MetLife 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

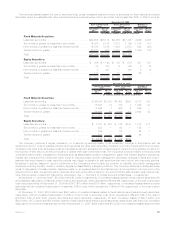

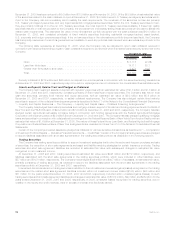

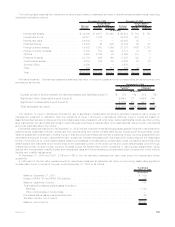

the same default methodology to all Alt-A bonds, regardless of the underlying collateral. The Company’s Alt-A portfolio has superior

structure to the overall Alt-A market. The Company’s Alt-A portfolio is 88% fixed rate collateral, has zero exposure to option ARM mortgages

and has only 12% hybrid ARMs. Fixed rate mortgages have performed better than both option ARMs and hybrid ARMs. Additionally, 83% of

the Company’s Alt-A portfolio has super senior credit enhancement, which typically provides double the credit enhancement of a standard

AAA rated bond. Based upon the analysis of the Company’s exposure to Alt-A mortgage loans through its investment in asset-backed

securities, the Company continues to expect to receive payments in accordance with the contractual terms of the securities.

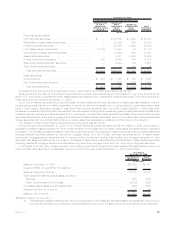

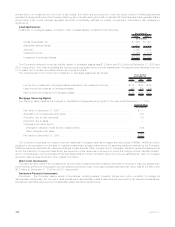

Asset-Backed Securities. The Company’s asset-backed securities are diversified both by sector and by issuer. At December 31,

2008, the largest exposures in the Company’s asset-backed securities portfolio were credit card receivables, automobile receivables,

student loan receivables and residential mortgage-backed securities backed by sub-prime mortgage loans of 49%, 10%, 10% and 10% of

the total holdings, respectively. At December 31, 2008 and 2007, the Company’s holdings in asset-backed securities was $10.5 billion

and $10.6 billion at estimated fair value. At December 31, 2008 and 2007, $7.9 billion and $5.7 billion, respectively, or 75% and 54%,

respectively, of total asset-backed securities were rated Aaa/AAA by Moody’s, S&P or Fitch.

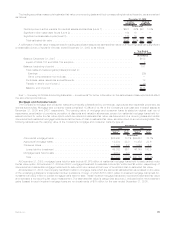

The Company’s asset-backed securities included in the structured securities table above include exposure to residential mortgage-

backed securities backed by sub-prime mortgage loans. Sub-prime mortgage lending is the origination of residential mortgage loans to

customers with weak credit profiles. The Company’s exposure exists through investment in asset-backed securities which are supported

by sub-prime mortgage loans. The slowing U.S. housing market, greater use of affordable mortgage products, and relaxed underwriting

standards for some originators of below-prime loans have recently led to higher delinquency and loss rates, especially within the 2006 and

2007 vintage year. Vintage year refers to the year of origination and not to the year of purchase. These factors have caused a pull-back in

market liquidity and repricing of risk, which has led to an increase in unrealized losses from December 31, 2007 to December 31, 2008.

Based upon the analysis of the Company’s exposure to sub-prime mortgage loans through its investment in asset-backed securities, the

Company expects to receive payments in accordance with the contractual terms of the securities.

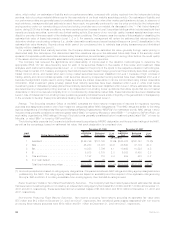

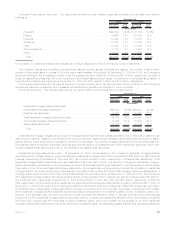

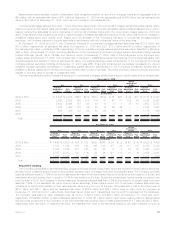

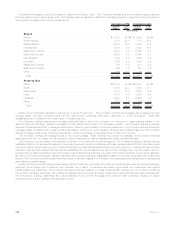

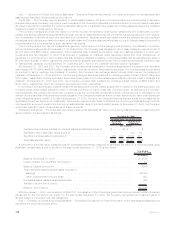

The following table shows the Company’s exposure to asset-backed securities supported by sub-prime mortgage loans by credit

quality and by vintage year:

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Aaa Aa A Baa

Below

Investment

Grade Total

December 31, 2008

(In millions)

2003 & Prior . . . . . . . . . . . . . . . . . $ 96 $ 77 $ 92 $ 72 $ 26 $16 $ 83 $ 53 $ 8 $ 4 $ 305 $ 222

2004 . . . . . . . . . . . . . . . . . . . . . 129 70 372 204 5 3 37 28 2 1 545 306

2005 . . . . . . . . . . . . . . . . . . . . . 357 227 186 114 20 11 79 46 4 4 646 402

2006 . . . . . . . . . . . . . . . . . . . . . 146 106 69 30 15 10 26 7 2 2 258 155

2007 . . . . . . . . . . . . . . . . . . . . . — — 78 33 35 21 2 2 3 1 118 57

2008 . . . . . . . . . . . . . . . . . . . . . —————— ———— — —

Total .................... $728 $480 $797 $453 $101 $61 $227 $136 $19 $12 $1,872 $1,142

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Cost or

Amortized

Cost Fair

Value

Aaa Aa A Baa

Below

Investment

Grade Total

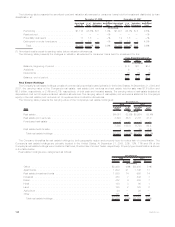

December 31, 2007

(In millions)

2003 & Prior . . . . . . . . . . . . . . . . $ 217 $ 206 $130 $123 $15 $14 $13 $12 $ 4 $ 2 $ 379 $ 357

2004 . . . . . . . . . . . . . . . . . . . . 186 169 412 383 11 9 — — 1 — 610 561

2005 . . . . . . . . . . . . . . . . . . . . 509 462 218 197 — — — — — — 727 659

2006 . . . . . . . . . . . . . . . . . . . . 244 223 64 43 — — — — — — 308 266

2007 . . . . . . . . . . . . . . . . . . . . 132 123 17 9 — — — — — — 149 132

Total ................... $1,288 $1,183 $841 $755 $26 $23 $13 $12 $5 $2 $2,173 $1,975

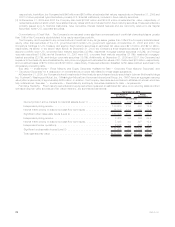

At December 31, 2008 and 2007, the Company had asset-backed securities supported by sub-prime mortgage loans with estimated

fair values of $1.1 billion and $2.0 billion, respectively, and unrealized losses of $730 million and $198 million, respectively, as outlined in

the tables above. At December 31, 2008, approximately 82% of the portfolio is rated Aa or better of which 82% was in vintage year 2005

and prior. At December 31, 2007, approximately 98% of the portfolio was rated Aa or better of which 79% was in vintage year 2005 and

prior. These older vintages benefit from better underwriting, improved enhancement levels and higher residential property price appre-

ciation. At December 31, 2008, 37% of the asset-backed securities backed by sub-prime mortgage loans have been guaranteed by

financial guarantee insurers, of which 19% and 37% were guaranteed by financial guarantee insurers who were Aa and Baa rated,

respectively. At December 31, 2008, all of the $1.1 billion of asset-backed securities supported by sub-prime mortgage loans were

classified as Level 3 securities.

96 MetLife, Inc.