Wells Fargo 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

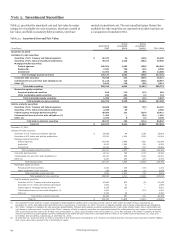

Note 5: Investment Securities

Table 5.1 provides the amortized cost and fair value by major carried at amortized cost. The net unrealized gains (losses) for

categories of available-for-sale securities, which are carried at available-for-sale securities are reported on an after-tax basis as

fair value, and held-to-maturity debt securities, which are a component of cumulative OCI.

Table 5.1: Amortized Cost and Fair Value

(in millions)

Amortized

Cost

Gross

unrealized

gains

Gross

unrealized

losses Fair value

December 31, 2015

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies $ 36,374 24 (148) 36,250

Securities of U.S. states and political subdivisions 49,167 1,325 (502) 49,990

Mortgage-backed securities:

Federal agencies 103,391 1,983 (828) 104,546

Residential 7,843 740 (25) 8,558

Commercial 13,943 230 (85) 14,088

Total mortgage-backed securities 125,177 2,953 (938) 127,192

Corporate debt securities 15,548 312 (449) 15,411

Collateralized loan and other debt obligations (1) 31,210 125 (368) 30,967

Other (2) 5,842 115 (46) 5,911

Total debt securities 263,318 4,854 (2,451) 265,721

Marketable equity securities:

Perpetual preferred securities 819 112 (13) 918

Other marketable equity securities 239 482 (2) 719

Total marketable equity securities

Total available-for-sale securities

1,058

264,376

594

5,448

(15)

(2,466)

1,637

267,358

Held-to-maturity securities:

Securities of U.S. Treasury and federal agencies 44,660 580 (73) 45,167

Securities of U.S. states and political subdivisions 2,185 65 — 2,250

Federal agency mortgage-backed securities 28,604 131 (314) 28,421

Collateralized loans and other debt obligations (1) 1,405 — (24) 1,381

Other (2) 3,343 8 (3) 3,348

Total held-to-maturity securities 80,197 784 (414) 80,567

Total (3) $ 344,573 6,232 (2,880) 347,925

December 31, 2014

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies $ 25,898 44 (138) 25,804

Securities of U.S. states and political subdivisions 43,939 1,504 (499) 44,944

Mortgage-backed securities:

Federal agencies 107,850 2,990 (751) 110,089

Residential 8,213 1,080 (24) 9,269

Commercial 16,248 803 (57) 16,994

Total mortgage-backed securities 132,311 4,873 (832) 136,352

Corporate debt securities

Collateralized loan and other debt obligations (1)

Other (2)

Total debt securities

14,211

25,137

6,251

247,747

745

408

295

7,869

(170)

(184)

(27)

(1,850)

14,786

25,361

6,519

253,766

Marketable equity securities:

Perpetual preferred securities

Other marketable equity securities

Total marketable equity securities

1,622

284

1,906

148

1,694

1,842

(70)

(2)

(72)

1,700

1,976

3,676

Total available-for-sale-securities 249,653 9,711 (1,922) 257,442

Held-to-maturity securities:

Securities of U.S. Treasury and federal agencies 40,886 670 (8) 41,548

Securities of U.S. states and political subdivisions 1,962 27 — 1,989

Federal agency mortgage-backed securities 5,476 165 — 5,641

Collateralized loans and other debt obligations (1) 1,404 — (13) 1,391

Other (2) 5,755 35 — 5,790

Total held-to-maturity securities 55,483 897 (21) 56,359

Total (3) $ 305,136 10,608 (1,943) 313,801

(1) The available-for-sale portfolio includes collateralized debt obligations (CDOs) with a cost basis and fair value of $247 million and $257 million, respectively, at

December 31, 2015, and $364 million and $500 million, respectively, at December 31, 2014. The held-to-maturity portfolio only includes collateralized loan obligations.

(2) The “Other” category of available-for-sale securities predominantly includes asset-backed securities collateralized by credit cards, student loans, home equity loans and

auto leases or loans and cash. Included in the “Other” category of held-to-maturity securities are asset-backed securities collateralized by auto leases or loans and cash

with a cost basis and fair value of $1.9 billion each at December 31, 2015, and $3.8 billion each at December 31, 2014. Also included in the “Other” category of held-to-

maturity securities are asset-backed securities collateralized by dealer floorplan loans with a cost basis and fair value of $1.4 billion each at December 31, 2015, and

$1.9 billion and $2.0 billion, respectively, at December 31, 2014.

(3) At December 31, 2015 and 2014, we held no securities of any single issuer (excluding the U.S. Treasury and federal agencies and government-sponsored entities (GSEs))

with a book value that exceeded 10% of stockholders’ equity.

Wells Fargo & Company

154