Wells Fargo 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management Oversight of Risk

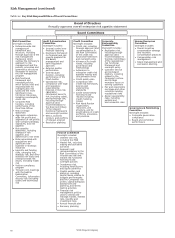

In addition to the Board committees that oversee the

Company's risk management framework, the Company has

established several management-level governance committees

to support Wells Fargo leaders in carrying out their risk

management responsibilities. Each risk-focused governance

committee has a defined set of authorities and responsibilities

specific to one or more risk types. The risk governance

committee structure is designed so that significant risk issues

are considered and, if necessary, decided upon at the

appropriate level of the Company and by the appropriate

leaders.

The Enterprise Risk Management Committee, chaired by

the Wells Fargo Chief Risk Officer, oversees the management

of all risk types across the Company, and additionally provides

primary oversight for reputation risk and strategic risk. The

Enterprise Risk Management Committee reports to the Board's

Risk Committee, and serves as the focal point for risk

governance and oversight at the management level. The

Enterprise Risk Management Committee is responsible for:

monitoring and evaluating the Company’s risk profile relative

to its risk appetite across risk types, businesses, and activities;

providing active oversight of risk mitigation and the adequacy

of risk management resources, skills, and capabilities across

the enterprise; reporting periodically to senior management

and the Board on the most significant current and emerging

risks, risk management issues, initiatives, and concerns; and

addressing key risk issues which are escalated to it by its

members or its reporting committees. The Enterprise Risk

Management Committee annually reviews the Company’s

Strategic Plan, with a primary view toward ensuring alignment

with the Company’s risk appetite.

Our CEO and Operating Committee develop our enterprise

statement of risk appetite in the context of our risk

management framework and culture described above. As part

of Wells Fargo’s risk appetite, we maintain metrics along with

associated objectives to measure and monitor the amount of

risk that the Company is prepared to take. Actual results of

these metrics are reported to the Enterprise Risk Management

Committee on a quarterly basis as well as to the Risk

Committee. Our operating segments also have business-

specific risk appetite statements based on the enterprise

statement of risk appetite. The metrics included in the

operating segment statements are harmonized with the

enterprise level metrics to ensure consistency where

appropriate. Business lines also maintain metrics and

qualitative statements that are unique to their line of business.

This allows for monitoring of risk and definition of risk

appetite deeper within the organization.

A number of management-level governance committees

that are responsible for issues specific to an individual risk type

report into the Enterprise Risk Management Committee. These

governance committees include the:

• Counterparty Credit Risk Committee

• Credit Risk Management Committee

• Enterprise Technology Governance Committee

• Fiduciary & Investment Risk Oversight Committee

• Financial Crimes Risk Committee

• International Oversight Committee

• Legal Entity Governance Committee

• Liquidity Risk Management Oversight Committee

• Market Risk Committee

• Model Risk Committee

• Operational Risk Management Committee, and

• Regulatory Compliance Risk Management Committee

Certain of these governance committees have dual escalation

and/or informational reporting paths to the Board committee

primarily responsible for the oversight of the specific risk type.

In addition, certain management-level risk committees,

including those that oversee risk for Community Banking,

Consumer Lending, WIM, and Wholesale Banking, report into

the Enterprise Risk Management Committee.

While the Enterprise Risk Management Committee and

the committees that report to it serve as the focal point for the

management of enterprise-wide risk issues, the management of

specific risk types is supported by additional management-level

governance committees. These committees include the:

• Ethics & Integrity Oversight Committee, Regulatory and

Risk Reporting Oversight Committee, Capital Reporting

Committee, and SOX Disclosure Committee, which all

report to the Board’s A&E Committee

• Corporate Asset and Liability Committee, Economic

Scenario Approval Committee, and Stress Testing

Oversight Committee, which all report to the Board’s

Finance Committee

• Allowance for Credit Losses Approval Committee, which

reports to the Board’s Credit Committee

• Incentive Compensation Committee, which reports to the

Board’s Human Resources Committee

The Company’s management-level governance committees

collectively help management facilitate enterprise-wide

understanding and monitoring of risks and challenges faced by

the Company.

Management’s Corporate Risk organization, which is the

Company’s primary second-line of defense, is headed by the

Company's Chief Risk Officer who, among other things, is

responsible for setting the strategic direction and driving the

execution of Wells Fargo’s risk management activities.

The Chief Risk Officer, as well as the Chief Risk Officer’s

direct reports, work closely with the Board’s committees and

frequently provide reports and updates to the committees and

the committee chairs on risk issues during and outside of

regular committee meetings, as appropriate.

Wells Fargo & Company

61