Wells Fargo 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Earning lifelong relationships

Wells Fargo & Company Annual Report 2015

Table of contents

-

Page 1

Earning lifelong relationships We l l s Fa r g o & C o m p a n y A n n u a l R e p o r t 2 0 1 5 -

Page 2

'' Earning lifelong relationships, one customer at a time, is fundamental to achieving our vision. '' - John G. Stumpf Chairman and Chief Executive Officer -

Page 3

... Directors, Executive Officers, and Corporate Staff 28 | Senior Business Leaders 29 | 2015 Financial Report - Financial Review - Controls and Procedures - Financial Statements - Report of Independent Registered Public Accounting Firm 267 | Stock Performance 2015 Annual Report | 1 -

Page 4

.... It is in any of the millions of relationships we have formed over generations with customers, team members, communities, and shareholders. "Relationships" define Wells Fargo. JOHN G. STUMPF Chairman and Chief Executive Officer Wells Fargo & Company 2 | 2015 Annual Report -

Page 5

...Whether we're helping a student open a first checking account, a young family purchase a home, a business owner expand, or a retiree manage investments, we are on our customers' side, offering them the products and services they want and need. We believe the best way we can... -

Page 6

...2,900 GE Capital team members to Wells Fargo when the transaction closes. We also acquired GE Railcar Services, a railcar finance, leasing, and fleet management business, on Jan. 1, 2016, and in the second quarter of 2015 we completed a GE Capital commercial real estate loan... -

Page 7

... opportunities, and benefits that include affordable health care options, workÂlife balance programs, 401(k) matching contributions, tuition reimbursement, and a discretionary profit sharing plan. We want all our team members to lead by bringing our vision and values... -

Page 8

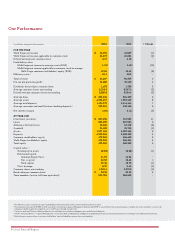

... Average total deposits Average consumer and small business banking deposits 3 Net interest margin AT YEARÂEND Investment securities Loans Allowance for loan losses Goodwill Assets Deposits Common stockholders' equity Wells Fargo stockholders' equity Total equity Capital ratios 4: Total equity to... -

Page 9

...our company donated $275,000 for relief efforts, and our team members staffed a specially designed mobile response unit six days a week, up to 10 hours a day, for customers. That allowed us to provide cash and mortgage assistance, insurance claim check processing, and... -

Page 10

... and online educational resources such as our Smarter Creditâ„¢ center and My Money MapSM, Total Shareholder Return (annualized) Ended Dec. 31, 2015 5yr Rank Wells Fargo Bank of America BB&T Capital One Citigroup Fifth Third Bancorp JPMorgan Chase KeyCorp PNC Financial Services... -

Page 11

online, and mobile banking - work together, integrated with our products, to benefit customers. In 2015, we brought together team members from existing Wells Fargo teams to form a new Innovation Group, a crossÂfunctional organization to help keep us at the leading edge ... -

Page 12

Julian Salazar and Paulette Drake Portland, Oregon 10 | 2015 Annual Report -

Page 13

... them to a Wells Fargo online tool to help the couple track their spending. "Julian took the time on that first visit - and subsequent visits - Paulette and Chris Drake medical care for his young son, Julian said the tool has helped his family manage its money more effectively. Once... -

Page 14

John Martinelli Watsonville, California 12 | 2015 Annual Report -

Page 15

... well as working capital needs." As S. Martinelli & Company looks to vertically integrate and expand its operations, Wells Fargo has been a valuable consultant. Relationship Manager Ryan Pacheco said, "We've been talking with Martinelli's about agriculture lending and lines of credit... -

Page 16

Shyam A. Maharaj Fort Lauderdale, Florida 14 | 2015 Annual Report -

Page 17

... went above and beyond what I could have hoped for in dealing with my situation," said Shyam, a longÂtime Wells Fargo customer. "He took the time to research everything, and I knew he was really working hard on what I needed." Learn more at wellsfargo.com/stories. 2015 Annual Report | 15 -

Page 18

Larry Chavez Albuquerque, New Mexico 16 | 2015 Annual Report -

Page 19

... relationship with Wells Fargo stretches from multiple commercial accounts to financing, merchant services, personal accounts, and investments. The company also relies on Wells Fargo to provide consumer finance options to its customers. "It goes beyond the bank accounts and financing... -

Page 20

Jaejung and Gary Cohen Livingston, New Jersey 18 | 2015 Annual Report -

Page 21

... select documents and received email and text alerts about important milestones. Jaejung, a risk manager for an insurance company, said, "Shane and Brittany did a great job of working with us throughout the process." Shane said, "As phoneÂbased mortgage consultants, we find that... -

Page 22

Paul Hartman and Cheryl Beckman Louisville, Kentucky 20 | 2015 Annual Report -

Page 23

...-Cutrer wines, and others. The company started working with Institutional Retirement and Trust in 2014 after more than a decade of working with the Corporate Banking team on lines of credit and foreign exchange. Paul Hartman, Cheryl Beckman and Andrew Simon 2015 Annual Report | 21 -

Page 24

Karen Spotted Tail Rosebud, South Dakota 22 | 2015 Annual Report -

Page 25

... job training and employment opportunities in solar installation. Since 2007, Wells Fargo has provided Karen Spotted Tail the organization with $4 million in grants, helping it expand services from its home base in California to locations across the U.S. And Wells Fargo team members... -

Page 26

Darnell Shields Chicago, Illinois 24 | 2015 Annual Report -

Page 27

... in school starts with access to quality day care, economic opportunities for family members, and a safe neighborhood. Wells Fargo has joined the effort, donating $300,000 to United Way of Metropolitan Chicago's Wendy DuBoe, Lisa Johnson, and Darnell Shields 2015 Annual Report | 25 -

Page 28

... $18.8B in new loan commitments extended to small business customers* in 2015 in community development loans and investments in 2015 to support low- and moderate-income neighborhoods Recreation Center Dry Cleaner $881.3M donated to nonproï¬ts in 2015 School $878M 8,000 team members identify as... -

Page 29

... Efficiency James H. Rowe Head of Investor Relations Eric D. Shand Chief Loan Examiner John R. Shrewsberry Chief Financial Officer * Timothy J. Sloan President, Chief Operating Officer, Head of Wholesale Banking * James M. Strother General Counsel * Oscar Suris Head of Corporate Communications... -

Page 30

... Group Kurt Marsden, Corporate Finance Group WHOLESALE BANKING President, Chief Operating Officer, Group Head Timothy J. Sloan Wells Fargo Securities Jonathan G. Weiss Walter E. Dolhare, Markets Division Robert A. Engel, Investment Banking and Capital Markets Benjamin V. Lambert, Eastdil Secured... -

Page 31

... Short-Term Investments Investment Securities Loans and Allowance for Credit Losses Premises, Equipment, Lease Commitments and Other Assets Securitizations and Variable Interest Entities Mortgage Banking Activities Intangible Assets Deposits Short-Term Borrowings Long-Term Debt Guarantees, Pledged... -

Page 32

... Wells Fargo's long-term safety, soundness and reputation. the year as the world's most valuable bank by market capitalization. We produced strong loan and deposit growth, grew the number of customers we serve, improved credit quality, enhanced our risk management practices, increased our capital... -

Page 33

... just over 1,000 locomotives that were added to our existing First Union Rail business. During fourth quarter 2015 we issued long-term debt to partially fund the anticipated closing of these GE Capital acquisitions. Deposit growth remained strong with period-end deposits up $55.0 billion from 2014... -

Page 34

... net income Earnings per common share Diluted earnings per common share Dividends declared per common share Balance sheet (at year end) Investment securities Loans Allowance for loan losses Goodwill Assets Deposits Long-term debt Wells Fargo stockholders' equity Noncontrolling interests Total equity... -

