MetLife 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

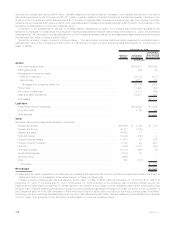

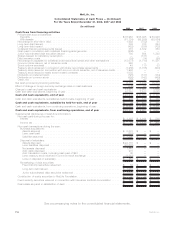

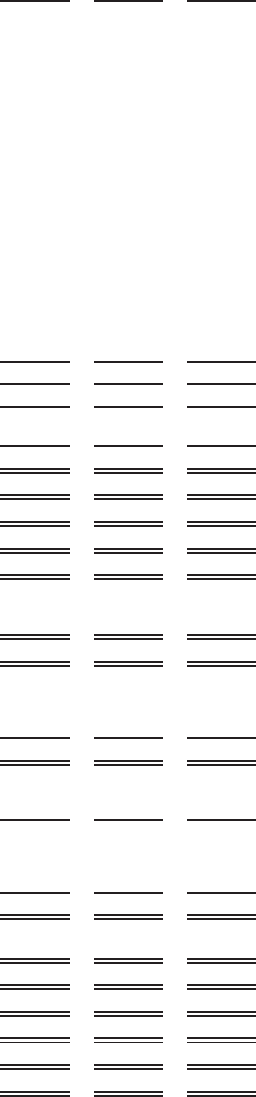

MetLife, Inc.

Consolidated Statements of Cash Flows — (Continued)

For the Years Ended December 31, 2008, 2007 and 2006

(In millions) 2008 2007 2006

Cash flows from financing activities

Policyholder account balances:

Deposits ....................................................... $76,963 $58,025 $53,946

Withdrawals ..................................................... (61,134) (55,256) (50,574)

Netchangeinshort-termdebt........................................... 1,992 (782) 35

Long-termdebtissued................................................ 339 726 284

Long-termdebtrepaid................................................ (422) (286) (732)

Collateralfinancingarrangementsissued.................................... 310 4,882 850

Cash paid in connection with collateral financing arrangements . .................... (800) — —

Juniorsubordinateddebtsecuritiesissued .................................. 750 694 1,248

Sharessubjecttomandatoryredemption.................................... — (131) —

Debtissuancecosts ................................................. (34) (14) (25)

Netchangeinpayablesforcollateralundersecuritiesloanedandothertransactions....... (13,077) (1,710) 11,331

Commonstockissued,netofissuancecosts................................. 290 — —

Stockoptionsexercised............................................... 45 110 83

Treasurystockacquiredinconnectionwithsharerepurchaseagreements.............. (1,250) (1,705) (500)

Treasury stock issued in connection with common stock issuance, net of issuance costs . . . . 1,936 — —

Treasurystockissuedtosettlestockforwardcontracts .......................... 1,035 — —

Dividendsonpreferredstock ........................................... (125) (137) (134)

Dividendsoncommonstock............................................ (592) (541) (450)

Other,net ........................................................ (38) 67 12

Netcashprovidedbyfinancingactivities ..................................... 6,188 3,942 15,374

Effectofchangeinforeigncurrencyexchangeratesoncashbalances ................. (349) 61 47

Changeincashandcashequivalents ....................................... 13,871 3,261 3,089

Cashandcashequivalents,beginningofyear.................................. 10,368 7,107 4,018

Cash and cash equivalents, end of year ................................... $24,239 $10,368 $ 7,107

Cashandcashequivalents,subsidiariesheld-for-sale,beginningofyear ................ $ 407 $ 170 $ 133

Cash and cash equivalents, subsidiaries held-for-sale, end of year .............. $ 32 $ 407 $ 170

Cashandcashequivalents,fromcontinuingoperations,beginningofyear............... $ 9,961 $ 6,937 $ 3,885

Cash and cash equivalents, from continuing operations, end of year ............. $24,207 $ 9,961 $ 6,937

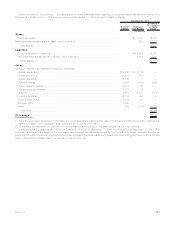

Supplemental disclosures of cash flow information:

Net cash paid during the year for:

Interest ........................................................ $ 1,107 $ 1,011 $ 819

Incometax ...................................................... $ 27 $ 2,128 $ 409

Non-cash transactions during the year:

Business acquisitions:

Assetsacquired ................................................. $ 2,083 $ — $ —

Less:cashpaid ................................................. (783) — —

Liabilitiesassumed ............................................... $ 1,300 $ — $ —

Disposal of subsidiary:

Assetsdisposed................................................. $22,135 $ — $ —

Less:liabilitiesdisposed............................................ (20,689) — —

Netassetsdisposed .............................................. 1,446 — —

Add:cashdisposed .............................................. 270 — —

Add:transactioncosts,includingcashpaidof$43 .......................... 60 — —

Less:treasurystockreceivedincommonstockexchange ..................... (1,318) — —

Lossondisposalofsubsidiary........................................ $ 458 $ — $ —

Remarketing of debt securities:

Fixed maturity securities redeemed ..................................... $ 32 $ — $ —

Long-termdebtissued............................................. $ 1,035 $ — $ —

Junior subordinated debt securities redeemed . . ........................... $ 1,067 $ — $ —

ContributionofequitysecuritiestoMetLifeFoundation........................... $ — $ 12 $ —

Fixedmaturitysecuritiesreceivedinconnectionwithinsurancecontractcommutation...... $ 115 $ — $ —

Realestateacquiredinsatisfactionofdebt .................................. $ 1 $ 1 $ 6

See accompanying notes to the consolidated financial statements.

F-6 MetLife, Inc.