Wells Fargo 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273

|

|

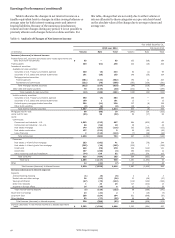

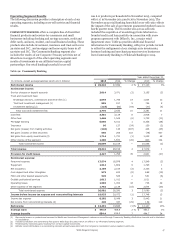

Operating Segment Results

We are organized for management reporting purposes into three

operating segments: Community Banking; Wholesale Banking;

and Wealth and Investment Management (WIM) (formerly

Wealth, Brokerage and Retirement). These segments are defined

by product type and customer segment and their results are

based on our management accounting process, for which there is

no comprehensive, authoritative financial accounting guidance

equivalent to generally accepted accounting principles (GAAP).

During 2015, we realigned our asset management business from

Wholesale Banking to WIM; our reinsurance business from WIM

to Wholesale Banking; and our strategic auto investments,

business banking and merchant payment services businesses

Table 9: Operating Segment Results – Highlights

from Community Banking to Wholesale Banking. These

realignments are part of our regular course of business as we are

always looking for ways to better align our businesses, deepen

existing customer relationships, and create a best-in-class

structure to benefit both our customers and our shareholders.

Results for these operating segments were revised for prior

periods to reflect the impact of these realignments. The following

discussion presents our methodology for measuring cross-sell

for each of our operating segments, and along with Tables 9, 9a,

9b and 9c, present our results by operating segment. For

additional financial information and the underlying

management accounting process, see Note 24 (Operating

Segments) to Financial Statements in this Report.

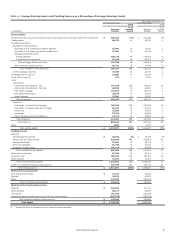

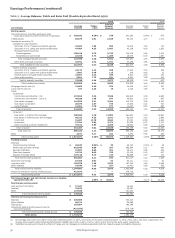

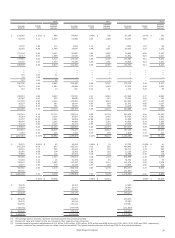

Year ended December 31,

Wealth and

Community Wholesale Investment Consolidated

(in millions, except average balances which are in billions) Banking Banking Management Other (1) Company

2015

Revenue $ 49,341 25,904 15,777 (4,965) 86,057

Provision (reversal of provision) for credit losses 2,427 27 (25) 13 2,442

Net income (loss) 13,491 8,194 2,316 (1,107) 22,894

Average loans $ 475.9 397.3 60.1 (47.9) 885.4

Average deposits 654.4 438.9 172.3 (71.5) 1,194.1

2014

Revenue $ 48,158 25,398 15,269 (4,478) 84,347

Provision (reversal of provision) for credit losses 1,796 (382) (50) 31 1,395

Net income (loss) 13,686 8,199 2,060 (888) 23,057

Average loans $ 468.8 355.6 52.1 (42.1) 834.4

Average deposits 614.3 404.0 163.5 (67.7) 1,114.1

2013

Revenue $ 47,679 25,847 14,330 (4,076) 83,780

Provision (reversal of provision) for credit losses 2,841 (521) (16) 5 2,309

Net income (loss) 12,147 8,752 1,766 (787) 21,878

Average loans $ 465.1 329.0 46.2 (37.6) 802.7

Average deposits 494.7 353.8 158.9 (65.3) 942.1

(1) Includes items not assigned to a specific business segment and elimination of certain items that are included in more than one business segment, substantially all of which

represents products and services for WIM customers served through Community Banking distribution channels.

Wells Fargo & Company

45