Wells Fargo 2015 Annual Report Download - page 269

Download and view the complete annual report

Please find page 269 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our core loan portfolios increased $62.8 billion from the prior

year. Our core loan portfolio growth included $11.5 billion from

the GE Capital commercial real estate loan purchase and related

financing transaction announced in first quarter 2015. We grew

our investment securities portfolio by $34.6 billion in 2015 and

our federal funds sold, securities purchased under resale

agreements and other short-term investments (collectively

referred to as federal funds sold and other short-term

investments elsewhere in this Report) increased by $11.7 billion,

or 5%, during the year. While we believe our liquidity position

continued to remain strong with increased regulatory

expectations, we have added to our position over the past year.

The strength of our balance sheet during 2015 positioned us

for the agreement we announced in third quarter 2015 to

purchase GE Capital's Commercial Distribution Finance and

Vendor Finance businesses as well as a portion of its Corporate

Finance business – an acquisition that will help us serve more

markets and meet more of our customers' financial needs. The

acquisition is expected to include total assets of approximately

$31 billion and is expected to close in two phases. The North

American portion, which represents approximately 90% of total

assets to be acquired, is expected to close late in first quarter

2016. The international portion is expected to close in second

quarter 2016. Also, in January 2016 we closed our purchase of

GE Railcar Services, which included $4.0 billion of operating

and capital leases, comprised of 77,000 railcars and just over

1,000 locomotives that were added to our existing First Union

Rail business. During fourth quarter 2015 we issued long-term

debt to partially fund the anticipated closing of these GE Capital

acquisitions.

Deposit growth remained strong with period-end deposits

up $55.0 billion from 2014. This increase reflected solid growth

across both our commercial and consumer businesses. We grew

our primary consumer checking customers by 5.6% and primary

small business and business banking checking customers by

4.8% from a year ago (November 2015 compared with November

2014). Our ability to grow primary customers is important to our

results because these customers have more interactions with us

and are significantly more profitable than non-primary

customers.

Credit Quality

Credit quality remained strong in 2015, demonstrating the

benefit of our diversified loan portfolio. Solid performance in

several of our commercial and consumer loan portfolios was

evidenced by losses remaining near historically low levels,

reflecting our long-term risk focus. Net charge-offs of

$2.9 billion were 0.33% of average loans, down 2 basis points

from a year ago. Net losses in our commercial portfolio were

$387 million, or 9 basis points of average loans. Net consumer

losses declined to 55 basis points in 2015 from 65 basis points in

2014. Our commercial real estate portfolios were in a net

recovery position for each quarter of the last three years,

reflecting our conservative risk discipline and improved market

conditions. Losses on our consumer real estate portfolios

declined $497 million, or 44%, from a year ago. The consumer

loss levels reflected the benefit of the improving housing market

and our continued focus on originating high quality loans.

Approximately 67% of the consumer first mortgage portfolio was

originated after 2008, when new underwriting standards were

implemented.

Our provision for credit losses in 2015 was $2.4 billion

compared with $1.4 billion a year ago reflecting a release of

$450 million from the allowance for credit losses, compared with

a release of $1.6 billion a year ago. We did not release or build

our allowance in the last half of 2015 as the credit improvement

in our residential real estate portfolios was offset by higher

commercial allowance reflecting deterioration in our oil and gas

portfolio. Total loans in the oil and gas portfolio were down 6%

from a year ago and are now less than 2% of our total loans

outstanding. Approximately $1.2 billion of the allowance at

December 31, 2015 was allocated to our oil and gas portfolio;

however the entire allowance is available to absorb credit losses

inherent in the total loan portfolio. If oil prices remain low for a

prolonged period of time, there could be additional performance

deterioration in our oil and gas portfolio resulting in higher

criticized assets, nonperforming loans, allowance levels and

ultimately credit losses. Deteriorated performance can take the

form of increased downgrades, borrower defaults, potentially

higher commitment drawdowns prior to default, and

downgraded borrowers being unable to fully access the capital

markets. Furthermore, our loan exposure in communities where

the employment base has a concentration in the oil and gas

sector may experience some credit challenges.

Future allowance levels may increase or decrease based on a

variety of factors, including loan growth, portfolio performance

and general economic conditions.

In addition to lower net charge-offs, nonperforming assets

(NPAs) through the end of 2015 have declined for 13 consecutive

quarters and were down $2.7 billion, or 17%, from 2014.

Nonaccrual loans declined $1.5 billion from the prior year while

foreclosed assets were down $1.2 billion from 2014.

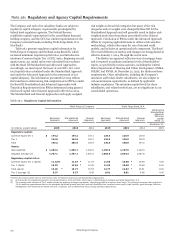

Capital

Our capital levels remained strong in 2015, even as we returned

more capital to our shareholders, with total equity increasing to

$193.9 billion at December 31, 2015, up $8.6 billion from the

prior year. We returned $12.6 billion to shareholders in 2015

($12.5 billion in 2014) through common stock dividends and net

share repurchases and our net payout ratio (which is the ratio of

(i) common stock dividends and share repurchases less

issuances and stock compensation-related items, divided by (ii)

net income applicable to common stock) was 59%. During 2015

we increased our quarterly common stock dividend by 7% to

$0.375 per share. In 2015, our common shares outstanding

declined by 78.2 million shares as we continued to reduce our

common share count through the repurchase of 163.4 million

common shares during the year. We also entered into a

$500 million forward repurchase contract with an unrelated

third party in December 2015 that settled in January 2016 for

9.2 million shares. In addition, we entered into a $750 million

forward repurchase contract with an unrelated third party in

January 2016 that settled in first quarter 2016 for 15.9 million

shares. We expect our share count to continue to decline in 2016

as a result of anticipated net share repurchases.

