MetLife 2008 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

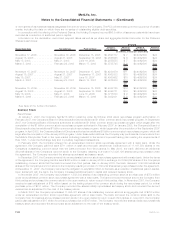

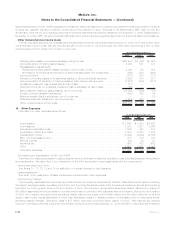

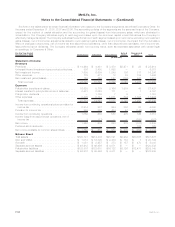

within Corporate & Other. Estimated restructuring costs may change as management continues to execute its restructuring plans.

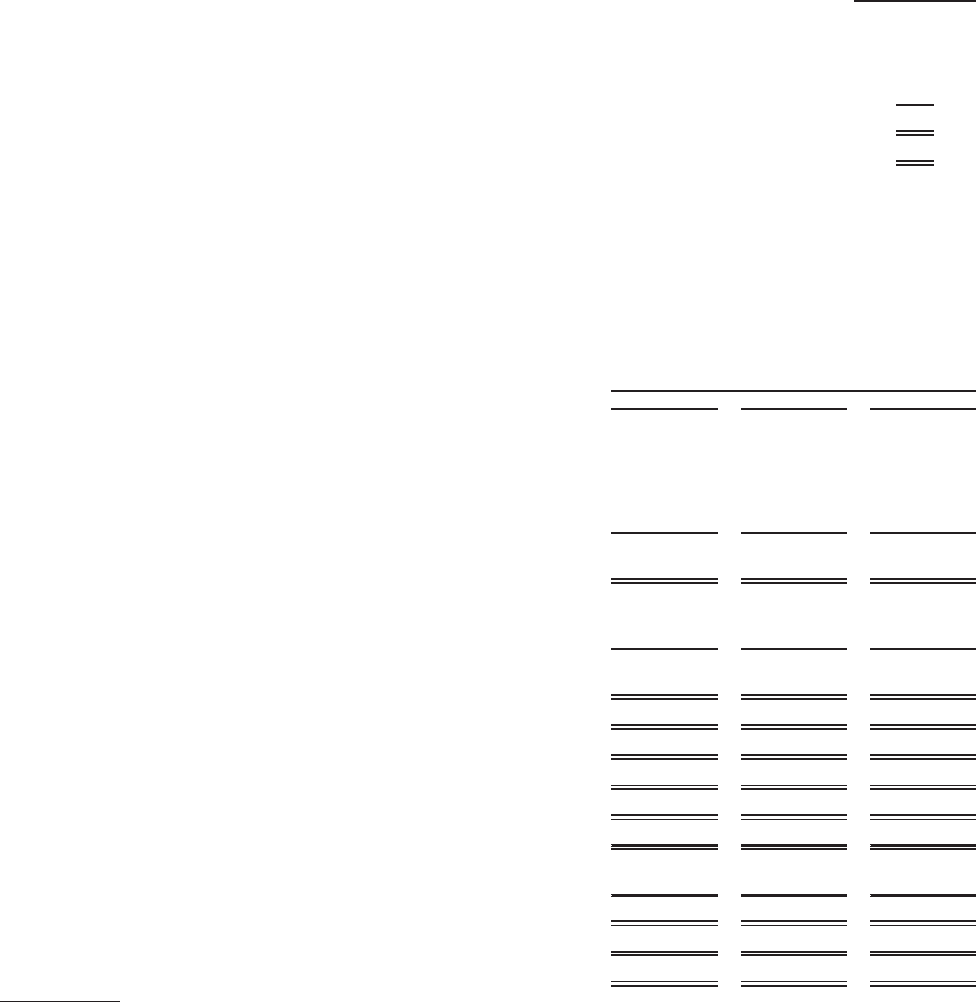

Restructuring charges associated with this enterprise-wide initiative were as follows: Year Ended

December 31, 2008

(In millions)

Balanceasofbeginningoftheperiod............................................... $ —

Severancecharges ......................................................... 109

Changeinseverancechargeestimates ............................................ (8)

Cashpayments............................................................ (15)

Balanceasofendoftheperiod................................................... $ 86

Totalrestructuringchargesincurred ................................................ $101

Management anticipates further restructuring charges including severance, lease and asset impairments will be incurred during the

years ended December 31, 2009 and 2010. However, such restructuring plans are not sufficiently developed to enable the Company to

make an estimate of such restructuring charges at December 31, 2008.

In addition to the restructuring charges incurred in connection with the aforementioned enterprise-wide initiative, the Company also

incurred severance costs in connection with the Argentine government’s nationalization of the its private pension business. The Company

recognized a restructuring charge of $15 million within the International segment during the fourth quarter of 2008 and made payments of

$12 million resulting in a restructuring liability of $3 million at December 31, 2008.

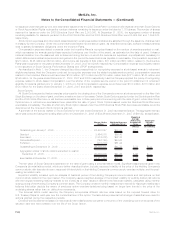

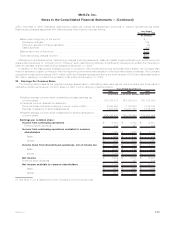

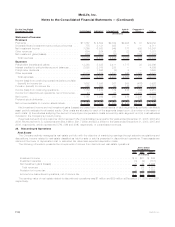

20. Earnings Per Common Share

The following table presents the weighted average shares used in calculating basic earnings per common share and those used in

calculating diluted earnings per common share for each income category presented below:

2008 2007 2006

Years Ended December 31,

(In millions, except share and per share data)

Weighted average common stock outstanding for basic earnings per

common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 735,184,337 744,153,514 761,105,024

Incremental common shares from assumed:

Stock purchase contracts underlying common equity units(1) . . . . . . . . . 2,043,553 7,138,900 1,416,134

Exercise or issuance of stock-based awards . . . . . . . . . . . . . . . . . . . 7,557,540 10,971,585 8,182,938

Weighted average common stock outstanding for diluted earnings per

common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 744,785,430 762,263,999 770,704,096

Earnings per common share:

Income from continuing operations ...................... $ 3,510 $ 4,102 $ 2,910

Preferredstockdividends .............................. 125 137 134

Income from continuing operations available to common

shareholders ..................................... $ 3,385 $ 3,965 $ 2,776

Basic.......................................... $ 4.60 $ 5.33 $ 3.65

Diluted ......................................... $ 4.54 $ 5.20 $ 3.60

Income (loss) from discontinued operations, net of income tax . . $ (301) $ 215 $ 3,383

Basic.......................................... $ (0.41) $ 0.29 $ 4.44

Diluted ......................................... $ (0.40) $ 0.28 $ 4.39

Net income ........................................ $ 3,209 $ 4,317 $ 6,293

Preferredstockdividends................................ 125 137 134

Net income available to common shareholders .............. $ 3,084 $ 4,180 $ 6,159

Basic.......................................... $ 4.19 $ 5.62 $ 8.09

Diluted ......................................... $ 4.14 $ 5.48 $ 7.99

(1) See Note 13 for a description of the Company’s common equity units.

F-91MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)