Page 35

...Per Common Share Data Year ended December 31, 2015 Profitability ratios Wells Fargo net income to average assets (ROA) Wells Fargo net income applicable to common stock to average Wells Fargo common stockholders' equity (ROE) Efficiency ratio (1) Capital ratios (2)(3) At year end: Wells Fargo common... -

Page 36

...interest income, reflecting increases in income from trading assets, investment securities, and loans. Our diversified sources of revenue generated by our businesses continued to be balanced between net interest income and noninterest income. In 2015, net interest income of $45.3 billion represented... -

Page 37

... Net interest income (A) Noninterest income Service charges on deposit accounts Trust and investment fees (1) Card fees Other fees (1) Mortgage banking (1) Insurance Net gains from trading activities Net gains (losses) on debt securities Net gains from equity investments Lease income Other Total... -

Page 38

... was primarily due to customer-driven deposit growth and higher long-term debt balances, partially offset by growth in loans and securities. The growth in customer-driven deposits and funding balances during 2015 kept cash, federal funds sold, and other short-term investments elevated, which diluted... -

Page 39

... family junior lien mortgage Credit card Automobile Other revolving credit and installment Total consumer Total loans (1) Other Total earning assets Funding sources Deposits: Interest-bearing checking Market rate and other savings Savings certificates Other time deposits Deposits in foreign offices... -

Page 40

... family junior lien mortgage Credit card Automobile Other revolving credit and installment Total consumer Total loans (4) Other Total earning assets Funding sources Deposits: Interest-bearing checking Market rate and other savings Savings certificates Other time deposits Deposits in foreign offices... -

Page 41

... of $1.1 billion, $902 million, $792 million, $701 million and $696 million for 2015, 2014, 2013, 2012 and 2011, respectively, primarily related to tax-exempt income on certain loans and securities. The federal statutory tax rate utilized was 35% for the periods presented. Wells Fargo & Company 39 -

Page 42

...volume and rate. For Table 6: Analysis of Changes of Net Interest Income Year ended December 31, 2015 over 2014 (in millions) Increase (decrease) in interest income: Federal funds sold, securities purchased under resale agreements and other short-term investments Trading assets Investment securities... -

Page 43

...management Investment banking Total trust and investment fees Card fees Other fees: Charges and fees on loans Merchant processing fees (1) Cash network fees Commercial real estate brokerage commissions Letters of credit fees All other fees Total other fees Mortgage banking: Servicing income, net Net... -

Page 44

...of $428 million for 2013. For additional information about mortgage loan repurchases, see the "Risk Management - Credit Risk Management - Liability for Mortgage Loan Repurchase Losses" section and Note 9 (Mortgage Banking Activities) to Financial Statements in this Report. 42 Wells Fargo & Company -

Page 45

... gains on derivatives that qualify for hedge accounting, a gain on sale of government-guaranteed student loans in fourth quarter 2014, and a gain on sale of 40 insurance offices in second quarter 2014 partially offset by lower income from equity method investments. Wells Fargo & Company 43 -

Page 46

... and other deposit assessments Outside professional services Operating losses Outside data processing Contract services Postage, stationery and supplies Travel and entertainment Advertising and promotion Insurance Telecommunications Foreclosed assets Operating leases All other Total 2015 $ 15,883... -

Page 47

... into three operating segments: Community Banking; Wholesale Banking; and Wealth and Investment Management (WIM) (formerly Wealth, Brokerage and Retirement). These segments are defined by product type and customer segment and their results are based on our management accounting process, for which... -

Page 48

...defined set of revenue generating products within the following product families: credit, treasury management, deposits, risk management, foreign exchange, capital markets and advisory, investments, insurance, trade financing, and trust and servicing. The number of customer relationships is based on... -

Page 49

... businesses including checking and savings accounts, credit and debit cards, and auto, student, and small business lending. These products also include investment, insurance and trust services in 39 states and D.C., and mortgage and home equity loans in all 50 states and D.C. The Community Banking... -

Page 50

... Finance, Insurance, International, Real Estate Capital Markets, Commercial Mortgage Servicing, Corporate Trust, Equipment Finance, Wells Fargo Securities, Principal Investments, and Asset Backed Finance. Wholesale Banking cross-sell is reported on a one-quarter lag and for fourth quarter 2015... -

Page 51

... income: Service charges on deposit accounts Trust and investment fees: Brokerage advisory, commissions and other fees Trust and investment management Investment banking Total trust and investment fees Card fees Other fees Mortgage banking Insurance Net gains from trading activities Net gains... -

Page 52

... income: Service charges on deposit accounts Trust and investment fees: Brokerage advisory, commissions and other fees Trust and investment management Investment banking (1) Total trust and investment fees Card fees Other fees Mortgage banking Insurance Net gains from trading activities Net gains on... -

Page 53

... and investment management business lines. Retail Brokerage Client Assets Brokerage advisory, commissions and other fees are received for providing fullservice and discount brokerage services predominantly to retail brokerage clients. Offering advisory account relationships to our brokerage clients... -

Page 54

... managed by Wells Fargo Asset Management consist of equity, alternative, balanced, fixed income, money market, and stable value, and include client assets that are managed or sub-advised on behalf of other Wells Fargo lines of business. Money Market fund activity is presented on a net inflow or net... -

Page 55

... million related to nonmarketable equity investments. For a discussion of our OTTI accounting policies and underlying considerations and analysis, see Note 1 (Summary of Significant Accounting Policies) and Note 5 (Investment Securities) to Financial Statements in this Report. Wells Fargo & Company... -

Page 56

... Fair value 127.2 115.5 132.0 The weighted-average expected maturity of debt securities held-to-maturity was 6.5 years at December 31, 2015. See Note 5 (Investment Securities) to Financial Statements in this Report for a summary of investment securities by security type. 54 Wells Fargo & Company -

Page 57

... guaranteed student loan portfolio. Additional information on the non-strategic and liquidating loan portfolios is included in Table 18 in the "Risk Management - Credit Risk Management" section in this Report. December 31, 2015 (in millions) Commercial Consumer Total loans Change from prior year... -

Page 58

... market risk, including interest rate risk, credit risk and foreign currency risk, and to assist customers with their risk management objectives. Derivatives are recorded on the balance sheet at fair value and volumes can be measured in terms of the notional amount, which is generally not exchanged... -

Page 59

... market rate and other savings accounts. Balances are presented net of unamortized debt discounts and premiums and purchase accounting adjustments. Represents the future interest obligations related to interest-bearing time deposits and long-term debt in the normal course of business including a net... -

Page 60

... rate risk, market risk, and liquidity and funding risks. Our risk culture is strongly rooted in our Vision and Values, and in order to succeed in our mission of satisfying our customers' financial needs and helping them succeed financially, our business practices and operating model must support... -

Page 61

... include overseeing the Company's risk management structure. The Board carries out its risk oversight responsibilities directly and through the work of its seven standing committees, which all report to the full Board. Each Board Committee has defined authorities and responsibilities for... -

Page 62

... forecasts and the Company's risk profile, capital adequacy assessment and planning, and stress testing activities • Financial risk management policies used to assess and manage market, interest rate, liquidity and investment risks • Annual financial plan • Recovery planning 60 Wells Fargo... -

Page 63

...-line of defense, is headed by the Company's Chief Risk Officer who, among other things, is responsible for setting the strategic direction and driving the execution of Wells Fargo's risk management activities. The Chief Risk Officer, as well as the Chief Risk Officer's direct reports, work closely... -

Page 64

... among other things, information security risk (including cyber) and technology risk. In addition, the A&E Committee periodically reviews updates from management on the state of operational risk and the general condition of operational risk management in the Company. Operational Risk Management At... -

Page 65

...acquired from Wachovia, certain portfolios from legacy Wells Fargo Home Equity and Wells Fargo Financial, and, through the first half of 2014, our education finance government guaranteed loan portfolio. We transferred the government guaranteed student loan portfolio to loans held for sale at the end... -

