Wells Fargo 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

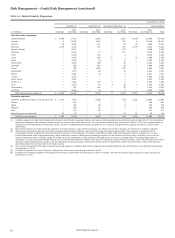

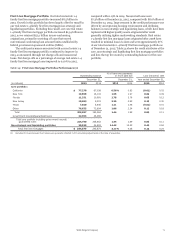

Credit Risk Management

We define credit risk as the risk of loss associated with a

borrower or counterparty default (failure to meet obligations in

accordance with agreed upon terms). Credit risk exists with

many of our assets and exposures such as debt security holdings,

certain derivatives, and loans. The following discussion focuses

on our loan portfolios, which represent the largest component of

assets on our balance sheet for which we have credit risk. Table

17 presents our total loans outstanding by portfolio segment and

class of financing receivable.

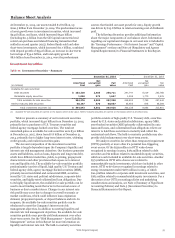

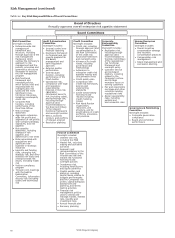

Table 17: Total Loans Outstanding by Portfolio Segment and

Class of Financing Receivable

(in millions)

Dec 31,

2015

Dec 31,

2014

Commercial:

Commercial and industrial $ 299,892 271,795

Real estate mortgage 122,160 111,996

Real estate construction 22,164 18,728

Lease financing 12,367 12,307

Total commercial 456,583 414,826

Consumer:

Real estate 1-4 family first mortgage 273,869 265,386

Real estate 1-4 family junior lien

mortgage 53,004 59,717

Credit card 34,039 31,119

Automobile 59,966 55,740

Other revolving credit and installment 39,098 35,763

Total consumer 459,976 447,725

Total loans $ 916,559 862,551

We manage our credit risk by establishing what we believe

are sound credit policies for underwriting new business, while

monitoring and reviewing the performance of our existing loan

portfolios. We employ various credit risk management and

monitoring activities to mitigate risks associated with multiple

risk factors affecting loans we hold, could acquire or originate

including:

• Loan concentrations and related credit quality

• Counterparty credit risk

• Economic and market conditions

• Legislative or regulatory mandates

• Changes in interest rates

• Merger and acquisition activities

• Reputation risk

Our credit risk management oversight process is governed

centrally, but provides for decentralized management and

accountability by our lines of business. Our overall credit process

includes comprehensive credit policies, disciplined credit

underwriting, frequent and detailed risk measurement and

modeling, extensive credit training programs, and a continual

loan review and audit process.

A key to our credit risk management is adherence to a well-

controlled underwriting process, which we believe is appropriate

for the needs of our customers as well as investors who purchase

the loans or securities collateralized by the loans.

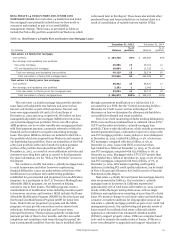

Credit Quality Overview Credit quality remained solid in

2015 due in part to an improving housing market, as well as our

proactive credit risk management activities. We continued to

benefit from improvements in the performance of our residential

real estate portfolio, offset by an increase in our commercial

allowance to reflect continued deterioration in the oil and gas

portfolio. In particular:

• Although commercial nonaccrual loans increased to

$2.4 billion at December 31, 2015, compared with

$2.2 billion at December 31, 2014, consumer nonaccrual

loans declined to $9.0 billion at December 31, 2015,

compared with $10.6 billion at December 31, 2014. The

increase in commercial nonaccrual loans was primarily

driven by continued deterioration in the oil and gas

portfolio, and the decline in consumer nonaccrual loans was

primarily driven by credit improvement in real estate 1-4

family first mortgage loans. Nonaccrual loans represented

1.24% of total loans at December 31, 2015, compared with

1.49% at December 31, 2014.

• Net charge-offs as a percentage of average total loans

improved to 0.33% in 2015, compared with 0.35% in 2014.

Net charge-offs as a percentage of our average commercial

and consumer portfolios were 0.09% and 0.55% in 2015,

respectively, compared with 0.01% and 0.65%, respectively,

in 2014.

• Loans that are not government insured/guaranteed and

90 days or more past due and still accruing were

$114 million and $867 million in our commercial and

consumer portfolios, respectively, at December 31, 2015,

compared with $47 million and $873 million at

December 31, 2014.

• Our provision for credit losses was $2.4 billion during 2015,

compared with $1.4 billion for the same period a year ago.

• The allowance for credit losses decreased to $12.5 billion, or

1.37% of total loans, at December 31, 2015, from

$13.2 billion or 1.53%, at December 31, 2014.

Additional information on our loan portfolios and our credit

quality trends follows.

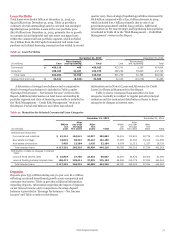

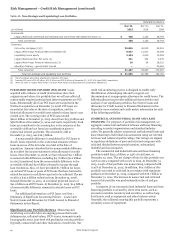

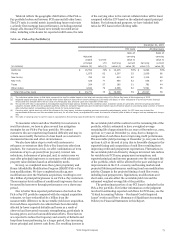

Non-Strategic and Liquidating Loan Portfolios We

continually evaluate and, when appropriate, modify our credit

policies to address appropriate levels of risk. We may designate

certain portfolios and loan products as non-strategic or

liquidating after which we cease their continued origination and

actively work to limit losses and reduce our exposures.

Table 18 identifies our non-strategic and liquidating loan

portfolios. They consist primarily of the Pick-a-Pay mortgage

portfolio and PCI loans acquired from Wachovia, certain

portfolios from legacy Wells Fargo Home Equity and

Wells Fargo Financial, and, through the first half of 2014, our

education finance government guaranteed loan portfolio. We

transferred the government guaranteed student loan portfolio to

loans held for sale at the end of second quarter 2014, and

substantially all of the portfolio was sold as of December 31,

2014. The total balance of our non-strategic and liquidating loan

portfolios has decreased 73% since the merger with Wachovia at

December 31, 2008, and decreased 15% from the end of 2014.

Additional information regarding the liquidating PCI and

Pick-a-Pay loan portfolios is provided in the discussion of loan

portfolios that follows.

Wells Fargo & Company

63