MetLife 2008 Annual Report Download - page 197

Download and view the complete annual report

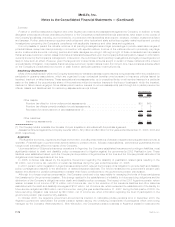

Please find page 197 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the years prior to commutation, the excess insurance policies for asbestos-related claims were subject to annual and per claim

sublimits. Amounts exceeding the sublimits during 2007, 2006 and 2005 were approximately $16 million, $8 million and $0, respectively.

Amounts were recoverable under the policies annually with respect to claims paid during the prior calendar year. Each asbestos-related

policy contained an experience fund and a reference fund that provided for payments to MLIC at the commutation date if the reference fund

was greater than zero at commutation or pro rata reductions from time to time in the loss reimbursements to MLIC if the cumulative return

on the reference fund was less than the return specified in the experience fund. The return in the reference fund was tied to performance of

the S&P 500 Index and the Lehman Brothers Aggregate Bond Index. A claim with respect to the prior year was made under the excess

insurance policies in each year from 2003 through 2008 for the amounts paid with respect to asbestos litigation in excess of the retention.

The foregone loss reimbursements were approximately $62.2 million with respect to claims for the period of 2002 through 2007. Because

the policies were commuted as of September 30, 2008, there will be no claims under the policies or forgone loss reimbursements with

respect to payments made in 2008 and thereafter.

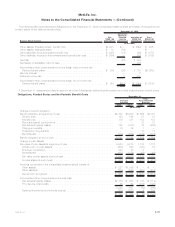

The Company believes adequate provision has been made in its consolidated financial statements for all probable and reasonably

estimable losses for asbestos-related claims. MLIC’s recorded asbestos liability is based on its estimation of the following elements, as

informed by the facts presently known to it, its understanding of current law, and its past experiences: (i) the probable and reasonably

estimable liability for asbestos claims already asserted against MLIC, including claims settled but not yet paid; (ii) the probable and

reasonably estimable liability for asbestos claims not yet asserted against MLIC, but which MLIC believes are reasonably probable of

assertion; and (iii) the legal defense costs associated with the foregoing claims. Significant assumptions underlying MLIC’s analysis of the

adequacy of its recorded liability with respect to asbestos litigation include: (i) the number of future claims; (ii) the cost to resolve claims;

and (iii) the cost to defend claims.

MLIC reevaluates on a quarterly and annual basis its exposure from asbestos litigation, including studying its claims experience,

reviewing external literature regarding asbestos claims experience in the United States, assessing relevant trends impacting asbestos

liability and considering numerous variables that can affect its asbestos liability exposure on an overall or per claim basis. These variables

include bankruptcies of other companies involved in asbestos litigation, legislative and judicial developments, the number of pending

claims involving serious disease, the number of new claims filed against it and other defendants, and the jurisdictions in which claims are

pending. As previously disclosed, in 2002 MLIC increased its recorded liability for asbestos-related claims by $402 million from

approximately $820 million to $1,225 million. Based upon its regular reevaluation of its exposure from asbestos litigation, MLIC has

updated its liability analysis for asbestos-related claims through December 31, 2008.

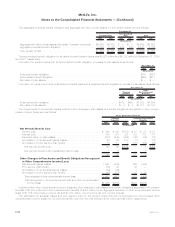

Regulatory Matters

The Company receives and responds to subpoenas or other inquiries from state regulators, including state insurance commissioners;

state attorneys general or other state governmental authorities; federal regulators, including the SEC; federal governmental authorities,

including congressional committees; and the Financial Industry Regulatory Authority seeking a broad range of information. The issues

involved in information requests and regulatory matters vary widely. Certain regulators have requested information and documents

regarding contingent commission payments to brokers, the Company’s awareness of any “sham” bids for business, bids and quotes that

the Company submitted to potential customers, incentive agreements entered into with brokers, or compensation paid to intermediaries.

Regulators also have requested information relating to market timing and late trading of mutual funds and variable insurance products and,

generally, the marketing of products. The Company has received a subpoena from the Office of the U.S. Attorney for the Southern District

of California asking for documents regarding the insurance broker Universal Life Resources. The Company has been cooperating fully with

these inquiries.

Regulatory authorities in a small number of states have had investigations or inquiries relating to sales of individual life insurance policies

or annuities or other products by MLIC; New England Mutual Life Insurance Company, New England Life Insurance Company and New

England Securities Corporation (collectively “New England”); GALIC; Walnut Street Securities, Inc. (“Walnut Street Securities”) and MetLife

Securities, Inc. (“MSI”). Over the past several years, these and a number of investigations by other regulatory authorities were resolved for

monetary payments and certain other relief. The Company may continue to resolve investigations in a similar manner.

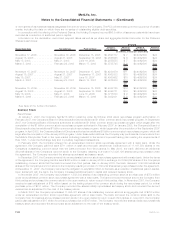

MSI is a defendant in two regulatory matters brought by the Illinois Department of Securities. In 2005, MSI received a notice from the

Illinois Department of Securities asserting possible violations of the Illinois Securities Act in connection with sales of a former affiliate’s

mutual funds. A response has been submitted and in January 2008, MSI received notice of the commencement of an administrative action

by the Illinois Department of Securities. In May 2008, MSI’s motion to dismiss the action was denied. In the second matter, in December

2008 MSI received a Notice of Hearing from the Illinois Department of Securities based upon a complaint alleging that MSI failed to

reasonably supervise one of its former registered representatives in connection with the sale of variable annuities to Illinois investors. MSI

intends to vigorously defend against the claims in these matters.

In June 2008, the Environmental Protection Agency issued a Notice of Violation (“NOV”) regarding the operations of the Homer City

Generating Station, an electrical generation facility. The NOV alleges, among other things, that the electrical generation facility is being

operated in violation of certain federal and stateCleanAirActrequirements.HomerCityOL6LLC,anentityownedbyMLIC,isapassive

investor with a minority interest in the electrical generation facility, which is solely operated by the lessee, EME Homer City Generation L.P.

(“EME Homer”). Homer City OL6 LLC and EME Homer are among the respondents identified in the NOV. EME Homer has been notified of its

obligation to indemnify Homer City OL6 LLC and MLIC for any claims resulting from the NOV and has expressly acknowledged its obligation

to indemnify Homer City OL6 LLC.

Other Litigation

Jacynthe Evoy-Larouche v. Metropolitan Life Ins. Co. (Que. Super. Ct., filed March 1998). This putative class action lawsuit involving

sales practices claims is pending against MLIC in Canada. Plaintiff alleges misrepresentations regarding dividends and future payments for

life insurance policies and seeks unspecified damages.

F-74 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)