Wells Fargo 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

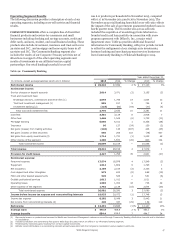

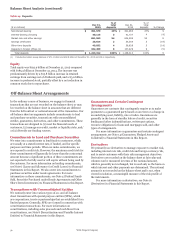

Loan Portfolio

Total loans were $916.6 billion at December 31, 2015, up

$54.0 billion from December 31, 2014. Table 12 provides a

summary of total outstanding loans by core and non-strategic/

liquidating loan portfolios. Loans in the core portfolio grew

$62.8 billion from December 31, 2014, primarily due to growth

in commercial and industrial and real estate mortgage loans

within the commercial loan portfolio segment, which included

$11.5 billion from the GE Capital commercial real estate loan

purchase and related financing transaction that settled in second

Table 12: Loan Portfolios

quarter 2015. Non-strategic/liquidating portfolios decreased by

$8.8 billion compared with a $20.1 billion decrease in 2014,

which included $10.7 billion primarily due to sale of our

government guaranteed student loan portfolio. Additional

information on the non-strategic and liquidating loan portfolios

is included in Table 18 in the “Risk Management – Credit Risk

Management” section in this Report.

December 31, 2015 December 31, 2014

(in millions) Core

Non-strategic

and liquidating Total Core

Non-strategic

and liquidating Total

Commercial $ 456,115 468 456,583 413,701 1,125 414,826

Consumer 408,489 51,487 459,976 388,062 59,663 447,725

Total loans 864,604 51,955 916,559 801,763 60,788 862,551

Change from prior year $ 62,841 (8,833) 54,008 60,343 (20,078) 40,265

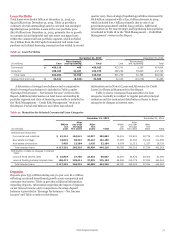

A discussion of average loan balances and a comparative

detail of average loan balances is included in Table 5 under

“Earnings Performance – Net Interest Income” earlier in this

Report. Additional information on total loans outstanding by

portfolio segment and class of financing receivable is included in

the “Risk Management – Credit Risk Management” section in

this Report. Period-end balances and other loan related

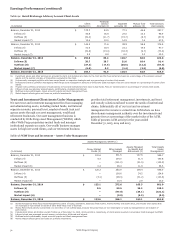

Table 13: Maturities for Selected Commercial Loan Categories

information are in Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements in this Report.

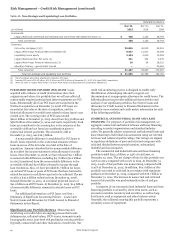

Table 13 shows contractual loan maturities for loan

categories normally not subject to regular periodic principal

reduction and the contractual distribution of loans in those

categories to changes in interest rates.

December 31, 2015 December 31, 2014

After After

(in millions)

Within

one

year

one year

through

five years

After

five

years Total

Within

one

year

one year

through

five years

After

five

years Total

Selected loan maturities:

Commercial and industrial $ 91,214 184,641 24,037 299,892 76,216 172,801 22,778 271,795

Real estate mortgage 18,622 68,391 35,147 122,160 17,485 61,092 33,419 111,996

Real estate construction 7,455 13,284 1,425 22,164 6,079 11,312 1,337 18,728

Total selected loans $ 117,291 266,316 60,609 444,216 99,780 245,205 57,534 402,519

Distribution of loans to changes in interest

rates:

Loans at fixed interest rates $ 16,819 27,705 23,533 68,057 15,574 25,429 20,002 61,005

Loans at floating/variable interest rates 100,472 238,611 37,076 376,159 84,206 219,776 37,532 341,514

Total selected loans $ 117,291 266,316 60,609 444,216 99,780 245,205 57,534 402,519

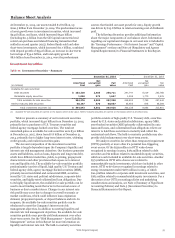

Deposits

Deposits grew $55.0 billion during 2015 to just over $1.2 trillion,

reflecting continued broad-based growth across commercial and

consumer businesses. Table 14 provides additional information

regarding deposits. Information regarding the impact of deposits

on net interest income and a comparison of average deposit

balances is provided in “Earnings Performance – Net Interest

Income” and Table 5 earlier in this Report.

Wells Fargo & Company

55