Wells Fargo 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|2015 Annual Report

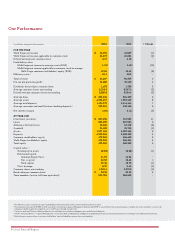

Our financial performance and

balance sheet strength allowed us

to return more capital to shareholders.

In 2015, we returned $12.6 billion to our

shareholders through common stock

dividends and net share repurchases,

reflecting the fifth consecutive year

in which we returned more capital

to shareholders than in the previous

year. We increased our quarterly

common stock dividend rate

by 7 percent to $0.375 per share,

and we repurchased 78.2 million

shares of our common stock on

a net basis. And we again ended

the year as the world’s most valuable

bank by market capitalization.

We also continued to make

strides in improving our company’s

eciency and reinvesting for the

future. In addition to simplifying our

operations, we reduced our travel

costs by 23 percent in 2015,

and we have eliminated more

than 20 million square feet of

occupied real estate since 2009.

We’re investing those savings

in areas such as innovation, risk

management, and cybersecurity.

Another benefit of our company’s

consistent performance is the ability

to be well positioned for strategic

acquisitions to support growth.

We were pleased to announce an

agreement to acquire GE Capital’s

Commercial Distribution Finance

and Vendor Finance platforms,

as well as a portion of its Corporate

Finance business. We anticipate

adding approximately $31 billion

in assets and welcoming about

2,900 GE Capital team members

to Wells Fargo when the transaction

closes. We also acquired GE Railcar

Services, a railcar finance, leasing,

and fleet management business,

on Jan. 1, 2016, and in the second

quarter of 2015 we completed a GE

Capital commercial real estate loan

portfolio transaction, which included

approximately $11.5 billion in loan

purchases and related financing.

These additions should grow

our business and provide greater

opportunities for us to expand

our relationships with customers.

Our financial performance and

customer focus earned us external

recognition in many ways in 2015.

For example, we ranked No. 7

on Barron’s 2015 ranking of the

world’s “100 Most Respected

Companies” — the fourth year in

a row we ranked highest among

all banks on the list. Euromoney

magazine named Wells Fargo

the “Best Bank in the U.S.”

in its 2015 Awards for Excellence.

And The Banker magazine named

Wells Fargo the Best Global and

U.S. Bank of the Year.

WellsFargo is one of the

most valuable companies

intheworld

By market value as of Dec.31, 2015

(inbillions)

Apple

Alphabet

Microsoft

Berkshire Hathaway

ExxonMobil

Amazon.com

Facebook

General Electric

Johnson & Johnson

WellsFargo

JPMorgan Chase

Ind. & Comm. Bank (China)

U.S. companies except where stated

Source: Bloomberg

Relationships are

at the core of our culture

While accolades are rewarding,

our highest honor is the trust that

customers place in us. And trust

is best built through relationships.

No document better captures

our relationship-based culture and

focus on customers than The Vision

& Values of Wells Fargo, which was

first published more than 20 years

ago. (I invite you to read our

Vision & Values at wellsfargo.Com.)

We bring the Vision & Values to life

each day through delivering on our

six priorities: putting customers

first, growing revenue, managing

expenses, living our vision and

values, connecting with communities

and stakeholders, and managing risk.

These priorities also support

our focus on the relationships

with customers, team members,

communities, and shareholders

that are at the heart of our culture.

Earning relationships

with our customers

We work to make every relationship

— new and old — a lasting one

by following a few simple principles.

We put our customers first and

treat them as our valued guests.

We are committed to our customers’

satisfaction and financial success

and to work in their best interest.

In short, we are on our customers’

side. You will read stories about

how we do that in the following

pages, including how we eased

an older couple’s budgeting

concerns and helped a customer

navigate the used-car buying process.

When we follow these principles,

we gain trust and earn relationships

that reach across decades and

generations. Just as our customers

trusted Wells Fargo and our

Abbot Downing-built stagecoaches

to transport their valuables in the

1800s, they trust us today with their

financial needs.

One example is the Hearst family.

We’ve nurtured a relationship with

the Hearsts for more than 100 years.

George Hearst, an entrepreneur and

mining developer, used Wells Fargo

stagecoaches and express services

to transport gold and silver to

U.S. Mints, starting in the 1860s.

His wife, Phoebe, an active investor

and philanthropist, was a Wells Fargo

investment services and trust customer.

Over the years, our relationship

with the Hearsts broadened as their

business grew from its origins

as a mining company and a single

newspaper to become one

of the world’s top private media

and information companies

encompassing more than

360 businesses in 150 countries.

We are honored to help the Hearst

family and business grow through

a broad assortment of products and

services, and today our ties are as