Wells Fargo 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management

Wells Fargo manages a variety of risks that can significantly

affect our financial performance and our ability to meet the

expectations of our customers, stockholders, regulators and

other stakeholders. Among the risks that we manage are

operational risk, credit risk, and asset/liability management

risk, which includes interest rate risk, market risk, and liquidity

and funding risks. Our risk culture is strongly rooted in our

Vision and Values, and in order to succeed in our mission of

satisfying our customers’ financial needs and helping them

succeed financially, our business practices and operating model

must support prudent risk management practices.

Risk Culture

Wells Fargo's risk culture is designed to promote

understanding of our risk profile, transparency of risks across

the Company, effective transfer of information (including the

escalation of important risk issues), and more informed

decision-making. Our risk culture also seeks to foster an

environment that encourages and promotes robust

communication and cooperation among the Company’s three

lines of defense – (1) Wells Fargo’s lines of business and certain

other corporate functions, (2) Corporate Risk, our Company’s

primary second-line of defense led by our Chief Risk Officer

who reports to the Board’s Risk Committee, and (3)

Wells Fargo Audit Services, our internal audit function which is

led by our Chief Auditor who reports to the Board’s Audit and

Examination Committee (A&E Committee). Our risk culture

begins with our Vision and Values and is demonstrated by

setting the appropriate tone at the top, fostering credible

challenge within and among each of our lines of defense, and

developing and maintaining sound incentive compensation risk

management practices.

• Our Vision and Values outlines our vision and our

Company’s six priorities, including putting customers first

and managing risk. Our focus is on earning our customers’

trust, establishing and maintaining deep and enduring

customer relationships, and providing exceptional

Wells Fargo customer experiences, which also means that

we must proactively protect our customers’ financial

security through a risk-focused culture.

• A strong risk culture starts with the tone at the top,

which is set by the Company’s Board of Directors, CEO,

Operating Committee (which consists of our Chief Risk

Officer and other senior executives) and other members of

senior management, and emphasizes a prudent approach

to taking and managing risk. In addition, our business and

risk leaders work with Wells Fargo’s lines of business and

other corporate functions to understand the risks inherent

in our businesses and to consider those risks when making

business and strategic planning decisions.

• We believe a key component of an effective risk

management function is the degree to which all team

members are accountable for risk management and have

the ability to provide credible challenge to business and

risk management decisions, such as communicating an

alternative view, opinion, or strategy, or offering ideas or

alternative approaches that may be equally or more

effective in mitigating risk.

• Wells Fargo’s incentive-based compensation

practices are designed to balance risk and financial

reward in a manner that does not provide team members

with an incentive to take inappropriate risk or act in a way

that is not in the best interest of customers.

Our risk culture is further supported by our Code of Ethics

and Business Conduct. We require all team members to adhere

to the highest standards of ethics and business conduct and

comply with all applicable laws and regulations.

Risk Framework

The Company’s primary risk management objectives are: (a) to

support the Board as it carries out its risk oversight

responsibilities; (b) to support members of senior management

in achieving the Company's strategic objectives and priorities

by maintaining and enhancing our risk framework; and (c) to

maintain and continually promote Wells Fargo’s strong risk

culture, which emphasizes each team member’s accountability

for appropriate risk management. Key elements of our risk

program include:

• Cultivating a strong risk culture, which emphasizes

each team member’s accountability for appropriate risk

management and the Company’s bias for conservatism

through which we strive to maintain a conservative

financial position measured by satisfactory asset quality,

capital levels, funding sources, and diversity of revenues.

• Defining and communicating across the Company an

enterprise-wide statement of risk appetite which

serves to guide business and risk leaders as they manage

risk on a daily basis. The enterprise-wide statement of risk

appetite describes the nature and magnitude of risk that

Wells Fargo is willing to assume in pursuit of its strategic

and business objectives.

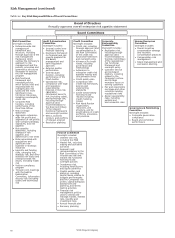

• Maintaining a risk management governance

structure, including escalation protocols and a

management-level committee structure, that enables the

comprehensive oversight of the Company’s risk program

and the effective and efficient escalation of risk issues to

the appropriate level of the Company for information and

decision-making.

• Designing risk frameworks, policies, standards,

procedures, controls, processes, and practices that

are effective and aligned, and facilitate the active and

timely management of current and emerging risks across

the Company.

• Structuring an effective and independent Corporate

Risk function whose primary responsibilities include:

(a) establishing and maintaining an effective risk

framework, (b) maintaining a comprehensive perspective

on the Company’s current and emerging risks, (c) credibly

challenging the intended business and risk management

actions of Wells Fargo’s first-line of defense, and (d)

reviewing risk management programs and practices across

the Company to confirm appropriate coordination and

consistency in the application of effective risk

management approaches.

• Maintaining an independent internal audit function

that is primarily responsible for adopting a systematic,

disciplined approach to evaluating the effectiveness of risk

management, control and governance processes and

activities as well as evaluating risk framework adherence

to relevant regulatory guidelines and appropriateness for

Wells Fargo’s size and risk profile.

Wells Fargo & Company

58