Wells Fargo 2015 Annual Report Download - page 45

Download and view the complete annual report

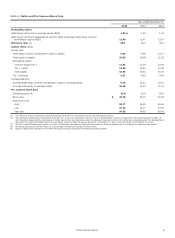

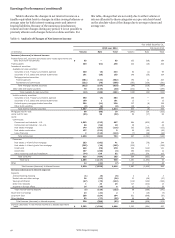

Please find page 45 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We engage in trading activities primarily to accommodate

the investment activities of our customers, and to execute

economic hedging to manage certain components of our balance

sheet risks. Net gains (losses) from trading activities, which

reflect unrealized changes in fair value of our trading positions

and realized gains and losses, were $614 million in 2015,

$1.2 billion in 2014 and $1.6 billion in 2013. The decrease in

2015 was driven by lower economic hedge income, lower trading

from customer accommodation activity, and lower deferred

compensation gains (offset in employee benefits expense). The

decrease in 2014 from 2013 was driven by lower trading from

customer accommodation activity within our capital markets

business and lower deferred compensation gains (offset in

employee benefits expense). Net gains from trading activities do

not include interest and dividend income and expense on trading

securities. Those amounts are reported within interest income

from trading assets and other interest expense from trading

liabilities. For additional information about trading activities,

see the “Risk Management – Asset/Liability Management –

Market Risk – Trading Activities” section in this Report.

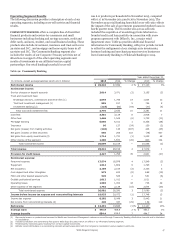

Net gains on debt and equity securities totaled $3.2 billion

for 2015 and $3.0 billion and $1.4 billion for 2014 and 2013,

respectively after other-than-temporary impairment (OTTI)

write-downs of $559 million, $322 million and $344 million,

respectively, for the same periods. The increase in OTTI write-

downs in 2015 mainly reflected deterioration in energy sector

corporate debt and nonmarketable equity investments. The

increase in net gains on debt and equity securities in 2015

compared with 2014 was due to higher net gains on debt

securities combined with continued strong equity markets

throughout the majority of 2015. The increase in net gains on

debt and equity securities in 2014 compared with 2013 reflected

the benefit of strong public and private equity markets.

All other income was $(115) million for 2015 compared with

$456 million in 2014 and $113 million in 2013. All other income

includes ineffectiveness recognized on derivatives that qualify

for hedge accounting, the results of certain economic hedges,

losses on low-income housing tax credit investments, foreign

currency adjustments and income from investments accounted

for under the equity method, any of which can cause decreases

and net losses in other income. The decrease in other income in

2015 compared with 2014 primarily reflected changes in

ineffectiveness recognized on interest rate swaps used to hedge

our exposure to interest rate risk on long-term debt and cross-

currency swaps, cross-currency interest rate swaps and forward

contracts used to hedge our exposure to foreign currency risk

and interest rate risk involving non-U.S. dollar denominated

long-term debt. The decline in other income in 2015 resulting

from these changes in ineffectiveness was partially offset by our

proportionate share of earnings from a merchant services joint

venture that we deconsolidated in 2015. Higher other income for

2014 compared with 2013 primarily reflected larger hedge

ineffectiveness gains on derivatives that qualify for hedge

accounting, a gain on sale of government-guaranteed student

loans in fourth quarter 2014, and a gain on sale of 40 insurance

offices in second quarter 2014 partially offset by lower income

from equity method investments.

Wells Fargo & Company

43