Wells Fargo 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

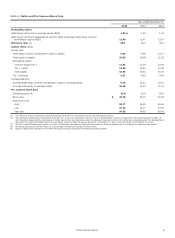

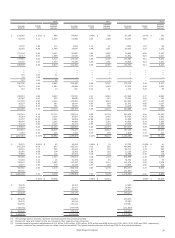

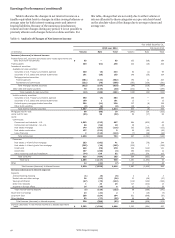

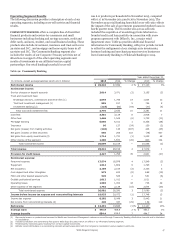

2011 2013 2012

Interest Interest Interest

Average Yields/ income/ Average Yields/ income/ Average Yields/ income/

balance rates expense balance rates expense balance rates expense

$ 154,902 0.32% $ 489 84,081 0.45% $ 378 87,186 0.40% $ 345

44,745 3.14 1,406 41,950 3.29 1,380 39,737 3.68 1,463

6,750 1.66 112 3,604 1.31 47 5,503 1.25 69

39,922 4.38 1,748 34,875 4.48 1,561 24,035 5.09 1,223

107,148 2.83 3,031 92,887 3.12 2,893 74,665 4.36 3,257

30,717 6.47 1,988 33,545 6.75 2,264 31,902 8.20 2,617

137,865 3.64 5,019 126,432 4.08 5,157 106,567 5.51 5,874

55,002 3.53 1,940 49,245 4.04 1,992 38,625 5.03 1,941

239,539 3.68 8,819 214,156 4.09 8,757 174,730 5.21 9,107

— — — — — — — — —

— — — — — — — — —

701 3.09 22 — — — — — —

16 1.99 — — — — — — —

717 3.06 22 — — — — — —

240,256 3.68 8,841 214,156 4.09 8,757 174,730 5.21 9,107

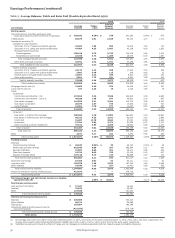

35,273 3.66 1,290 48,955 3.73 1,825 37,232 4.42 1,644

163 7.95 13 661 6.22 41 1,104 5.25 58

185,813 3.66 6,807 173,913 4.01 6,981 157,608 4.37 6,894

40,987 2.03 832 38,838 2.34 910 35,042 2.13 745

107,316 3.94 4,233 105,492 4.19 4,416 102,320 4.07 4,167

16,537 4.76 787 18,047 4.97 897 21,672 4.88 1,057

12,373 6.10 755 13,067 7.18 939 13,223 7.52 994

363,026 3.70 13,414 349,357 4.05 14,143 329,865 4.20 13,857

254,012 4.22 10,717 235,011 4.55 10,704 227,676 4.90 11,156

70,264 4.29 3,014 80,887 4.28 3,460 90,755 4.33 3,930

24,757 12.46 3,084 22,809 12.68 2,892 21,556 13.04 2,811

48,476 6.94 3,365 44,986 7.54 3,390 43,834 8.14 3,568

42,135 4.80 2,024 42,174 4.57 1,928 43,458 4.56 1,980

439,644 5.05 22,204 425,867 5.25 22,374 427,279 5.49 23,445

802,670 4.44 35,618 775,224 4.71 36,517 757,144 4.93 37,302

4,354 5.39 235 4,438 4.70 209 4,929 4.12 203

$ 1,282,363 3.73% $ 47,892 1,169,465 4.20% $ 49,107 1,102,062 4.55% $ 50,122

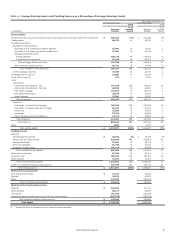

$ 35,570 0.06% $ 22 30,564 0.06% $ 19 47,705 0.08% $ 40

550,394 0.08 450 505,310 0.12 592 464,450 0.18 836

49,510 1.13 559 59,484 1.31 782 69,711 1.43 995

28,090 0.69 194 13,363 1.68 225 13,126 2.04 268

76,894 0.15 112 67,920 0.16 109 61,566 0.22 136

740,458 0.18 1,337 676,641 0.26 1,727 656,558 0.35 2,275

54,716 0.13 71 51,196 0.18 94 51,781 0.18 94

134,937 1.92 2,585 127,547 2.44 3,110 141,079 2.82 3,978

12,471 2.46 307 10,032 2.44 245 10,955 2.88 316

942,582 0.46 4,300 865,416 0.60 5,176 860,373 0.77 6,663

339,781 — — 304,049 — — 241,689 — —

$ 1,282,363 0.33 4,300 1,169,465 0.44 5,176 1,102,062 0.61 6,663

3.40% $ 43,592 3.76% $ 43,931 3.94% $ 43,459

$ 16,272 16,303 17,388

25,637 25,417 24,904

121,711 130,450 125,911

$ 163,620 172,170 168,203

$ 280,229 263,863 215,242

58,178 61,214 57,399

164,994 151,142 137,251

(339,781) (304,049) (241,689)

$ 163,620 172,170 168,203

$ 1,445,983 1,341,635 1,270,265

(3) The average balance amounts represent amortized cost for the periods presented.

(4) Nonaccrual loans and related income are included in their respective loan categories.

(5) Includes taxable-equivalent adjustments of $1.1 billion, $902 million, $792 million, $701 million and $696 million for 2015, 2014, 2013, 2012 and 2011, respectively,

primarily related to tax-exempt income on certain loans and securities. The federal statutory tax rate utilized was 35% for the periods presented.

Wells Fargo & Company

39