Wells Fargo 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Asset/Liability Management (continued)

An inventory of scenarios is maintained representing both

historical and hypothetical stress events that affect a broad range

of market risk factors with varying degrees of correlation and

differing time horizons. Hypothetical scenarios assess the impact

of large movements in financial variables on portfolio values.

Typical examples include a 1% (100 basis point) increase across

the yield curve or a 10% decline in equity market indexes.

Historical scenarios utilize an event-driven approach: the stress

scenarios are based on plausible but rare events, and the analysis

addresses how these events might affect the risk factors relevant

to a portfolio.

The Company’s stress testing framework is also used in

calculating results in support of the Federal Reserve Board’s

Comprehensive Capital Analysis and Review (CCAR) and

internal stress tests. Stress scenarios are regularly reviewed and

updated to address potential market events or concerns. For

more detail on the CCAR process, see the “Capital Management”

section in this Report.

Regulatory Market Risk Capital is based on U.S. regulatory

agency risk-based capital regulations that are based on the Basel

Committee Capital Accord of the Basel Committee on Banking

Supervision. The Company must calculate regulatory capital

based on the Basel III market risk capital rule, which requires

banking organizations with significant trading activities to adjust

their capital requirements to better account for the market risks

of those activities based on comprehensive and risk sensitive

methods and models. The market risk capital rule is intended to

cover the risk of loss in value of covered positions due to changes

in market conditions.

Composition of Material Portfolio of Covered Positions The

positions that are “covered” by the market risk capital rule are

generally a subset of our trading assets and trading liabilities,

specifically those held by the Company for the purpose of short-

term resale or with the intent of benefiting from actual or

expected short-term price movements, or to lock in arbitrage

profits. Positions excluded from market risk regulatory capital

treatment are subject to the credit risk capital rules applicable to

the “non-covered” trading positions.

The material portfolio of the Company’s “covered” positions

is predominantly concentrated in the trading assets and trading

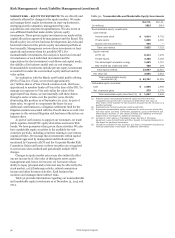

Table 44: Regulatory 10-Day 99% General VaR by Risk Category

liabilities managed within Wholesale Banking where the

substantial portion of market risk capital resides. Wholesale

Banking engages in the fixed income, traded credit, foreign

exchange, equities, and commodities markets businesses. Other

business segments also hold small trading positions covered

under the market risk capital rule.

Regulatory Market Risk Capital Components The capital

required for market risk on the Company’s “covered” positions is

determined by internally developed models or standardized

specific risk charges. The market risk regulatory capital models

are subject to internal model risk management and validation.

The models are continuously monitored and enhanced in

response to changes in market conditions, improvements in

system capabilities, and changes in the Company’s market risk

exposure. The Company is required to obtain and has received

prior written approval from its regulators before using its

internally developed models to calculate the market risk capital

charge.

Basel III prescribes various VaR measures in the

determination of regulatory capital and risk-weighted assets

(RWAs). The Company uses the same VaR models for both

market risk management purposes as well as regulatory capital

calculations. For regulatory purposes, we use the following

metrics to determine the Company’s market risk capital

requirements:

General VaR measures the risk of broad market movements such

as changes in the level of credit spreads, interest rates, equity

prices, commodity prices, and foreign exchange rates. General

VaR uses historical simulation analysis based on 99% confidence

level and a 10-day time horizon.

Table 44 shows the General VaR measure by major risk

categories for Wholesale Banking. Average 10-day Company

Regulatory General VaR was $40 million for the quarter ended

December 31, 2015, compared with $35 million for the quarter

ended September 30, 2015. The increase was primarily driven by

changes in portfolio composition.

Quarter ended

December 31, 2015 September 30, 2015

Period Period

(in millions) end Average Low High end Average Low High

Wholesale Regulatory General VaR Risk Categories

Credit $ 29 38 26 54 45 46 30 61

Interest rate 25 29 21 40 38 45 27 77

Equity 9 7 4 11 7 6 3 13

Commodity 2 3 1 5 1 3 1 5

Foreign exchange 2 2 1 5 2 4 1 6

Diversification benefit (1) (22) (41) (64) (72)

Wholesale Regulatory General VaR $ 45 38 26 54 29 32 21 56

Company Regulatory General VaR 47 40 28 56 31 35 23 58

(1) The period-end VaR was less than the sum of the VaR components described above, which is due to portfolio diversification. The diversification benefit arises because the

risks are not perfectly correlated causing a portfolio of positions to usually be less risky than the sum of the risks of the positions alone. The diversification benefit is not

meaningful for low and high metrics since they may occur on different days.

Wells Fargo & Company

94