Page 66

... home equity Legacy Wachovia other PCI loans (1) Legacy Wells Fargo Financial indirect auto (3) Education Finance - government insured Total consumer Total non-strategic and liquidating loan portfolios (1) (2) (3) Net of purchase accounting adjustments related to PCI loans. Includes PCI loans... -

Page 67

... variety of relationship focused products and services, including loans supporting short-term trade finance and working capital needs. The $18.1 billion of foreign loans in the financial institutions category were predominantly originated by our Global Financial Institutions (GFI) business. Slightly... -

Page 68

... when acquired at December 31, 2008, reflecting principal payments, loan resolutions and write-downs. Table 20: CRE Loans by State and Property Type December 31, 2015 Real estate mortgage (in millions) By state: California Texas New York Florida North Carolina Arizona Washington Georgia Virginia... -

Page 69

...agencies, enhanced by centralized monitoring of macroeconomic and capital markets conditions in the respective countries. We establish exposure limits for each country through a centralized oversight process based on customer needs, and in consideration of relevant economic, political, social, legal... -

Page 70

... cash credit trading businesses, which sometimes results in selling and purchasing protection on the identical reference entity. Generally, we do not use market instruments such as CDS to hedge the credit risk of our investment or loan positions, although we do use them to manage risk in our trading... -

Page 71

... area consisting of more than 5% of total loans. We monitor changes in real estate values and underlying economic or market conditions for all geographic areas of our real estate 1-4 family mortgage portfolio as part of our credit risk management process. Our underwriting and periodic review of... -

Page 72

... in excess of $7.2 billion. Represents loans whose repayments are predominantly insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA). Includes $13.4 billion in real estate 1-4 family mortgage PCI loans in California. 70 Wells Fargo & Company -

Page 73

... liquidating first lien mortgage portfolios and lists the top five states by outstanding balance for the core portfolio. Outstanding balance December 31, (in millions) Core portfolio: California New York Florida New Jersey Texas Other Total Government insured/guaranteed loans Total core portfolio... -

Page 74

... 15% of the total Pick-a-Pay portfolio at December 31, 2015, compared with 51% at acquisition. (in millions) Option payment loans Non-option payment adjustable-rate and fixed-rate loans Full-term loan modifications Total adjusted unpaid principal balance Total carrying value (1) % of total 39% 13... -

Page 75

... further information on the judgment involved in estimating expected cash flows for PCI loans, see the "Critical Accounting Policies - Purchased Credit-Impaired Loans" section and Note 1 (Summary of Significant Accounting Policies) to Financial Statements in this Report. Wells Fargo & Company 73 -

Page 76

... loan to value (CLTV) ratio in excess of 100%. Of those junior liens with a CLTV ratio in excess of 100%, 2.77% were two payments or more past due. CLTV means the ratio of the total loan balance of first mortgages and junior lien mortgages (including unused line amounts for credit line products... -

Page 77

...date of acquisition. Table 28: Junior Lien Mortgage Line and Loan and Senior Lien Mortgage Line Portfolios Payment Schedule Scheduled end of draw/term Outstanding balance (in millions) Junior lien lines and loans First lien lines Total (2)(3) % of portfolios (1) (2) (3) $ $ December 31, 2015 52,935... -

Page 78

... contractual terms. Real estate 1-4 family mortgage loans predominantly insured by the FHA or guaranteed by the VA and student loans predominantly guaranteed by agencies on behalf of the U.S. Department of Education under the Federal Family Education Loan Program are not placed on nonaccrual status... -

Page 79

... Lease financing Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Automobile Other revolving credit and installment Total consumer Total nonaccrual loans Foreclosed assets: Government insured/guaranteed Non-government insured/guaranteed... -

Page 80

...offs Payments, sales and other (1) Total outflows Balance, end of period Consumer nonaccrual loans Balance, beginning of period Inflows Outflows: Returned to accruing Foreclosures Charge-offs Payments, sales and other (1) Total outflows Balance, end of period Total nonaccrual loans (1) Sep 30, 2015... -

Page 81

... loans, of which 52% is predominantly FHA insured or VA guaranteed and expected to have minimal or no loss content. The remaining foreclosed assets balance of $564 million has been written down to estimated net realizable value. The decrease in foreclosed assets at December 31, 2015, compared... -

Page 82

... Balance by Quarter During 2015 Dec 31, (in millions) Commercial TDRs Commercial and industrial Real estate mortgage Real estate construction Lease financing Total commercial TDRs Consumer TDRs Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit Card Automobile... -

Page 83

...refinanced or restructured at market terms and qualify as a new loan. Quarter ended Dec 31, (in millions) Commercial TDRs Balance, beginning of period Inflows (1) Outflows Charge-offs Foreclosure Payments, sales and other (2) Balance, end of period Consumer TDRs Balance, beginning of period Inflows... -

Page 84

... mortgage Real estate construction Total commercial Consumer: Real estate 1-4 family first mortgage (3) Real estate 1-4 family junior lien mortgage (3) Credit card Automobile Other revolving credit and installment Total consumer Total, not government insured/guaranteed (1) (2) (3) (4) LOANS 90 DAYS... -

Page 85

...37: Net Charge-offs Year ended December 31, Net loan charge($ in millions) 2015 Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit card... -

Page 86

...(ACL) Dec 31, 2015 Loans as % of total (in millions) Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit card Automobile Other revolving... -

Page 87

...and general economic conditions. Our process for determining the allowance for credit losses is discussed in the "Critical Accounting Policies - Allowance for Credit Losses" section and Note 1 (Summary of Significant Accounting Policies) to Financial Statements in this Report. Wells Fargo & Company... -

Page 88

... MBS, and (3) other financial institutions that purchase mortgage loans for investment or private label securitization. In addition, we pool FHA-insured and VA-guaranteed mortgage loans that are then used to back securities guaranteed by the Government National Mortgage Association (GNMA). We may be... -

Page 89

...part of our process to update our repurchase liability estimate as new information becomes available. The liability was $378 million at December 31, 2015, and $615 million at December 31, 2014. In 2015, we released $159 million, which increased net gains on mortgage loan origination/sales activities... -

Page 90

...rates paid on checking and savings deposit accounts by an amount that is less than the general decline in market interest rates); • short-term and long-term market interest rates may change by different amounts (for example, the shape of the yield curve may affect new loan yields and funding costs... -

Page 91

... loans and long-term debt, from fixed-rate payments to floating-rate payments, or vice versa; and • to economically hedge our mortgage origination pipeline, funded mortgage loans and MSRs using interest rate swaps, swaptions, futures, forwards and options. MORTGAGE BANKING INTEREST RATE AND MARKET... -

Page 92

... the mix of new business between ARMs and fixed-rate mortgages, the relationship between short-term and long-term interest rates, the degree of volatility in interest rates, the relationship between mortgage interest rates and other interest rate markets, and other interest rate factors. Additional... -

Page 93

...into separate derivative or security positions to manage our exposure related to our long or short security positions. Income earned on this type of market-making activity is reflected in the fair value changes of these positions recorded in net gains on trading activities. 91 Wells Fargo & Company -

Page 94

...economic loss from adverse changes in market risk factors such as interest rates, credit spreads, foreign exchange rates, equity prices, commodity prices, mortgage rates and mortgage liquidity. Market risk is intrinsic to the Company's sales and trading, market making, investing, and risk management... -

Page 95

... ended December 31, 2015 (in millions) Company Trading General VaR Risk Categories Credit Interest rate Equity Commodity Foreign exchange Diversification benefit (1) Company Trading General VaR (1) September 30, 2015 Period end 20 18 16 1 1 (38) 18 Average 20 14 14 1 1 (29) 21 Low 16 6 12 1 - High... -

