Wells Fargo 2015 Annual Report Download - page 204

Download and view the complete annual report

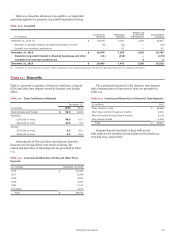

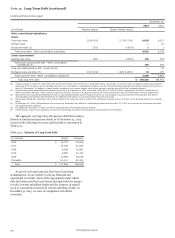

Please find page 204 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 14: Guarantees, Pledged Assets and Collateral (continued)

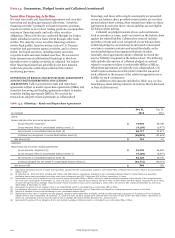

SECURITIES LENDING AND OTHER INDEMNIFICATIONS As

a securities lending agent, we lend debt and equity securities

from participating institutional clients’ portfolios to third-party

borrowers. These arrangements are for an indefinite period of

time, and we indemnify our clients against default by the

borrower in returning these lent securities. This indemnity is

supported by collateral received from the borrowers and is

generally in the form of cash or highly liquid securities that are

marked to market daily. For the transactions subject to the

indemnifications, the fair value of securities loaned out at

December 31, 2015 and 2014, totaled $0 million and

$211 million, respectively. The fair value of collateral supporting

the loaned securities was $0 million and $218 million at

December 31, 2015 and 2014, respectively.

We use certain third-party clearing agents to clear and settle

transactions on behalf of some of our institutional brokerage

customers. We indemnify the clearing agents against loss that

could occur for non-performance by our customers on

transactions that are not sufficiently collateralized. Transactions

subject to the indemnifications may include customer

obligations related to the settlement of margin accounts and

short positions, such as written call options and securities

borrowing transactions. Outstanding customer obligations were

$352 million and $950 million and the related collateral was

$1.5 billion and $5.6 billion at December 31, 2015 and 2014,

respectively. Our estimate of maximum exposure to loss, which

requires judgment regarding the range and likelihood of future

events, was $1.8 billion as of December 31, 2015, and $5.7 billion

as of December 31, 2014.

We enter into other types of indemnification agreements in

the ordinary course of business under which we agree to

indemnify third parties against any damages, losses and

expenses incurred in connection with legal and other

proceedings arising from relationships or transactions with us.

These relationships or transactions include those arising from

service as a director or officer of the Company, underwriting

agreements relating to our securities, acquisition agreements

and various other business transactions or arrangements.

Because the extent of our obligations under these agreements

depends entirely upon the occurrence of future events, we are

unable to determine our potential future liability under these

agreements. We do, however, record a liability for residential

mortgage loans that we expect to repurchase pursuant to various

representations and warranties. See Note 9 (Mortgage Banking

Activities) for additional information on the liability for

mortgage loan repurchase losses.

WRITTEN PUT OPTIONS Written put options are contracts

that give the counterparty the right to sell to us an underlying

instrument held by the counterparty at a specified price and may

include options, floors, caps and credit default swaps. These

written put option contracts generally permit net settlement.

While these derivative transactions expose us to risk if the option

is exercised, we manage this risk by entering into offsetting

trades or by taking short positions in the underlying instrument.

We offset substantially all put options written to customers with

purchased options. Additionally, for certain of these contracts,

we require the counterparty to pledge the underlying instrument

as collateral for the transaction. Our ultimate obligation under

written put options is based on future market conditions and is

only quantifiable at settlement. See Note 16 (Derivatives) for

additional information regarding written derivative contracts.

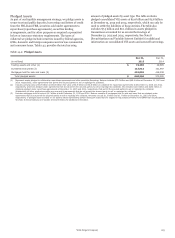

LOANS AND MHFS SOLD WITH RECOURSE In certain loan

sales or securitizations, we provide recourse to the buyer

whereby we are required to indemnify the buyer for any loss on

the loan up to par value plus accrued interest. We provide

recourse, predominantly to the GSEs, on loans sold under

various programs and arrangements. Predominantly all of these

programs and arrangements require that we share in the loans’

credit exposure for their remaining life by providing recourse to

the GSE, up to 33.33% of actual losses incurred on a pro-rata

basis in the event of borrower default. Under the remaining

recourse programs and arrangements, if certain events occur

within a specified period of time from transfer date, we have to

provide limited recourse to the buyer to indemnify them for

losses incurred for the remaining life of the loans. The maximum

exposure to loss reported in the accompanying table represents

the outstanding principal balance of the loans sold or securitized

that are subject to recourse provisions or the maximum losses

per the contractual agreements. However, we believe the

likelihood of loss of the entire balance due to these recourse

agreements is remote, and amounts paid can be recovered in

whole or in part from the sale of collateral. During 2015 and

2014 we repurchased $6 million and $14 million, respectively, of

loans associated with these agreements. We also provide

representation and warranty guarantees on loans sold under the

various recourse programs and arrangements. Our loss exposure

relative to these guarantees is separately considered and

provided for, as necessary, in determination of our liability for

loan repurchases due to breaches of representation and

warranties. See Note 9 (Mortgage Banking Activities) for

additional information on the liability for mortgage loan

repurchase losses.

FACTORING GUARANTEES Under certain factoring

arrangements, we are required to purchase trade receivables

from third parties, generally upon their request, if receivable

debtors default on their payment obligations.

OTHER GUARANTEES We are members of exchanges and

clearing houses that we use to clear our trades and those of our

customers. It is common that all members in these organizations

are required to collectively guarantee the performance of other

members. Our obligations under the guarantees are based on

either a fixed amount or a multiple of the collateral we are

required to maintain with these organizations. We have not

recorded a liability for these arrangements as of the dates

presented in the previous table because we believe the likelihood

of loss is remote.

Other guarantees also include liquidity agreements and

contingent performance arrangements. We provide liquidity to

certain off-balance sheet entities that hold securitized fixed-rate

municipal bonds and consumer or commercial assets that are

partially funded with the issuance of money market and other

short-term notes. See Note 8 (Securitization and Variable

Interest Entities) for additional information on securitization

and VIEs.

Under our contingent performance arrangements, we are

required to pay the counterparties to transactions related to

various customer relationships and lease agreements if third

parties default on certain obligations.

Wells Fargo & Company

202