MetLife 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

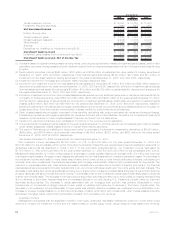

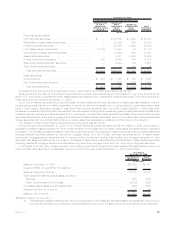

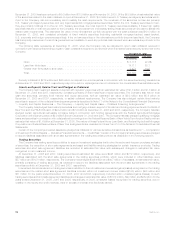

The following tables present the cost or amortized cost, gross unrealized loss and number of securities for fixed maturity and equity

securities, where the estimated fair value had declined and remained below cost or amortized cost by less than 20%, or 20% or more at:

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized

Cost Gross Unrealized

Loss Number of

Securities

December 31, 2008

(In millions, except number of securities)

Fixed Maturity Securities:

Less than six months . . . . . . . . . . . . . . . . . . . . . . . . . $32,658 $48,114 $2,358 $17,191 4,566 2,827

Six months or greater but less than nine months . . . . . . . . 14,975 2,180 1,313 1,109 1,314 157

Nine months or greater but less than twelve months . . . . . 16,372 3,700 1,830 2,072 934 260

Twelvemonthsorgreater....................... 23,191 650 2,533 415 1,809 102

Total .................................... $87,196 $54,644 $8,034 $20,787

Equity Securities:

Lessthansixmonths ......................... $ 386 $ 1,190 $ 58 $ 519 351 551

Sixmonthsorgreaterbutlessthanninemonths........ 33 413 6 190 8 32

Nine months or greater but less than twelve months . . . . . 3 487 — 194 5 15

Twelvemonthsorgreater....................... 171 — 11 — 20 —

Total .................................... $ 593 $ 2,090 $ 75 $ 903

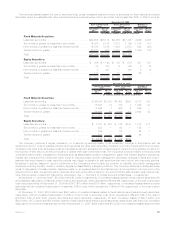

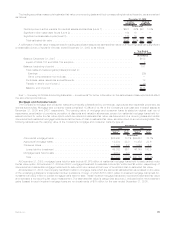

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized

Cost Gross Unrealized

Loss Number of

Securities

December 31, 2007

(In millions, except number of securities)

Fixed Maturity Securities:

Lessthansixmonths........................... $ 46,343 $1,375 $1,482 $383 4,713 148

Six months or greater but less than nine months . . . . . . . . . 15,833 14 730 4 1,028 24

Nine months or greater but less than twelve months . . . . . . . 8,529 7 492 2 586 —

Twelve months or greater . . . . . . . . . . . . . . . . . . . . . . . . 29,893 50 1,162 13 2,692 32

Total...................................... $100,598 $1,446 $3,866 $402

Equity Securities:

Lessthansixmonths........................... $ 1,757 $ 423 $ 148 $133 1,212 417

Six months or greater but less than nine months . . . . . . . . . 528 — 62 — 154 —

Nine months or greater but less than twelve months . . . . . . . 439 — 54 — 62 1

Twelvemonthsorgreater ........................ 511 — 52 — 90 —

Total...................................... $ 3,235 $ 423 $ 316 $133

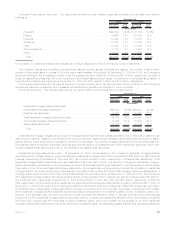

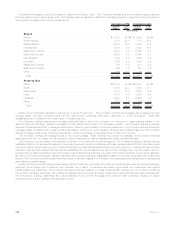

The Company performs a regular evaluation, on a security-by-security basis, of its investment holdings in accordance with its

impairment policy in order to evaluate whether such securities are other-than-temporarily impaired. One of the criteria which the Company

considers in its other-than-temporary impairment analysis is its intent and ability to hold securities for a period of time sufficient to allow for

therecoveryoftheirvaluetoanamountequaltoorgreaterthancostoramortized cost. The Company’s intent and ability to hold securities

considers broad portfolio management objectives such as asset/liability duration management, issuer and industry segment exposures,

interest rate views and the overall total return focus. In following these portfolio management objectives, changes in facts and circum-

stances that were present in past reporting periods may trigger a decision to sell securities that were held in prior reporting periods.

Decisions to sell are based on current conditions or the Company’s need to shift the portfolio to maintain its portfolio management

objectives including liquidity needs or duration targets on asset/liability managed portfolios. The Company attempts to anticipate these

types of changes and if a sale decision has been made on an impaired security and that security is not expected to recover prior to the

expected time of sale, the security will be deemed other-than-temporarily impaired in the period that the sale decision was made and an

other-than-temporary impairment loss will be recognized. See “— Summary of Critical Accounting Estimates — Investments.”

At December 31, 2008 and 2007, $8.0 billion and $3.9 billion, respectively, of unrealized losses related to fixed maturity securities with

an unrealized loss position of less than 20% of cost or amortized cost, which represented 9% and 4%, respectively, of the cost or amortized

cost of such securities. At December 31, 2008 and 2007, $75 million and $316 million, respectively, of unrealized losses related to equity

securities with an unrealized loss position of less than 20% of cost, which represented 13% and 10%, respectively, of the cost of such

securities.

At December 31, 2008, $20.8 billion and $903 million of unrealized losses related to fixed maturity securities and equity securities,

respectively, with an unrealized loss position of 20% or more of cost or amortized cost, which represented 38% and 43% of the cost or

amortized cost of such fixed maturity securities and equity securities, respectively. Of such unrealized losses of $20.8 billion and

$903 million, $17.2 billion and $519 million related to fixed maturity securities and equity securities, respectively, that were in an unrealized

loss position for a period of less than six months. At December 31, 2007, $402 million and $133 million of unrealized losses related to fixed

91MetLife, Inc.