Page 96

... trading Table 44: Regulatory 10-Day 99% General VaR by Risk Category Quarter ended December 31, 2015 (in millions) Wholesale Regulatory General VaR Risk Categories Credit Interest rate Equity Commodity Foreign exchange Diversification benefit (1) Wholesale Regulatory General VaR Company Regulatory... -

Page 97

... of the net long or short exposure, and are capped at the maximum loss that could be incurred on any given transaction. Table 46 shows the aggregate net fair market value of securities and derivative securitization positions by exposure type that meet the regulatory definition of a covered trading... -

Page 98

... model. Backtesting is a comparison of the daily VaR estimate with the actual clean profit and loss (clean P&L) as defined by the market risk capital rule. Clean P&L is the change in the value of the Company's covered trading positions that would have occurred had previous end-of-day covered trading... -

Page 99

... Company's market risk. The group is responsible for developing corporate market risk policy, creating quantitative market risk models, establishing independent risk limits, calculating and analyzing market risk capital, and reporting aggregated and line-of-business market risk information. Limits... -

Page 100

... on our balance sheet. As part of our business to support our customers, we trade public equities, listed/OTC equity derivatives and convertible bonds. We have parameters that govern these activities. We also have marketable equity securities in the available-for-sale securities portfolio, including... -

Page 101

... 31, 2015, deposits were 133% of total loans compared with 135% at December 31, 2014. Additional funding is provided by long-term debt and short-term borrowings. Table 52 shows selected information for short-term borrowings, which generally mature in less than 30 days. Wells Fargo & Company 99 -

Page 102

.... Highest month-end balance in each of the last five quarters was in December, September, June and February 2015 and December 2014. We access domestic and international capital markets for long-term funding (generally greater than one year) through issuances of registered debt securities, private... -

Page 103

...the Federal Home Loan Bank System. In January 2016, Wells Fargo Bank, N.A. executed an additional $12.5 billion in Federal Home Loan Bank advances. Credit Ratings Investors in the long-term capital markets, as well as other market participants, generally will consider, among other factors, a company... -

Page 104

... 2016 that settled in first quarter 2016 for 15.9 million shares. For additional information about our forward repurchase agreements, see Note 1 (Summary of Significant Accounting Policies) to Financial Statements in this Report. Regulatory Capital Guidelines The Company and each of our insured... -

Page 105

... that are used by management, bank regulatory agencies, investors and analysts to assess and monitor the Company's capital position. See Table 56 for information regarding the calculation and components of CET1, Tier 1 capital, total capital and RWAs, as well as the corresponding reconciliation... -

Page 106

...at December 31, 2015 and under the General Approach at December 31, 2014. Table 56: Risk-Based Capital Calculation and Components Under Basel III December 31, 2015 (in billions) Total equity Noncontrolling interests Total Wells Fargo stockholders' equity Adjustments: Preferred stock Cumulative other... -

Page 107

... for the year ended December 31, 2015. Table 58: Analysis of Changes in Basel III RWAs (in billions) Basel III RWAs (General Approach) at December 31, 2014 Effect of changes in rules Basel III RWAs (Fully Phased-In) at December 31, 2014 Net change in credit risk RWAs Net change in market risk RWAs... -

Page 108

... is used by management, bank regulatory agencies, investors and analysts to assess and monitor the Company's leverage exposure. See Table 59 for information regarding the calculation and components of the SLR. Table 59: Basel III Fully Phased-In SLR (in billions) Tier 1 capital Total average assets... -

Page 109

... determine the amount and timing of our share repurchases, including our capital requirements, the number of shares we expect to issue for employee benefit plans and acquisitions, market conditions (including the trading price of our stock), and regulatory and legal considerations, including the FRB... -

Page 110

...to a number of consumer businesses and products, including mortgage lending and servicing, fair lending requirements, student lending activities, and auto finance. At this time, the Company cannot predict the full impact of the CFPB's rulemaking and supervisory authority on our business practices or... -

Page 111

... Wells Fargo and our insured depository institutions and to implement the Basel III liquidity coverage ratio. For more information on the final capital, leverage and liquidity rules, and additional capital requirements under consideration by federal banking regulators, see the "Capital Management... -

Page 112

..., which is management's estimate of credit losses inherent in the loan portfolio, including unfunded credit commitments, at the balance sheet date, excluding loans carried at fair value. For a description of our related accounting policies, see Note 1 (Summary of Significant Accounting Policies) to... -

Page 113

... and interest payments are PCI loans. Substantially all of our PCI loans were acquired in the Wachovia acquisition on December 31, 2008. For a description of our related accounting policies, see Note 1 (Summary of Significant Accounting Policies) to Financial Statements in this Report. We apply... -

Page 114

...considers the number of defaulted loans as well as changes in servicing processes associated with default and foreclosure management. Both prepayment speed and discount rate assumptions can, and generally will, change quarterly as market conditions and mortgage interest rates change. For example, an... -

Page 115

...tax benefits on uncertain tax positions are reflected in Note 21 (Income Taxes) to Financial Statements in this Report. Foreign taxes paid are generally applied as credits to reduce federal income taxes payable. We account for interest and penalties as a component of income tax expense. Wells Fargo... -

Page 116

... in business combinations when the accounting is incomplete at the acquisition date. Under the new guidance, companies should record adjustments in the same reporting period in which the amounts are determined. The Update eliminates the disclosure requirement to categorize investments within... -

Page 117

... proposed Update would require lessees to recognize leases on the balance sheet with lease liabilities and corresponding right-of-use assets based on the present value of lease payments. Additionally, lessors would largely continue current accounting with lease financings and operating lease assets... -

Page 118

... and legal actions; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber attacks; the effect of changes in the level of checking or savings account deposits on our funding costs... -

Page 119

... the trading activity of investors, reducing commissions and other fees we earn from our brokerage business. The U.S. stock market experienced alltime highs in 2015, but also experienced significant volatility and there is no guarantee that high price levels will continue. Poor economic conditions... -

Page 120

..." and the "Balance Sheet Analysis - Investment Securities" sections in this Report and Note 5 (Investment Securities) to Financial Statements in this Report. Effective liquidity management, which ensures that we can meet customer loan requests, customer deposit maturities/withdrawals and other cash... -

Page 121

... the operation of our business and our financial results and condition. As noted above, we rely heavily on bank deposits for our funding and liquidity. We compete with banks and other financial services companies for deposits. If our competitors raise the rates they pay on deposits our funding costs... -

Page 122

... in our business practices as a result of new regulations and requirements which could limit or negatively affect the products and services that we currently offer our customers. For example, in 2013 and 2015, the CFPB issued a number of new rules impacting residential mortgage lending practices. As... -

Page 123

... the housing finance market in the United States. These proposals, among other things, consider winding down the GSEs and reducing or eliminating over time the role of the GSEs in guaranteeing mortgages and providing funding for mortgage loans, as well as the implementation of reforms relating to... -

Page 124

... and rules, may require higher capital and liquidity levels, limiting our ability to pay common stock dividends, repurchase our common stock, invest in our business, or provide loans or other products and services to our customers. The Company and each of our insured depository institutions... -

Page 125

..., federal banking regulations may increase our compliance costs as well as limit our ability to invest in our business or provide loans or other products and services to our customers. For more information, refer to the "Capital Management" and "Regulatory Reform" sections in this Report and the... -

Page 126

... to the "Critical Accounting Policies - Purchased Credit-Impaired (PCI) Loans" and "Risk Management - Credit Risk Management" sections in this Report. Our mortgage banking revenue can be volatile from quarter to quarter, including as a result of changes in interest rates and the value of our MSRs... -

Page 127

... their current form, as well as any effect on the Company's business and financial results, are uncertain. For more information, refer to the "Risk Management - Asset/Liability Management - Mortgage Banking Interest Rate and Market Risk" and "Critical Accounting Policies" sections in this Report. We... -

