Wells Fargo 2015 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

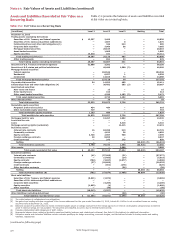

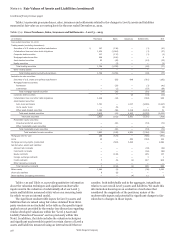

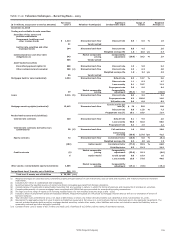

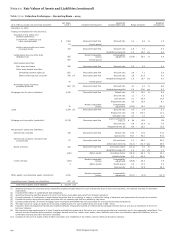

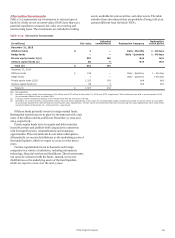

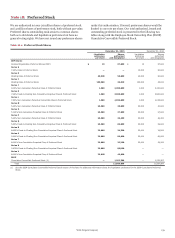

Table 17.10: Valuation Techniques – Recurring Basis – 2015

($ in millions, except cost to service amounts)

Fair Value

Level 3 Valuation Technique(s)

Significant

Unobservable Input

Range of

Inputs

Weighted

Average (1)

December 31, 2015

Trading and available-for-sale securities:

Securities of U.S. states and

political subdivisions:

Government, healthcare and

other revenue bonds $ 1,213 Discounted cash flow Discount rate 0.8 -5.6 % 1.9

51 Vendor priced

Auction rate securities and other

municipal bonds 244 Discounted cash flow Discount rate 0.8 -4.5 2.0

Weighted average life 1.0 -10.0 yrs 4.7

Collateralized loan and other debt Market comparable Comparability

obligations (2) 343 pricing adjustment (20.0) -20.3 % 2.9

565 Vendor priced

Asset-backed securities:

Diversified payment rights (3) 608 Discounted cash flow Discount rate 1.0 -5.0 3.2

Other commercial and consumer 508 (4) Discounted cash flow Discount rate 2.5 -6.3 3.8

Weighted average life 1.0 -9.4 yrs 4.3

66 Vendor priced

Mortgages held for sale (residential) 1,033 Discounted cash flow Default rate 0.5 -13.7 % 3.6

Discount rate 1.1 -6.3 4.7

Loss severity 0.1 -22.7 11.2

Prepayment rate 2.6 -9.6 6.4

Market comparable Comparability

49 pricing adjustment (53.3) -0.0 (32.6)

Loans 5,316 (5) Discounted cash flow Discount rate 0.0 -3.9 3.1

Prepayment rate 0.2 -100.0 14.6

Utilization rate 0.0 -0.8 0.3

Mortgage servicing rights (residential) 12,415 Discounted cash flow

Cost to service per

loan (6) $ 70 -599 168

Discount rate 6.8 -11.8 % 7.3

Prepayment rate (7) 10.1 -18.9 11.4

Net derivative assets and (liabilities):

Interest rate contracts 230 Discounted cash flow Default rate 0.1 -9.6 2.6

Loss severity 50.0 -50.0 50.0

Prepayment rate 0.3 -2.5 2.2

Interest rate contracts: derivative loan

commitments 58 (8) Discounted cash flow Fall-out factor 1.0 -99.0 18.8

Initial-value

servicing (30.6) -127.0 bps 41.5

Equity contracts 72 Discounted cash flow Conversion factor (10.6) -0.0 % (8.1)

Weighted average life 0.5 -2.0 yrs 1.5

(183) Option model Correlation factor (77.0) -98.5 % 66.0

Volatility factor 6.5 -91.3 24.2

Credit contracts (9)

Market comparable

pricing

Comparability

adjustment (53.6) -18.2 (0.6)

6 Option model Credit spread 0.0 -19.9 1.6

Loss severity 13.0 -73.0 49.6

Other assets: nonmarketable equity investments 3,065 Market comparable

pricing

Comparability

adjustment (19.1) -(5.5) (15.1)

Insignificant Level 3 assets, net of liabilities 516 (9)

Total level 3 assets, net of liabilities $ 26,166 (10)

(1) Weighted averages are calculated using outstanding unpaid principal balance for cash instruments, such as loans and securities, and notional amounts for derivative

instruments.

(2) Includes $257 million of collateralized debt obligations.

(3) Securities backed by specified sources of current and future receivables generated from foreign originators.

(4) Consists largely of investments in asset-backed securities that are revolving in nature, in which the timing of advances and repayments of principal are uncertain.

(5) Consists predominantly of reverse mortgage loans securitized with GNMA that were accounted for as secured borrowing transactions.

(6) The high end of the range of inputs is for servicing modified loans. For non-modified loans the range is $70 - $335.

(7) Includes a blend of prepayment speeds and expected defaults. Prepayment speeds are influenced by mortgage interest rates as well as our estimation of drivers of

borrower behavior.

(8) Total derivative loan commitments were a net asset of $56 million, of which a $2 million derivative liability was classified as level 2 at December 31, 2015.

(9) Represents the aggregate amount of Level 3 assets and liabilities measured at fair value on a recurring basis that are individually and in the aggregate insignificant. The

amount includes corporate debt securities, mortgage-backed securities, certain other assets, other liabilities and certain net derivative assets and liabilities, such as

commodity contracts and other derivative contracts.

(10) Consists of total Level 3 assets of $27.7 billion and total Level 3 liabilities of $1.5 billion, before netting of derivative balances.

Wells Fargo & Company

229