests held is calculated

independently without changing any other assumptions. In

reality, changes in one factor may result in changes in others (for

example, changes in prepayment speed estimates could result in

changes in the credit losses), which might magnify or counteract

the sensitivities.

Off-Balance Sheet Loans

Table 8.6 presents information about the principal balances of

off-balance sheet loans that were sold or securitized, including

residential mortgage loans sold to FNMA, FHLMC, GNMA and

other investors, for which we have some form of continuing

involvement (primarily servicer). Delinquent loans include loans

90 days or more past due and loans in bankruptcy, regardless of

delinquency status. For loans sold or securitized where servicing

is our only form of continuing involvement, we would only

experience a loss if we were required to repurchase a delinquent

loan or foreclosed asset due to a breach in representations and

warranties associated with our loan sale or servicing contracts.

Net charge-offs

Delinquent loans and

Total loans foreclosed assets (1) Year ended

December 31, December 31, December 31,

(in millions) 2015 2014 2015 2014 2015 2014

Commercial:

Real estate mortgage $ 110,815 114,081 6,670 7,949 383 621

Total commercial 110,815 114,081 6,670 7,949 383

Consumer:

Real estate 1-4 family first mortgage 1,235,662 1,322,136 20,904 28,639 814 1,209

Real estate 1-4 family junior lien mortgage — 1 — — — —

Other revolving credit and installment — 1,599 — 75 —

Total consumer 1,235,662 1,323,736 20,904 28,714 814 1,210

Total off-balance sheet sold or securitized loans (2) $ 1,346,477 1,437,817 27,574 36,663 1,197 1,831

(1) Includes $5.0 billion and $3.3 billion of commercial foreclosed assets and $2.2 billion and $2.7 billion of consumer foreclosed assets at December 31, 2015 and 2014,

respectively.

(2) At December 31, 2015 and 2014, the table includes total loans of $1.2 trillion and $1.3 trillion, delinquent loans of $12.1 billion and $16.5 billion, and foreclosed assets of

$1.7 billion and $2.4 billion, respectively, for FNMA, FHLMC and GNMA. Net charge-offs exclude loans sold to FNMA, FHLMC and GNMA as we do not service or manage the

underlying real estate upon foreclosure and, as such, do not have access to net charge-off information.

Wells Fargo & Company

621

1

190