Page 128

... an additional risk of repurchase loss associated with claim amounts for loans sold to third-party investors. Similarly, some of the mortgage loans we hold for investment or for sale carry mortgage insurance. If a mortgage insurer is unable to meet its credit obligations with Wells Fargo & Company -

Page 129

... in our computer systems and networks. Our banking, brokerage, investment advisory, and capital markets businesses rely on our digital technologies, computer and email systems, software, and networks to conduct their operations. In addition, to access our products and services, our customers may use... -

Page 130

..., report and analyze the types of risk to which we are subject, including liquidity risk, credit risk, market risk, interest rate risk, operational risk, legal and compliance risk, and reputational risk, among others. However, as with any risk management framework, there are inherent limitations to... -

Page 131

... affect our customer relationships, market share and results of operations and/or cause us to increase our capital investment in our businesses in order to remain competitive. In addition, our ability to reposition or reprice our products and services from time to time may be limited and could... -

Page 132

... type of business to be acquired, the purchase price, and the potential dilution to existing stockholders or our earnings per share if we issue common stock in connection with the acquisition. We generally must receive federal regulatory approvals before we can acquire a bank, bank holding company... -

Page 133

... officer concluded that the Company's disclosure controls and procedures were effective as of December 31, 2015. Internal Control Over Financial Reporting Internal control over financial reporting is defined in Rule 13a-15(f) promulgated under the Securities Exchange Act of 1934 as a process... -

Page 134

..., changes in equity, and cash flows for each of the years in the three-year period ended December 31, 2015, and our report dated February 24, 2016, expressed an unqualified opinion on those consolidated financial statements. San Francisco, California February 24, 2016 132 Wells Fargo & Company -

Page 135

... Long-term debt Other interest expense Total interest expense Net interest income Provision for credit losses Net interest income after provision for credit losses Noninterest income Service charges on deposit accounts Trust and investment fees Card fees Other fees Mortgage banking Insurance Net... -

Page 136

Wells Fargo & Company and Subsidiaries Consolidated Statement of Comprehensive Income Year ended December 31, (in millions) Wells Fargo net income Other comprehensive income (loss), before tax: Investment securities: Net unrealized gains (losses) arising during the period Reclassification of net ... -

Page 137

Wells Fargo & Company and Subsidiaries Consolidated Balance Sheet Dec 31, (in millions, except shares) Assets Cash and due from banks Federal funds sold, securities purchased under resale agreements and other short-term investments Trading assets Investment securities: Available-for-sale, at fair ... -

Page 138

... transaction that settled in first quarter 2015 for 14.3 million shares of common stock. See Note 1 (Summary of Significant Accounting Policies) for additional information. The accompanying notes are an integral part of these statements. (continued on following pages) 136 Wells Fargo & Company -

Page 139

Wells Fargo stockholders' equity Additional paid-in capital...(5,056) (1,308) 1,094 Unearned ESOP shares (986) (986) Total Wells Fargo stockholders' equity 157,554 157,554 21,878 (4,264)...21,878 Treasury stock (6,610) (6,610) Noncontrolling interests 1,357 1,357 346 267 (1,104) Total equity 158,911 ... -

Page 140

... to a private forward repurchase transaction that settled in first quarter 2016 for 9.2 million shares of common stock. See Note 1 (Summary of Significant Accounting Policies) for additional information. The accompanying notes are an integral part of these statements. 138 Wells Fargo & Company -

Page 141

... Total Wells Fargo stockholders' equity 184,394 184,394 22,894 (3,221) 2 2,644 (8,697) - 825 - (49) 2,972 (7,580) (1,426) 453 844 (1,057) 8,604 192,998 25 893 Additional paid-in capital 60,537 60,537 Retained earnings 107,040 107,040 22,894 Treasury stock (13,690) (13,690) Unearned ESOP shares... -

Page 142

... Cash flows from financing activities: Net change in: Deposits Short-term borrowings Long-term debt: Proceeds from issuance Repayment Preferred stock: Proceeds from issuance Cash dividends paid Common stock: Proceeds from issuance Repurchased Cash dividends paid Excess tax benefits related to stock... -

Page 143

...and related Notes. Note 1: Summary of Significant Accounting Policies Wells Fargo & Company is a diversified financial services company. We provide banking, insurance, trust and investments, mortgage banking, investment banking, retail banking, brokerage, and consumer and commercial finance through... -

Page 144

... of the price decline, such as the general level of interest rates or adverse conditions specifically related to the security, an industry or a geographic area; the issuer's financial condition, near-term prospects and ability to service the debt; the payment structure of the debt security and the... -

Page 145

... charge-offs, unamortized deferred fees and costs on originated loans and unamortized premiums or discounts on purchased loans. PCI loans are reported net of any remaining purchase accounting adjustments. See the "Purchased Credit-Impaired Loans" section in this Note for our accounting policy... -

Page 146

... number of days past due, as follows: • 1-4 family first and junior lien mortgages - We generally charge down to net realizable value when the loan is 180 days past due. • Auto loans - We generally fully charge off when the loan is 120 days past due. • Credit card loans - We generally fully... -

Page 147

.... Generally, commercial PCI loans are accounted for as individual loans and consumer PCI loans are included in pools. Accounting for PCI loans involves estimating fair value at acquisition using the principal and interest cash flows expected to be collected discounted at the prevailing market rate... -

Page 148

... as junior lien mortgages behind delinquent first lien mortgages and junior lien lines of credit subject to near term significant payment increases. We incorporate the default rates and high severity of loss for these higher risk portfolios, including the impact of our established loan modification... -

Page 149

... information on our repurchase liability, see Note 9 (Mortgage Banking Activities). Pension Accounting We account for our defined benefit pension plans using an actuarial model. Two principal assumptions in determining net periodic pension cost are the discount rate and the expected long-term rate... -

Page 150

... dividing net income (after deducting dividends on preferred stock) by the average number of common shares outstanding during the year plus the effect of common stock equivalents (for example, stock options, restricted share rights, convertible debentures and warrants) that are dilutive. Fair Value... -

Page 151

... parties to complement our open-market common stock repurchase strategies, to allow us to manage our share repurchases in a manner consistent with our capital plans, currently submitted under the 2015 Comprehensive Capital Analysis and Review (CCAR), and to provide an economic benefit to the Company... -

Page 152

... legal accrual that increased operating losses within noninterest expense by $200 million and, as a result, reduced net income for the year ended December 31, 2015, by $134 million, or $0.03 per common share. See Note 15 (Legal Actions) for additional information. 150 Wells Fargo & Company -

Page 153

... of a small investment intermediary and purchased total assets of $3 million. We had two acquisitions pending as of December 31, 2015. The first acquisition, which closed on January 1, 2016, was the purchase of $4.0 billion of operating and capital leases associated with GE Railcar Services, which... -

Page 154

...of credit may require collateral to be held to provide added security to the bank. For further discussion of RBC, see Note 26 (Regulatory and Agency Capital Requirements) in this Report. Dividends paid by our subsidiary banks are subject to various federal and state regulatory limitations. Dividends... -

Page 155

... Agreements and Other Short-Term Investments Table 4.1 provides the detail of federal funds sold, securities purchased under short-term resale agreements (generally less than one year) and other short-term investments. The majority of interest-earning deposits at December 31, 2015 and 2014, were... -

Page 156

... by credit cards, student loans, home equity loans and auto leases or loans and cash. Included in the "Other" category of held-to-maturity securities are asset-backed securities collateralized by auto leases or loans and cash with a cost basis and fair value of $1.9 billion each at December 31, 2015... -

Page 157

... 31, 2015 Available-for-sale securities: Securities of U.S. Treasury and federal agencies Securities of U.S. states and political subdivisions Mortgage-backed securities: Federal agencies Residential Commercial Total mortgage-backed securities Corporate debt securities Collateralized loan and other... -

