MetLife 2008 Annual Report Download - page 112

Download and view the complete annual report

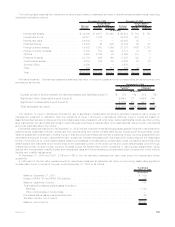

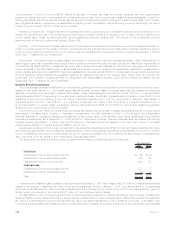

Please find page 112 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the period the policy benefits are payable. Utilizing these assumptions, liabilities are established on a block of business basis. If experience

is less favorable than assumed and future losses are projected under loss recognition testing, then additional liabilities may be required,

resulting in a charge to policyholder benefits and claims.

Group Life. Future policy benefits are comprised mainly of liabilities for disabled lives under disability waiver of premium policy

provisions, liabilities for survivor income benefit insurance, and premium stabilization and other contingency liabilities held under

participating group life insurance contracts.

Retirement & Savings. Liabilities are primarily related to retirement and structured settlement annuities. There is no interest rate

crediting flexibility on these liabilities. A sustained low interest rate environment could negatively impact earnings as a result. The Company

has various derivative positions, primarily interest rate floors and interest rate swaps, to mitigate the risks associated with such a scenario.

Non-Medical Health & Other. Future policy benefits are comprised mainly of provisions for liabilities for disabled lives under group

long-term disability, individual disability, and long-term care policies, active life liabilities under long-term care and individual disability

policies. The Company entered into various derivative positions, primarily interest rate swaps and swaptions, to mitigate the risk that

investment of premiums received and reinvestment of maturing assets over the life of the policy will be at rates below those assumed in the

original pricing of these contracts.

Traditional Life. Future policy benefits mostly relate to participating whole life policies and endowments (including the closed block).

The remainder support liabilities for term life policies. The Company has often reinsured a portion of the mortality risk on new individual life

insurance policies. The reinsurance programs are routinely evaluated and this may result in increases or decreases to existing coverage.

Variable & Universal Life. Future policy benefits are comprised mainly of reserves for mortality and SOP 03-1 liabilities related to

universal life secondary guarantees. In order to manage risk, the Company has often reinsured a portion of the mortality risk on new

individual life insurance policies. The reinsurance programs are routinely evaluated and this may result in increases or decreases to existing

coverage.

Annuities. Future policy benefits are comprised mainly of reserves for life-contingent income annuities, supplemental contracts with

and without life contingencies, reserves for Guaranteed Minimum Death Benefits (“GMDBs”) included in certain annuity contracts, and a

certain portion of guaranteed living benefits. See‘‘—Variable Annuity Guarantees.”

International. Future policy benefits are held primarily for immediate annuities in Latin America, as well as for total return pass-thru

provisions included in certain universal life and savings products in Latin America, and traditional life, endowment and annuity contracts

sold in various countries in the Asia Pacific region. They also include SOP 03-1 liabilities for variable annuity guarantees of minimum death

benefits, and longevity guarantees sold in the Asia Pacific region. Finally, in the European region, they also include unearned premium

liabilities established for credit insurance contracts covering death, disability and involuntary loss of employment, as well as a small amount

of traditional life and endowment contracts. Factors impacting these liabilities include sustained periods of lower yields than rates

established at issue, lower than expected asset reinvestment rates, asset default and more rapid improvement of mortality levels than

anticipated for life contingent immediate annuities. The Company mitigates its risks by implementing an asset/liability matching policy and

through the development of periodic experience studies. See “— Variable Annuity Guarantees.”

Auto & Home. Future policy benefits include liabilities for unpaid claims and claim expenses for property and casualty insurance and

represent the amount estimated for claims that have been reported but not settled and claims incurred but not reported. Liabilities for

unpaid claims are estimated based upon assumptions such as rates of claim frequencies, levels of severities, inflation, judicial trends,

legislative changes or regulatory decisions. Assumptions are based upon the Company’s historical experience and analyses of historical

development patterns of the relationship of loss adjustment expenses to losses for each line of business, and consider the effects of

current developments, anticipated trends and risk management programs, reduced for anticipated salvage and subrogation.

Estimates for the liabilities for unpaid claims and claim expenses are reset as actuarial indications change and these changes in the

liability are reflected in the current results of operation as either favorable or unfavorable development of prior year losses.

Corporate & Other. Future policy benefits primarily include liabilities for quota-share reinsurance agreements for certain long-term care

and workers’ compensation business written by MICC, a subsidiary of the Company, prior to the acquisition of MICC. These run-off

businesses have been included within Corporate & Other since the acquisition of MICC.

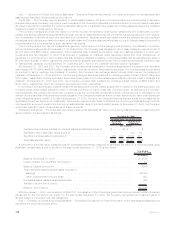

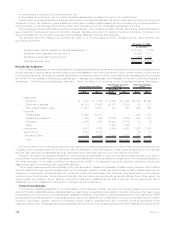

Policyholder Account Balances

Policyholder account balances are generally equal to the account value, which includes accrued interest credited, but exclude the

impact of any applicable surrender charge that may be incurred upon surrender.

Group Life. Policyholder account balances are held for death benefit disbursement retained asset accounts, universal life policies, the

fixed account of variable life insurance policies, and specialized life insurance products for benefit programs. Policyholder account

balances are credited interest at a rate set by the Company, which are influenced by current market rates. The majority of the policyholder

account balances have a guaranteed minimum credited rate between 1.5% and 4.0%. A sustained low interest rate environment could

negatively impact earnings as a result of the minimum credited rate guarantees. The Company has various derivative positions, primarily

interest rate floors, to partially mitigate the risks associated with such a scenario.

Retirement & Savings. Policyholder account balances are comprised of funding agreements, GICs and Global GICs (“GGICs”). Interest

crediting rates vary by type of contract, and can be fixed or variable. Variable interest crediting rates are generally tied to an external index,

109MetLife, Inc.