Wells Fargo 2015 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

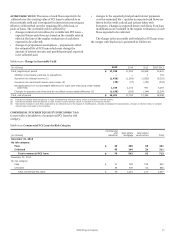

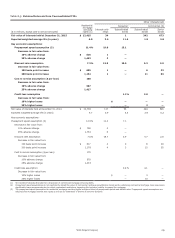

Note 7: Premises, Equipment, Lease Commitments and Other Assets

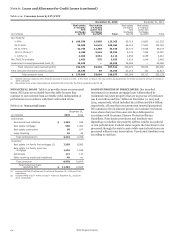

Table 7.1: Premises and Equipment

(in millions) Dec 31,

2015

Dec 31,

2014

Land

Buildings

Furniture and equipment

Leasehold improvements

Premises and equipment leased under

capital leases

$ 1,743

8,479

7,289

2,131

79

1,748

8,155

7,215

2,009

79

Total premises and equipment

Less: Accumulated depreciation and

amortization

19,721

11,017

19,206

10,463

Net book value, premises and

equipment $ 8,704 8,743

Depreciation and amortization expense for premises and

equipment was $1.2 billion in 2015, 2014 and 2013, respectively.

Dispositions of premises and equipment, included in

noninterest expense, resulted in a net gain of $75 million in

2015, a net gain of $28 million in 2014 and a net loss of

$15 million in 2013.

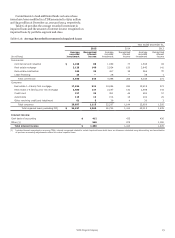

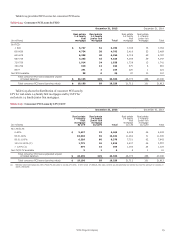

We have obligations under a number of noncancelable

operating leases for premises and equipment. The leases

predominantly expire over the next fifteen years, with the

longest expiring in 2105, and many provide for periodic

adjustment of rentals based on changes in various economic

indicators. Some leases also include a renewal option. Table 7.2

provides the future minimum payments under capital leases and

noncancelable operating leases, net of sublease rentals, with

terms greater than one year as of December 31, 2015.

Table 7.2: Minimum Lease Payments

(in millions)

Operating

leases

Capital

leases

Year ended December 31,

2016 $ 1,131 2

2017 1,026 2

2018 902 3

2019 781 3

2020 628 3

Thereafter 2,234 6

Total minimum lease payments $ 6,702 19

Executory costs $ (7)

Amounts representing interest (4)

Present value of net minimum lease

payments $ 8

Operating lease rental expense (predominantly for

premises), net of rental income, was $1.3 billion, in 2015, 2014

and 2013, respectively.

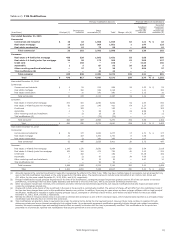

Table 7.3 presents the components of other assets.

Table 7.3: Other Assets

Dec 31, Dec 31,

(in millions) 2015 2014

Nonmarketable equity investments:

Cost method:

Federal bank stock $ 4,814 4,733

Private equity 1,626 2,300

Auction rate securities (1) 595 —

Total cost method 7,035 7,033

Equity method:

LIHTC (2) 8,314 7,278

Private equity 3,300 3,043

Tax-advantaged renewable energy 1,625 1,710

New market tax credit and other 408 379

Total equity method 13,647 12,410

Fair value (3) 3,065 2,512

Total nonmarketable equity

investments 23,747 21,955

Corporate/bank-owned life insurance 19,199 18,982

Accounts receivable (4) 26,251 27,151

Interest receivable 5,065 4,871

Core deposit intangibles 2,539 3,561

Customer relationship and other amortized

intangibles 614 857

Foreclosed assets:

Residential real estate:

Government insured/guaranteed (4) 446 982

Non-government insured/guaranteed 414 671

Non-residential real estate 565 956

Operating lease assets 3,782 2,714

Due from customers on acceptances 273 201

Other (5) 17,887 16,156

Total other assets $ 100,782 99,057

(1) Reflects auction rate perpetual preferred equity securities that were

reclassified during 2015 with a cost basis of $689 million (fair value of

$640 million) from available-for-sale securities because they do not trade on a

qualified exchange.

(2) Represents low income housing tax credit investments.

(3) Represents nonmarketable equity investments for which we have elected the

fair value option. See Note 17 (Fair Values of Assets and Liabilities) for

additional information.

(4) Certain government-guaranteed residential real estate mortgage loans upon

foreclosure are included in Accounts receivable. Both principal and interest

related to these foreclosed real estate assets are collectible because the loans

were predominantly insured by the FHA or guaranteed by the VA.

(5) Includes derivatives designated as hedging instruments, derivatives not

designated as hedging instruments, and derivative loan commitments, which

are carried at fair value. See Note 16 (Derivatives) for additional information.

Wells Fargo & Company

180