Wells Fargo 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

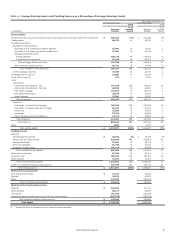

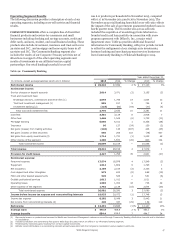

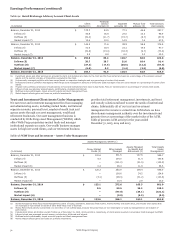

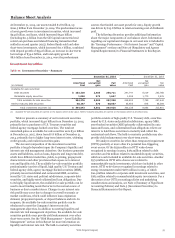

Earnings Performance (continued)

Noninterest Expense

Table 8: Noninterest Expense

Year ended December 31,

(in millions) 2015 2014 2013

Salaries $ 15,883 15,375 15,152

Commission and incentive

compensation 10,352 9,970 9,951

Employee benefits 4,446 4,597 5,033

Equipment 2,063 1,973 1,984

Net occupancy 2,886 2,925 2,895

Core deposit and other intangibles 1,246 1,370 1,504

FDIC and other deposit

assessments 973 928 961

Outside professional services 2,665 2,689 2,519

Operating losses 1,871 1,249 821

Outside data processing 985 1,034 983

Contract services 978 975 935

Postage, stationery and supplies 702 733 756

Travel and entertainment 692 904 885

Advertising and promotion 606 653 610

Insurance 448 422 437

Telecommunications 439 453 482

Foreclosed assets 381 583 605

Operating leases 278 220 204

All other 2,080 1,984 2,125

Total $ 49,974 49,037 48,842

Noninterest expense was $50.0 billion in 2015, up 2% from

$49.0 billion in 2014, which was up slightly from $48.8 billion in

2013. The increase in 2015 was driven predominantly by higher

personnel expenses ($30.7 billion, up from $29.9 billion in

2014) and higher operating losses ($1.9 billion, up from

$1.2 billion in 2014), partially offset by lower travel and

entertainment expense ($692 million, down from $904 million

in 2014) and lower foreclosed assets expense ($381 million,

down from $583 million in 2014). The increase in 2014 from

2013 was driven by higher operating losses and higher outside

professional services, partially offset by lower personnel

expenses.

Personnel expenses, which include salaries, commissions,

incentive compensation and employee benefits, were up

$739 million, or 2%, compared with 2014, due to annual salary

increases, staffing growth across various businesses, and higher

revenue-related incentive compensation. Lower employee

benefits expense was predominantly due to lower deferred

compensation expense (offset in trading revenue), partially

offset by increases in other employee benefits. Personnel

expenses were down 1% in 2014, compared with 2013, due to

lower employee benefits expense, reduced staffing and lower

volume-related compensation in our mortgage business,

partially offset by increased personnel expenses in our non-

mortgage businesses.

Outside professional services in 2015 were flat compared

with 2014, which was up 7% compared with 2013. Many

noninterest expense categories in 2015, including outside

professional services, reflected continued investments in our

products, technology and service delivery, as well as costs for the

heightened industry focus on regulatory compliance and

evolving cybersecurity risk.

Operating losses were up $622 million, or 50%, in 2015

compared with 2014, and up $428 million, or 52%, in 2014

compared with 2013, predominantly due to litigation expense in

each year for various legal matters.

Travel and entertainment expense was down $212 million,

or 23%, in 2015 compared with 2014, primarily driven by travel

expense reduction initiatives. Travel and entertainment expense

remained relatively stable in 2014 compared with 2013.

Foreclosed assets expense was down $202 million, or 35%,

compared with 2014, primarily driven by higher gains on sales of

foreclosed properties, lower write-downs and lower operating

expenses.

All other noninterest expense in 2015 included a

$126 million contribution to the Wells Fargo Foundation.

Our full year 2015 efficiency ratio was 58.1%, compared with

58.1% in 2014 and 58.3% in 2013. The Company expects to

operate at the higher end of its targeted efficiency ratio range of

55-59% for full year 2016.

Income Tax Expense

The 2015 annual effective tax rate was 31.2% compared with

30.9% in 2014 and 32.2% in 2013. The effective tax rate for 2015

included net reductions in reserves for uncertain tax positions

primarily due to audit resolutions of prior period matters with

U.S. federal and state taxing authorities. The effective tax rate for

2014 included a net reduction in the reserve for uncertain tax

positions primarily due to the resolution of prior period matters

with state taxing authorities. The effective tax rate for 2013

included a net reduction in the reserve for uncertain tax

positions primarily due to settlements with authorities regarding

certain cross border transactions and tax benefits recognized

from the realization for tax purposes of a previously written

down investment. See Note 21 (Income Taxes) to Financial

Statements in this Report for additional information about our

income taxes.

Wells Fargo & Company

44