Wells Fargo 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

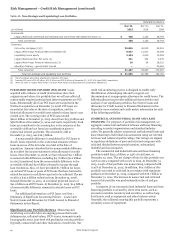

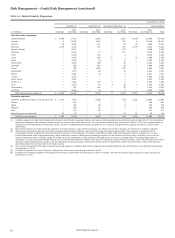

Risk Management – Credit Risk Management (continued)

Junior Lien Mortgage Portfolio The junior lien mortgage

portfolio consists of residential mortgage lines and loans that are

subordinate in rights to an existing lien on the same property. It

is not unusual for these lines and loans to have draw periods,

interest only payments, balloon payments, adjustable rates and

similar features. The majority of our junior lien loan products

are amortizing payment loans with fixed interest rates and

repayment periods between five to 30 years.

We continuously monitor the credit performance of our

junior lien mortgage portfolio for trends and factors that

influence the frequency and severity of loss. We have observed

that the severity of loss for junior lien mortgages is high and

generally not affected by whether we or a third party own or

service the related first lien mortgage, but the frequency of

delinquency is typically lower when we own or service the first

lien mortgage. In general, we have limited information available

on the delinquency status of the third party owned or serviced

senior lien where we also hold a junior lien. To capture this

inherent loss content, we use the experience of our junior lien

mortgages behind delinquent first liens that are owned or

serviced by us adjusted for any observed differences in

delinquency and loss rates associated with junior lien mortgages

behind third party first lien mortgages. We incorporate this

inherent loss content into our allowance for loan losses. Our

allowance process for junior liens considers the relative

difference in loss experience for junior liens behind first lien

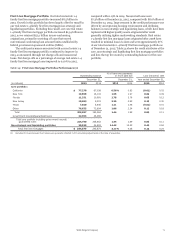

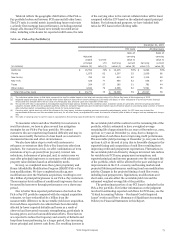

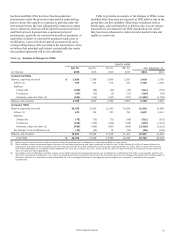

Table 27: Junior Lien Mortgage Portfolios Performance (1)

mortgage loans we own or service, compared with those behind

first lien mortgage loans owned or serviced by third parties. In

addition, our allowance process for junior liens that are current,

but are in their revolving period, considers the inherent loss

where the borrower is delinquent on the corresponding first lien

mortgage loans.

Table 27 shows the credit attributes of the core, non-

strategic and liquidating junior lien mortgage portfolios and lists

the top five states by outstanding balance for the core portfolio.

Loans to California borrowers represent the largest state

concentration in each of these portfolios. The decrease in

outstanding balances since December 31, 2014, predominantly

reflects loan paydowns. As of December 31, 2015, 17% of the

outstanding balance of the junior lien mortgage portfolio was

associated with loans that had a combined loan to value (CLTV)

ratio in excess of 100%. Of those junior liens with a CLTV ratio

in excess of 100%, 2.77% were two payments or more past due.

CLTV means the ratio of the total loan balance of first mortgages

and junior lien mortgages (including unused line amounts for

credit line products) to property collateral value. The unsecured

portion (the outstanding amount that was in excess of the most

recent property collateral value) of the outstanding balances of

these loans totaled 7% of the junior lien mortgage portfolio at

December 31, 2015.

Outstanding balance

% of loans two payments

or more past due Loss rate

December 31, December 31, Year ended December 31,

(in millions) 2015 2014 2015 2014 2015 2014

Core portfolio

California $ 13,776 15,535 1.94% 2.07 0.16 0.48

Florida 4,718 5,283 2.41 2.96 0.82 1.40

New Jersey 4,367 4,705 3.03 3.43 1.06 1.42

Virginia 2,889 3,160 2.02 2.18 0.73 0.84

Pennsylvania 2,721 2,942 2.33 2.72 0.88 1.11

Other 22,181 25,006 2.08 2.20 0.70 0.95

Total 50,652 56,631 2.16 2.36 0.60 0.90

Non-strategic and liquidating portfolios 2,283 2,985 4.56 4.77 2.01 2.74

Total junior lien mortgages $ 52,935 59,616 2.27% 2.49 0.67 1.00

(1) Excludes PCI loans because their losses were generally reflected in PCI accounting adjustments at the date of acquisition.

Wells Fargo & Company

74