Page 158

... mortgage loans in each transaction. We use forecasted loan performance to project cash flows to the various tranches in the structure. We also consider cash flow forecasts and, as applicable, independent industry analyst reports and forecasts, sector credit ratings, and other independent market... -

Page 159

... 31, 2015 Available-for-sale securities: Securities of U.S. Treasury and federal agencies Securities of U.S. states and political subdivisions Mortgage-backed securities: Federal agencies Residential Commercial Total mortgage-backed securities Corporate debt securities Collateralized loan and other... -

Page 160

... 31, 2015 Available-for-sale securities (1): Securities of U.S. Treasury and federal agencies Securities of U.S. states and political subdivisions Mortgage-backed securities: Federal agencies Residential Commercial Total mortgage-backed securities Corporate debt securities Collateralized loan and... -

Page 161

... (in millions) December 31, 2015 Held-to-maturity securities: Fair value: Securities of U.S. Treasury and federal agencies Securities of U.S. states and political subdivisions Federal agency mortgage-backed securities Collateralized loan and other debt obligations Other Total held-to-maturity debt... -

Page 162

... 31, 2015, 2014 or 2013. Year ended December 31, (in millions) OTTI write-downs included in earnings Debt securities: Securities of U.S. states and political subdivisions Mortgage-backed securities: Federal agencies Residential Commercial Corporate debt securities (1) Collateralized loan and other... -

Page 163

... present value of expected future cash flows discounted using the security's current effective interest rate and the amortized cost basis of the security prior to considering credit loss. Year ended December 31, (in millions) Credit loss recognized, beginning of year Additions: For securities with... -

Page 164

... 106,028 19,470 13,387 344,709 2015 2014 2013 2012 2011 December 31, 2015 and 2014, respectively, for unearned income, net deferred loan fees, and unamortized discounts and premiums. Our foreign loans are reported by respective class of financing receivable in the table above. Substantially all of... -

Page 165

... lines of credit products generally have a draw period of 10 years (with some up to 15 or 20 years) with variable interest rate and payment options during the draw period of (1) interest only or (2) 1.5% of total outstanding balance plus accrued interest. During the draw period, the Table 6.3: Loan... -

Page 166

..., autos, other short-term liquid assets such as accounts receivable or inventory and long-lived assets, such as equipment and other business assets. Collateral requirements for each loan or commitment may vary based on the loan product and our assessment of a customer's credit risk according to... -

Page 167

... construction Lease financing Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit card Automobile Other revolving credit and installment Total consumer Total loan recoveries Net loan charge-offs (2) Other Balance, end of year Components... -

Page 168

...criticized commercial real estate (CRE) loans at December 31, 2015, $1.0 billion has been placed on nonaccrual status and written down to net realizable collateral value. CRE loans have a high level of monitoring in place to manage these assets and mitigate loss exposure. 166 Wells Fargo & Company -

Page 169

... mortgage Real estate construction Lease financing Total Table 6.9 provides past due information for commercial loans, which we monitor as part of our credit risk management practices. Table 6.9: Commercial Loans by Delinquency Status (in millions) December 31, 2015 By delinquency status: Current... -

Page 170

... 31, 2014 By delinquency status: Current-29 DPD 30-59 DPD 60-89 DPD 90-119 DPD 120-179 DPD 180+ DPD Government insured/guaranteed loans (1) Total consumer loans (excluding PCI) Total consumer PCI loans (carrying value) Total consumer loans (1) Credit card Automobile Total $ 225,195 2,072 821... -

Page 171

... insured by the FHA or guaranteed by the VA. LTV refers to the ratio comparing the loan's unpaid principal balance to the property's collateral value. CLTV refers to the combination of first mortgage and junior lien mortgage (including unused line amounts for credit line products) ratios... -

Page 172

... Real estate construction Lease financing Total commercial (1) Consumer: Real estate 1-4 family first mortgage (2) Real estate 1-4 family junior lien mortgage Automobile Other revolving credit and installment Total consumer Total nonaccrual loans (excluding PCI) (1) (2) 2015 $ 1,363 969 66 26... -

Page 173

... insured by the FHA or guaranteed by the VA. Includes mortgage loans held for sale 90 days or more past due and still accruing. Represents loans whose repayments are predominantly guaranteed by agencies on behalf of the U.S. Department of Education under the FFELP. Wells Fargo & Company... -

Page 174

... by the FHA or guaranteed by the VA and generally do not have an allowance. Impaired loans may also have limited, if any, allowance when the recorded investment of the loan approximates estimated net realizable value as a result of charge-offs prior to a TDR modification. 172 Wells Fargo & Company -

Page 175

... Investment in Impaired Loans Year ended December 31, 2015 (in millions) Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit card... -

Page 176

... any loans modified through a loan resolution such as foreclosure or short sale to be a TDR. We may require some consumer borrowers experiencing financial difficulty to make trial payments generally for a period of three to four months, according to the terms of a planned permanent modification... -

Page 177

... investment related to interest rate reduction (5) (in millions) Year ended December 31, 2015 Commercial: Commercial and industrial Real estate mortgage Real estate construction Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit card... -

Page 178

... first mortgage Real estate 1-4 family junior lien mortgage Total consumer Total PCI loans (carrying value) Total PCI loans (unpaid principal balance) $ $ 19,190 69 19,259 19,971 28,278 21,712 101 21,813 23,320 32,924 $ 78 542 92 712 75 1,261 171 1,507 2015 Dec 31, 2014 176 Wells Fargo & Company -

Page 179

...(1) Accretion into noninterest income due to sales (2) Reclassification from nonaccretable difference for loans with improving credit-related cash flows Changes in expected cash flows that do not affect nonaccretable difference (3) Total, end of period (1) (2) (3) 2015 $ 17,790 - (1,429) (28) 1,166... -

Page 180

...have not allocated the remaining purchase accounting adjustments, which were established at a pool level. Table 6.23 provides the delinquency status of consumer PCI loans. Table 6.23: Consumer PCI Loans by Delinquency Status December 31, 2015 Real estate 1-4 family first mortgage $ 18,086 1,686 716... -

Page 181

... 2014 Real estate 1-4 family junior lien mortgage 75 53 69 39 13 6 1 10 266 101 (in millions) By FICO: < 600 600-639 640-679 680-719 720-759 760-799 800+ No FICO available Total consumer PCI loans (adjusted unpaid principal balance) Total consumer PCI loans (carrying value) Total 5,789 4,792 6,256... -

Page 182

... bank stock Private equity Auction rate securities (1) Total cost method Equity method: LIHTC (2) Private equity Tax-advantaged renewable energy New market tax credit and other Total equity method Fair value (3) Total nonmarketable equity investments Corporate/bank-owned life insurance Accounts... -

Page 183

...) related to nonmarketable equity investments. Table 7.4: Nonmarketable Equity Investments Year ended December 31, (in millions) Net realized gains from nonmarketable equity investments $ All other Total $ 2015 1,659 (743) 916 2014 1,479 (741) 738 2013 1,158 (287) 871 Low Income Housing Tax Credit... -

Page 184

... to support short-term obligations of SPEs issued to third party investors; • providing credit enhancement on securities issued by SPEs or market value guarantees of assets held by SPEs through the use of letters of credit, financial guarantees, credit default swaps and total return swaps... -

Page 185

... 8.1: Balance Sheet Transactions with VIEs Transfers that we account for as secured borrowings - 203 2,171 4,887 - 26 7,287 1,799 (2) (2) (in millions) December 31, 2015 Cash Trading assets Investment securities (1) Loans Mortgage servicing rights Other assets Total assets Short-term borrowings... -

Page 186

... mortgage loan securitizations: Conforming (2) Other/nonconforming Commercial mortgage securitizations Collateralized debt obligations: Debt securities Loans (3) Asset-based finance structures Tax credit structures Collateralized loan obligations Investment funds Other (4) Total Derivatives Net... -

