Wells Fargo 2015 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

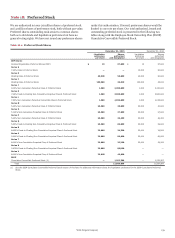

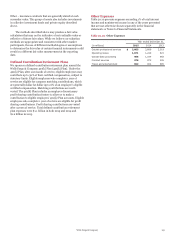

Note 20: Employee Benefits and Other Expenses

Pension and Postretirement Plans

We sponsor a frozen noncontributory qualified defined benefit

retirement plan called the Wells Fargo & Company Cash Balance

Plan (Cash Balance Plan), which covers eligible employees of

Wells Fargo. The Cash Balance Plan was frozen on July 1, 2009

and no new benefits accrue after that date.

Prior to July 1, 2009, eligible employees' Cash Balance Plan

accounts were allocated a compensation credit based on a

percentage of their certified compensation; the freeze

discontinued the allocation of compensation credits after June

30, 2009. Investment credits continue to be allocated to

participants based on their accumulated balances.

We recognize settlement losses for our Cash Balance Plan

based on an assessment of whether our estimated lump sum

payments related to the Cash Balance Plan will, in aggregate for

the year, exceed the sum of its annual service and interest cost

(threshold). Lump sum payments did not exceed this threshold

in 2015 and 2014. In 2013, lump sum payments exceeded this

threshold. Settlement losses of $123 million were recognized in

2013, representing the pro rata portion of the net loss remaining

in cumulative other comprehensive income based on the

percentage reduction in the Cash Balance Plan’s projected

benefit obligation. A remeasurement of the Cash Balance liability

and related plan assets occurs at the end of each quarter in

which settlement losses are recognized.

We did not make a contribution to our Cash Balance Plan in

2015. We do not expect that we will be required to make a

contribution to the Cash Balance Plan in 2016; however, this is

dependent on the finalization of the actuarial valuation in 2016.

Our decision of whether to make a contribution in 2016 will be

based on various factors including the actual investment

performance of plan assets during 2016. Given these

uncertainties, we cannot estimate at this time the amount, if any,

that we will contribute in 2016 to the Cash Balance Plan. For the

nonqualified pension plans and postretirement benefit plans,

there is no minimum required contribution beyond the amount

needed to fund benefit payments; we may contribute more to our

postretirement benefit plans dependent on various factors.

We provide health care and life insurance benefits for

certain retired employees and reserve the right to terminate,

modify or amend any of the benefits at any time.

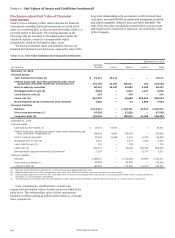

The information set forth in the following tables is based on

current actuarial reports using the measurement date of

December 31 for our pension and postretirement benefit plans.

In 2015 and 2014, the Society of Actuaries (SOA) published

updated mortality tables. The benefit obligations at

December 31, 2015 and 2014, reflect the SOA's updated

mortality tables, which did not have a material effect on these

obligations.

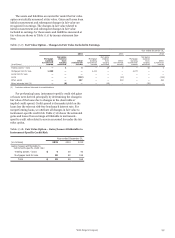

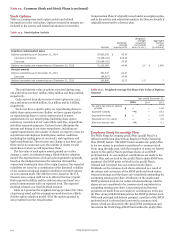

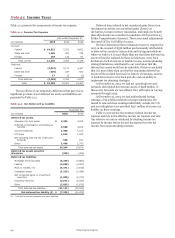

Table 20.1 presents the changes in the benefit obligation

and the fair value of plan assets, the funded status, and the

amounts recognized on the balance sheet.

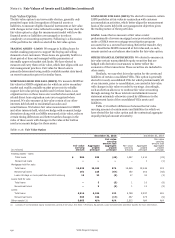

Table 20.1: Changes in Benefit Obligation and Fair Value of Plan Assets

December 31, 2015 December 31, 2014

Pension benefits Pension benefits

Non- Other Non- Other

(in millions) Qualified qualified benefits Qualified qualified benefits

Change in benefit obligation:

Benefit obligation at beginning of year $ 11,125 730 1,100 10,198 669 982

Service cost 2 — 6 1 — 7

Interest cost 429 25 42 465 27 42

Plan participants’ contributions — — 68 — — 73

Actuarial loss (gain) (196) (25) (56) 1,161 89 136

Benefits paid (676) (82) (139) (692) (54) (148)

Medicare Part D subsidy — — 9 — — 9

Curtailment — — (25) — — —

Foreign exchange impact (11) (1) (3) (8) (1) (1)

Benefit obligation at end of year 10,673 647 1,002 11,125 730 1,100

Change in plan assets:

Fair value of plan assets at beginning of year 9,626 — 624 9,409 — 645

Actual return on plan assets (112) — 2 909 — 26

Employer contribution 7 82 4 7 54 19

Plan participants’ contributions — — 68 — — 73

Benefits paid (676) (82) (139) (692) (54) (148)

Medicare Part D subsidy — — 9 — — 9

Foreign exchange impact (9) — — (7) — —

Fair value of plan assets at end of year 8,836 — 568 9,626 — 624

Funded status at end of year $ (1,837) (647) (434) (1,499) (730) (476)

Amounts recognized on the balance sheet at end of year:

Liabilities $ (1,837) (647) (434) (1,499) (730) (476)

Wells Fargo & Company

246