We believe an important measure of our capital strength is

the Common Equity Tier 1 ratio on a fully phased-in basis, which

increased to 10.77% in 2015 from 10.43% a year ago. Likewise,

our other regulatory capital ratios remained strong. See the

“Capital Management” section in this Report for more

information regarding our capital, including the calculation of

our regulatory capital amounts.

31

Stock Performance

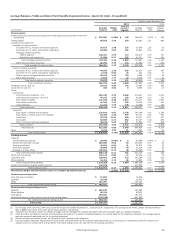

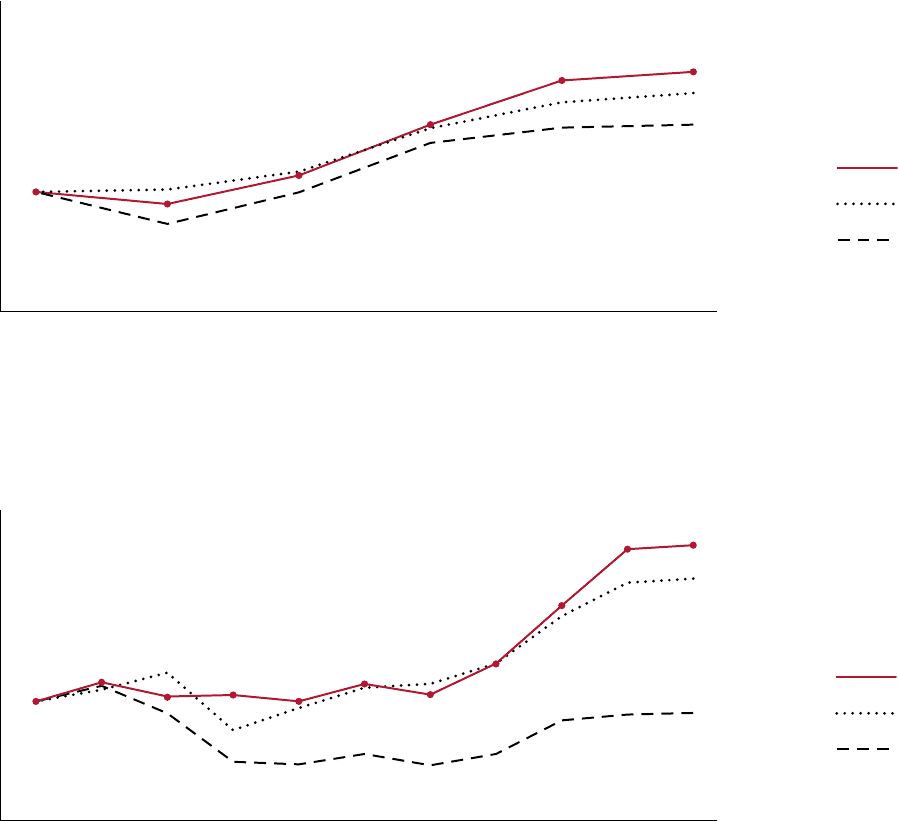

These graphs compare the cumulative total stockholder return and total compound annual growth rate

(CAGR) for our common stock (NYSE: WFC) for the five- and ten-year periods ended December 31, 2015,

with the cumulative total stockholder returns for the same periods for the Keefe, Bruyette and Woods (KBW)

Total Return Bank Index (KBW Nasdaq Bank Index (BKX)) and the S&P 500 Index.

The cumulative total stockholder returns (including reinvested dividends) in the graphs assume the

investment of $100 in Wells Fargo’s common stock, the KBW Nasdaq Bank Index and the S&P 500 Index.

Five Year Performance Graph

Wells Fargo

(WFC)

S&P 500

KBW Nasdaq

Bank Index

$ 80

$140

$120

$100

$ 60

$ 40

$ 20

$160

$180

$200

$220

$240

2010 2011 2012 2013 2014 2015 5-year

CAGR

$100 $91 $115 $158 $195 $199 15% Wells Fargo

100 102 118 157 178 181 13% S&P 500

100 77 102 141 154 155 9% KBW Nasdaq

Bank Index

Ten Year Performance Graph

Wells Fargo

(WFC)

S&P 500

KBW Nasdaq

Bank Index

$ 80

$140

$120

$100

$ 60

$ 40

$ 20

$160

$180

$200

$220

$240

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 10-year

CAGR

$100 $117 $103 $105 $100 $115 $104 $133 $182 $226 $230 9% Wells Fargo

100 116 122 77 97 112 114 133 176 200 203 7% S&P 500

100 117 91 48 47 58 45 59 82 89 90 (1)% KBW Nasdaq

Bank Index

Wells Fargo & Company

267