Wells Fargo 2015 Annual Report Download - page 87

Download and view the complete annual report

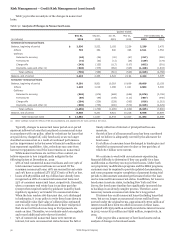

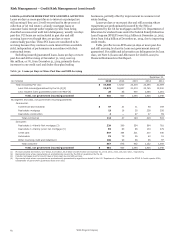

Please find page 87 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition to the allowance for credit losses, there was

$1.9 billion at December 31, 2015, and $2.9 billion at

December 31, 2014, of nonaccretable difference to absorb losses

for PCI loans. The allowance for credit losses is lower than

otherwise would have been required without PCI loan

accounting. As a result of PCI loans, certain ratios of the

Company may not be directly comparable with credit-related

metrics for other financial institutions. Additionally, loans

purchased at fair value generally reflect a lifetime credit loss

adjustment and therefore do not initially require additions to the

allowance as is typically associated with loan growth. For

additional information on PCI loans, see the “Risk Management

– Credit Risk Management – Purchased Credit-Impaired Loans”

section, Note 1 (Summary of Significant Accounting Policies) and

Note 6 (Loans and Allowance for Credit Losses) to Financial

Statements in this Report.

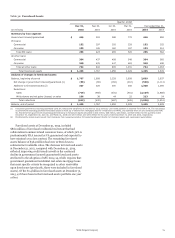

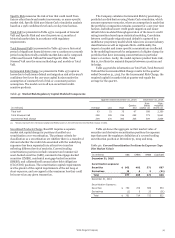

The ratio of the allowance for credit losses to total

nonaccrual loans may fluctuate significantly from period to

period due to such factors as the mix of loan types in the

portfolio, borrower credit strength and the value and

marketability of collateral. Over one-half of our nonaccrual loans

were real estate 1-4 family first and junior lien mortgage loans at

December 31, 2015.

The allowance for credit losses declined in 2015, which

reflected continued credit improvement, particularly in our

residential real estate portfolios and primarily associated with

continued improvement in the housing market, partially offset

by an increase in our commercial allowance to reflect

deterioration in the oil and gas portfolio. The total provision for

credit losses was $2.4 billion in 2015, $1.4 billion in 2014 and

$2.3 billion in 2013. The 2015 provision for credit losses was

$450 million less than net charge-offs, due to strong underlying

credit, and improvement in the housing market. The 2014

provision was $1.6 billion less than net charge-offs, and the 2013

provision was $2.2 billion less than net charge-offs. For each of

2014 and 2013, the provision was influenced by continually

improving credit performance.

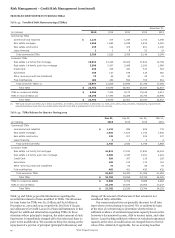

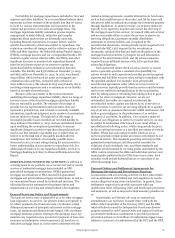

We believe the allowance for credit losses of $12.5 billion at

December 31, 2015, was appropriate to cover credit losses

inherent in the loan portfolio, including unfunded credit

commitments, at that date. Approximately $1.2 billion of the

allowance at December 31, 2015 was allocated to our oil and gas

portfolio, however the entire allowance is available to absorb

credit losses inherent in the total loan portfolio. The allowance

for credit losses is subject to change and reflects existing factors

as of the date of determination, including economic or market

conditions and ongoing internal and external examination

processes. Due to the sensitivity of the allowance for credit losses

to changes in the economic and business environment, it is

possible that we will incur incremental credit losses not

anticipated as of the balance sheet date. Future allowance levels

may increase or decrease based on a variety of factors, including

loan growth, portfolio performance and general economic

conditions. Our process for determining the allowance for credit

losses is discussed in the “Critical Accounting Policies –

Allowance for Credit Losses” section and Note 1 (Summary of

Significant Accounting Policies) to Financial Statements in this

Report.

Wells Fargo & Company

85