Wells Fargo 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273

|

|

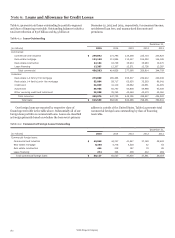

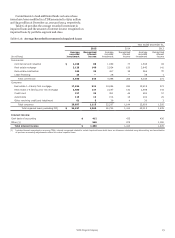

Note 6: Loans and Allowance for Credit Losses (continued)

approximately $75 billion at December 31, 2015 and $87 billion

at December 31, 2014.

We issue commercial letters of credit to assist customers in

purchasing goods or services, typically for international trade. At

December 31, 2015 and 2014, we had $1.1 billion and

$1.2 billion, respectively, of outstanding issued commercial

letters of credit. We also originate multipurpose lending

commitments under which borrowers have the option to draw

on the facility for different purposes in one of several forms,

including a standby letter of credit. See Note 14 (Guarantees,

Pledged Assets and Collateral) for additional information on

standby letters of credit.

When we make commitments, we are exposed to credit risk.

The maximum credit risk for these commitments will generally

be lower than the contractual amount because a significant

portion of these commitments are expected to expire without

being used by the customer. In addition, we manage the

potential risk in commitments to lend by limiting the total

amount of commitments, both by individual customer and in

total, by monitoring the size and maturity structure of these

commitments and by applying the same credit standards for

these commitments as for all of our credit activities.

For loans and commitments to lend, we generally require

collateral or a guarantee. We may require various types of

collateral, including commercial and consumer real estate, autos,

other short-term liquid assets such as accounts receivable or

inventory and long-lived assets, such as equipment and other

business assets. Collateral requirements for each loan or

commitment may vary based on the loan product and our

assessment of a customer’s credit risk according to the specific

credit underwriting, including credit terms and structure.

The contractual amount of our unfunded credit

commitments, including unissued standby and commercial

letters of credit, is summarized by portfolio segment and class of

financing receivable in Table 6.4. The table excludes the standby

and commercial letters of credit and temporary advance

arrangements described above.

Table 6.4: Unfunded Credit Commitments

(in millions)

Dec 31,

2015

Dec 31,

2014

Commercial:

Commercial and industrial $ 296,710 278,093

Real estate mortgage 7,378 6,134

Real estate construction 18,047 15,587

Lease financing — 3

Total commercial 322,135 299,817

Consumer:

Real estate 1-4 family first mortgage 34,621 32,055

Real estate 1-4 family

junior lien mortgage 43,309 45,492

Credit card 98,904 95,062

Other revolving credit and installment 27,899 24,816

Total consumer 204,733 197,425

Total unfunded

credit commitments $526,868 497,242

Wells Fargo & Company

164