Page 187

... rating agencies at both December 31, 2015 and 2014. These senior loans are accounted for at amortized cost and are subject to the Company's allowance and credit charge-off policies. Includes structured financing and credit-linked note structures. Also contains investments in auction rate securities... -

Page 188

... SPE purchases a pool of assets consisting of loans and issues multiple tranches of equity or notes to investors. Generally, CLOs are structured on behalf of a third party asset manager that typically selects and manages the assets for the term of the CLO. Typically, the asset manager has the power... -

Page 189

... warranties we make to purchasers and issuers. Table 8.3 presents the cash flows for our transfers accounted for as sales. Table 8.3: Cash Flows From Sales and Securitization Activity Year ended December 31, 2015 (in millions) Proceeds from securitizations and whole loan sales Fees from servicing... -

Page 190

...at the date of securitization. Table 8.4: Residential Mortgage Servicing Rights Residential mortgage servicing rights 2015 Year ended December 31, Prepayment speed (1) Discount rate Cost to service ($ per loan) (2) (1) 2014 12.4 7.6 259 2013 11.2 7.3 184 12.1% 7.3 $ 223 (2) The prepayment speed... -

Page 191

...Senior bonds 673 5.8 ($ in millions, except cost to service amounts) Fair value of interests held at December 31, 2015 Expected weighted-average life (in years) Key economic assumptions: Prepayment speed assumption (3) Decrease in fair value from: 10% adverse change 25% adverse change Discount rate... -

Page 192

... 200 basis points in the risk premium component of the discount rate assumption is a decrease in fair value of $82 million and $130 million at December 31, 2015 and 2014, respectively. For more information on the student loan sale, see the discussion on Asset-Based Finance Structures earlier in this... -

Page 193

... limited contractual support, the assets of the VIEs are the sole source of repayment of the securities held by third parties. MUNICIPAL TENDER OPTION BOND SECURITIZATIONS As part of our normal investment portfolio activities, we consolidate municipal bond trusts that hold highly rated, long-term... -

Page 194

..., we are generally obligated to purchase them at par under standby liquidity facilities unless the bond's credit rating has declined below investment grade or there has been an event of default or bankruptcy of the issuer and insurer. NONCONFORMING RESIDENTIAL MORTGAGE LOAN SECURITIZATIONS We have... -

Page 195

... in valuation model inputs or assumptions: Mortgage interest rates (2) Servicing and foreclosure costs (3) Discount rates (4) Prepayment estimates and other (5) Net changes in valuation model inputs or assumptions Other changes in fair value (6) Total changes in fair value Fair value, end of year... -

Page 196

... derivative gains (losses) from economic hedges (4) Total servicing income, net Net gains on mortgage loan origination/sales activities Total mortgage banking noninterest income Market-related valuation changes to MSRs, net of hedge results (2)(4) (1) (2) (3) (4) 2015 2014 2013 $ 4,037 198 288... -

Page 197

... losses: Loan sales Change in estimate (1) Net additions (reductions) Losses (2) Balance, end of year (1) (2) 2015 $ 615 43 (202) (159) (78) $ 378 2014 899 44 (184) (140) (144) 615 2013 2,206 143 285 428 (1,735) 899 Results from changes in investor demand, mortgage insurer practices, credit and... -

Page 198

...time we acquire a business, we allocate goodwill to applicable reporting units based on their relative fair value, and if we have a significant business reorganization, we may reallocate the goodwill. See Note 24 (Operating Segments) for further information on management reporting. 196 Wells Fargo... -

Page 199

.... See Note 24 (Operating Segments) for additional information. Note 11: Deposits Table 11.1 presents a summary of the time certificates of deposit (CDs) and other time deposits issued by domestic and foreign offices. Table 11.1: Time Certificates of Deposit December 31, (in billions) Total domestic... -

Page 200

... short-term borrowings rate in 2015 is a result of increased customer demand for certain securities in stock loan transactions combined with the impact of low interest rates. (2) Highest month-end balance in each of the last three years was October 2015, December 2014 and May 2013. (3) Highest month... -

Page 201

... Total long-term debt - Parent (2) Wells Fargo Bank, N.A. and other bank entities (Bank) Senior Fixed-rate notes Floating-rate notes Floating-rate extendible notes (4) Fixed-rate advances - Federal Home Loan Bank (FHLB) (5) Floating-rate advances - FHLB (5) Structured notes (1) Capital leases (Note... -

Page 202

... under which debt has been issued have provisions that may limit the merger or sale of certain subsidiary banks and the issuance of capital stock or convertible securities by certain subsidiary banks. At December 31, 2015, we were in compliance with all the covenants. 200 Wells Fargo & Company -

Page 203

... us to make payments to a guaranteed party based on an event or a change in an underlying asset, liability, rate or index. Guarantees are generally in the form of standby letters of credit, securities lending and other indemnifications, written put options, recourse obligations, and other types of... -

Page 204

... to certain off-balance sheet entities that hold securitized fixed-rate municipal bonds and consumer or commercial assets that are partially funded with the issuance of money market and other short-term notes. See Note 8 (Securitization and Variable Interest Entities) for additional information on... -

Page 205

...31, 2015 and 2014, respectively. See Note 8 (Securitizations and Variable Interest Entities) for additional information on consolidated VIE assets and secured borrowings. Dec 31, (in millions) Trading assets and other (1) Investment securities (2) Mortgages held for sale and loans (3) Total pledged... -

Page 206

... 31, 2015 and 2014, includes $45.7 billion and $36.8 billion, respectively, classified on our consolidated balance sheet in federal funds sold, securities purchased under resale agreements and other short-term investments and $20.1 billion and $14.9 billion, respectively, in loans. Represents... -

Page 207

... States and political subdivisions Federal agency mortgage-backed securities Non-agency mortgage-backed securities Corporate debt securities Asset-backed securities Equity securities Other Total repurchases Securities lending: Securities of U.S. Treasury and federal agencies Federal agency mortgage... -

Page 208

... complaint asserts claims against defendants based 206 actions have been filed against Wachovia Bank, N.A. and Wells Fargo Bank, N.A., as well as many other banks, challenging the "high to low" order in which the banks post debit card transactions to consumer deposit accounts. There are currently... -

Page 209

... liability that cannot be estimated. Based on information currently available, advice of counsel, available insurance coverage and established reserves, Wells Fargo believes that the eventual outcome of the actions against Wells Fargo and/or its subsidiaries, including the matters described... -

Page 210

... rate, commodity, equity, credit and foreign exchange contracts, to our customers as part of our trading businesses. These derivative transactions, which involve us engaging in market-making activities or acting as an intermediary, are conducted in an effort to help customers manage their market... -

Page 211

... rate contracts (2) Equity contracts Foreign exchange contracts Subtotal (3) Customer accommodation, trading and other derivatives: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts - protection sold Credit contracts - protection purchased... -

Page 212

...also have balance sheet netting related to resale and repurchase agreements that are disclosed within Note 14 (Guarantees, Pledged Assets and Collateral). (in millions) December 31, 2015 Derivative assets Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 213

...years ended December 31, 2015, 2014, and 2013 of the time value component recognized as net interest income (expense) on forward derivatives hedging foreign currency available-for-sale securities and long-term debt that were excluded from the assessment of hedge effectiveness. Wells Fargo & Company... -

Page 214

... for each period end is due to changes in the underlying market indices and interest rates as well as the purchase and sale of derivative financial instruments throughout the period as part of our dynamic MSR risk management process. Interest rate lock commitments for mortgage loans that we intend... -

Page 215

... recognized on economic hedge derivatives: Interest rate contracts Recognized in noninterest income: Mortgage banking (1) Other (2) Equity contracts (3) Foreign exchange contracts (2) Credit contracts (2) Subtotal Net gains (losses) recognized on customer accommodation, trading and other derivatives... -

