Wells Fargo 2015 Annual Report Download - page 257

Download and view the complete annual report

Please find page 257 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

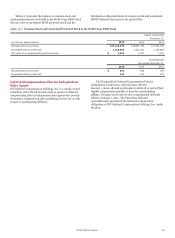

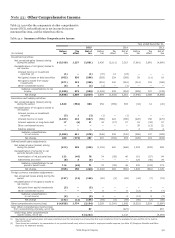

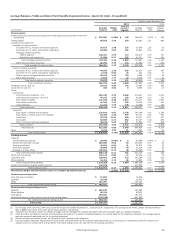

Note 23: Other Comprehensive Income

Table 23.1 provides the components of other comprehensive

income (OCI), reclassifications to net income by income

statement line item, and the related tax effects.

Table 23.1: Summary of Other Comprehensive Income

Year ended December 31,

2015 2014 2013

Before Tax Net of Before Tax Net of Before Tax Net of

(in millions) tax effect tax tax effect tax tax effect tax

Investment securities:

Net unrealized gains (losses) arising

during the period $ (3,318) 1,237 (2,081) 5,426 (2,111) 3,315 (7,661) 2,981 (4,680)

Reclassification of net (gains) losses to

net income:

Interest income on investment

securities (1) (1) — (1) (37) 14 (23) — — —

Net (gains) losses on debt securities (952) 356 (596) (593) 224 (369) 29 (11) 18

Net (gains) losses from equity

investments (571) 213 (358) (901) 340 (561) (314) 118 (196)

Other noninterest income (6) 3 (3) (1) — (1) — — —

Subtotal reclassifications to net

income (1,530) 572 (958) (1,532) 578 (954) (285) 107 (178)

Net change (4,848) 1,809 (3,039) 3,894 (1,533) 2,361 (7,946) 3,088 (4,858)

Derivatives and hedging activities:

Net unrealized gains (losses) arising

during the period 1,549 (584) 965 952 (359) 593 (32) 12 (20)

Reclassification of net (gains) losses to

net income:

Interest income on investment

securities (3) 1 (2) (1) — (1) — — —

Interest income on loans (1,103) 416 (687) (588) 222 (366) (426) 156 (270)

Interest expense on long-term debt 17 (6) 11 44 (17) 27 91 (34) 57

Other noninterest income — — — — — — 35 (13) 22

Salaries expense — — — — — — 4 (2) 2

Subtotal reclassifications

to net income (1,089) 411 (678) (545) 205 (340) (296) 107 (189)

Net change 460 (173) 287 407 (154) 253 (328) 119 (209)

Defined benefit plans adjustments:

Net actuarial gains (losses) arising

during the period (512) 193 (319) (1,116) 420 (696) 1,533 (578) 955

Reclassification of amounts to net

periodic benefit costs (2):

Amortization of net actuarial loss 122 (46) 76 74 (28) 46 151 (57) 94

Settlements and other (8) 3 (5) — — — 125 (46) 79

Subtotal reclassifications to net

periodic benefit costs 114 (43) 71 74 (28) 46 276 (103) 173

Net change (398) 150 (248) (1,042) 392 (650) 1,809 (681) 1,128

Foreign currency translation adjustments:

Net unrealized losses arising during the

period (137) (12) (149) (60) (5) (65) (44) (7) (51)

Reclassification of net (gains) losses to

net income:

Net gains from equity investments (5) — (5) — — — — — —

Other noninterest income — — — 6 — 6 (12) 5 (7)

Subtotal reclassifications

to net income (5) — (5) 6 — 6 (12) 5 (7)

Net change (142) (12) (154) (54) (5) (59) (56) (2) (58)

Other comprehensive income (loss) $ (4,928) 1,774 (3,154) 3,205 (1,300) 1,905 (6,521) 2,524 (3,997)

Less: Other comprehensive income (loss)

from noncontrolling interests, net of tax 67 (227) 267

Wells Fargo other comprehensive

income (loss), net of tax $ (3,221) 2,132 (4,264)

(1) Represents net unrealized gains and losses amortized over the remaining lives of securities that were transferred from the available-for-sale portfolio to the held-to-

maturity portfolio.

(2) These items are included in the computation of net periodic benefit cost, which is recorded in employee benefits expense (see Note 20 (Employee Benefits and Other

Expenses) for additional details).

Wells Fargo & Company

255