Page 216

... (B) Net protection sold (A)-(B) Other protection purchased (in millions) December 31, 2015 Credit default swaps on: Corporate bonds Structured products Credit protection on: Default swap index Commercial mortgage-backed securities index Asset-backed securities index Other Total credit derivatives... -

Page 217

... including determining the legal enforceability of the arrangement, it is our policy to present derivative balances and related cash collateral amounts net on the balance sheet. We incorporate credit valuation adjustments (CVA) to reflect counterparty credit risk in determining the fair value of our... -

Page 218

... DERIVATIVES) AND INVESTMENT SECURITIES Trading assets and available-for- Fair Value Hierarchy Assets SHORT-TERM FINANCIAL ASSETS Short-term financial assets include cash and due from banks, federal funds sold and securities purchased under resale agreements and due from customers on acceptances... -

Page 219

...1-4 family first and junior lien mortgages, we calculate fair value by discounting contractual cash flows, adjusted for prepayment and credit loss estimates, using discount rates based on current industry pricing (where readily available) or our own estimate of an appropriate discount rate for loans... -

Page 220

...exchange markets. LONG-TERM DEBT Long-term debt is generally carried at amortized cost. For disclosure, we are required to estimate the fair value of long-term debt and generally do so using the discounted cash flow method. Contractual cash flows are discounted using rates currently offered for new... -

Page 221

... Third-Party Pricing Services Brokers (in millions) December 31, 2015 Trading assets (excluding derivatives) Available-for-sale securities: Securities of U.S. Treasury and federal agencies Securities of U.S. states and political subdivisions Mortgage-backed securities Other debt securities (1) Total... -

Page 222

... Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans held for sale Loans Mortgage servicing rights (residential) Derivative assets: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Netting Total... -

Page 223

... Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans held for sale Loans Mortgage servicing rights (residential) Derivative assets: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Netting Total... -

Page 224

... Fair Value Levels Level 1 (in millions) Year ended December 31, 2015 Trading assets (excluding derivatives) Available-for-sale securities (2) Mortgages held for sale Loans Net derivative assets and liabilities (3) Short sale liabilities Total transfers Year ended December 31, 2014 Trading assets... -

Page 225

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) (7) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 226

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 227

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) (7) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 228

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 229

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) (8) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 230

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 231

... Basis - 2015 ($ in millions, except cost to service amounts) December 31, 2015 Trading and available-for-sale securities: Securities of U.S. states and political subdivisions: Government, healthcare and other revenue bonds Auction rate securities and other municipal bonds Collateralized loan and... -

Page 232

... 2014 ($ in millions, except cost to service amounts) December 31, 2014 Trading and available-for-sale securities: Securities of U.S. states and political subdivisions: Government, healthcare and other revenue bonds Auction rate securities and other municipal bonds Collateralized loan and other debt... -

Page 233

...The discount rate consists of a benchmark rate component and a risk premium component. The benchmark rate component, for example, OIS, LIBOR or U.S. Treasury rates, is generally observable within the market and is necessary to appropriately reflect the time value of money. The risk premium component... -

Page 234

... increase (decrease) in value if the utilization rate input were to increase (decrease). Generally, a change in the assumption used for default rate is accompanied by a directionally similar change in the risk premium component of the discount rate (specifically, the portion related to credit risk... -

Page 235

.... Table 17.13: Change in Value of Assets with Nonrecurring Fair Value Adjustment Year ended December 31, (in millions) Mortgages held for sale (LOCOM) Loans held for sale Loans: Commercial Consumer Total loans (1) Other assets (2) Total (1) (2) 2015 $ (3) (3) (165) (1,001) (1,166) (396) $ (1,568... -

Page 236

...rate of expected defaults for the government insured/guaranteed loans, which impacts the frequency and timing of early resolution of loans. The range and weighted average have not been provided since the investments have been recorded at their net asset redemption values. 234 Wells Fargo & Company -

Page 237

... share as a practical expedient to measure fair value on recurring and nonrecurring bases. The investments are included in trading Table 17.15: Alternative Investments (in millions) December 31, 2015 Offshore funds Hedge funds Private equity funds (1)(2) Venture capital funds (2) Total (3) December... -

Page 238

...-making purposes to support the buying and selling demands of our customers. These loans are generally held for a short period of time and managed within parameters of internally approved market risk limits. We have elected to measure and carry them at fair value, which best aligns with our risk... -

Page 239

...Value Option - Gains/Losses Attributable to Instrument-Specific Credit Risk Year ended December 31, (in millions) Gains (losses) attributable to instrument-specific credit risk: Trading assets - loans Mortgages held for sale Total $ $ 4 29 33 29 60 89 40 126 166 2015 2014 2013 Wells Fargo & Company... -

Page 240

... Mortgages held for sale (2) Loans held for sale (2) Loans, net (3) Nonmarketable equity investments (cost method) Financial liabilities Deposits Short-term borrowings (1) Long-term debt (4) December 31, 2014 Financial assets Cash and due from banks (1) Federal funds sold, securities purchased... -

Page 241

... with the Employee Stock Ownership Plan (ESOP) Cumulative Convertible Preferred Stock. - - - - See the ESOP Cumulative Convertible Preferred Stock section of this Note for additional information about the liquidation preference for the ESOP Cumulative Preferred Stock. Wells Fargo & Company 239 -

Page 242

... A Preferred Stock, Series V, for an aggregate public offering price of $1.0 billion. See Note 8 (Securitizations and Variable Interest Entities) for additional information on our trust preferred securities. We do not have a commitment to issue Series H preferred stock. 240 Wells Fargo & Company -

Page 243

... rates based upon the year of issuance. Each share of ESOP Preferred Stock released from the unallocated reserve of the 401(k) Plan is converted into shares of our common stock based on the stated value of the ESOP Preferred Stock and the then current market Table 18.3: ESOP Preferred Stock price... -

Page 244

... RSRs are canceled when employment ends. For various acquisitions and mergers, we converted employee and director stock options of acquired or merged companies into stock options to purchase our common stock based on the terms of the original stock option plan and the agreed-upon exchange ratio. In... -

Page 245

... value $ 36.46 55.34 37.39 41.98 42.00 Holders of PSAs are entitled to the related shares of common stock at no cost subject to the Company's achievement of specified performance criteria over a three-year period. PSAs are granted at a target number; based on the Company's performance, the number... -

Page 246

... determine the amount and timing of our share repurchases, including our capital requirements, the number of shares we expect to issue for acquisitions and employee benefit plans, market conditions (including the trading price of our stock), and regulatory and legal considerations. These factors can... -

Page 247

Table 19.7 presents the balance of common stock and unreleased preferred stock held in the Wells Fargo ESOP fund, the fair value of unreleased ESOP preferred stock and the dividends on allocated shares of common stock and unreleased ESOP Preferred Stock paid to the 401(k) Plan. Table 19.7: Common ... -

Page 248

... of year Actual return on plan assets Employer contribution Plan participants' contributions Benefits paid Medicare Part D subsidy Foreign exchange impact Fair value of plan assets at end of year Funded status at end of year Amounts recognized on the balance sheet at end of year: Liabilities... -

Page 249

... benefit pension plans and other post retirement plans that will be amortized from cumulative OCI into net periodic benefit cost in 2016 is $141 million. The net prior service credit for other post retirement plans was fully recognized in 2015 in conjunction with a curtailment. Wells Fargo & Company... -

Page 250

... seek to achieve the expected long-term rate of return with a prudent level of risk given the benefit obligations of the pension plans and their funded status. Our overall investment strategy is designed to provide our Cash Balance Plan with long-term growth opportunities while ensuring that risk is... -

Page 251

... fixed income Domestic large-cap stocks (3) Domestic mid-cap stocks Domestic small-cap stocks (4) Global stocks (5) International stocks (6) Emerging market stocks Real estate/timber (7) Hedge funds (8) Private equity Other Total plan investments Payable upon return of securities loaned Net... -

Page 252