MetLife 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

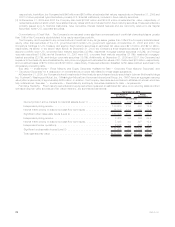

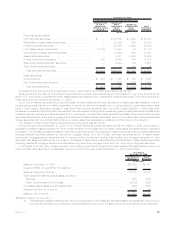

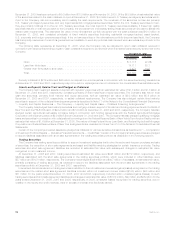

b) Net transfers in and/or out of Level 3 for fixed maturity securities were $1,839 million for the year ended December 31, 2008 and

were comprised of transfers in of $3,522 million and transfers out of ($1,683) million. Net transfers in and/or out of Level 3 for

equity securities were ($29) million for the year ended December 31, 2008 and were comprised of transfers in of $38 million and

transfers out of ($67) million.

c) Included in earnings and other comprehensive income (loss) in the above table, that were incurred for transfers in subsequent to

their transfer to Level 3 were ($479) million and ($723) million, respectively, for fixed maturity securities, and ($20) million and

($3) million, respectively, for equity securities, for the year ended December 31, 2008.

d) Overall, transfers in and/or out of Level 3 are attributable to a change in the observability of inputs. During the year ended

December 31, 2008, fixed maturity securities transfers into Level 3 of $3,522 million resulted primarily from current market

conditions characterized by a lack of trading activity, decreased liquidity, fixed maturity securities going into default, and ratings

downgrades (e.g. from investment grade to below investment grade). These current market conditions have resulted in

decreased transparency of valuations, and an increased use of broker quotations and unobservable inputs to determine fair

value. During the year ended December 31, 2008, fixed maturity securities transfers out of Level 3 of ($1,683) million resulted

primarily from increased transparency of both new issuances that subsequent to issuance and establishment of trading activity

became priced by pricing services and existing issuances that, over time, the Company was able to corroborate pricing

received from independent pricing services with observable inputs.

See “— Summary of Critical Accounting Estimates — Investments” for further information on the estimates and assumptions that affect

the amounts reported above.

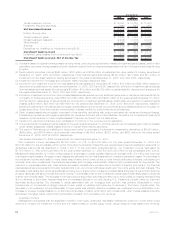

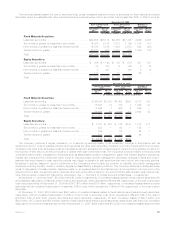

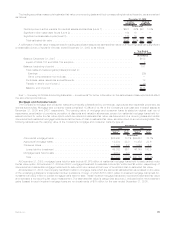

Net Unrealized Investment Gains (Losses). The components of net unrealized investment gains (losses), included in accumulated

other comprehensive income (loss), are as follows:

2008 2007 2006

Years Ended December 31,

(In millions)

Fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(21,246) $ 3,479 $ 5,075

Equitysecurities............................................... (934) 159 541

Derivatives .................................................. (2) (373) (208)

Minorityinterest............................................... (10) (150) (159)

Other...................................................... 53 3 9

Subtotal................................................... (22,139) 3,118 5,258

Amounts allocated from:

Insuranceliabilitylossrecognition.................................... 42 (608) (1,149)

DACandVOBA ............................................... 3,025 (327) (189)

Policyholderdividendobligation..................................... — (789) (1,062)

Subtotal................................................... 3,067 (1,724) (2,400)

Deferredincometax ............................................ 6,508 (423) (994)

Subtotal................................................... 9,575 (2,147) (3,394)

Net unrealized investment gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(12,564) $ 971 $ 1,864

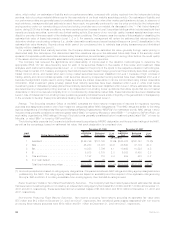

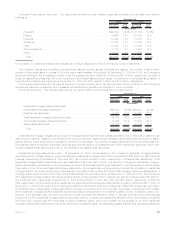

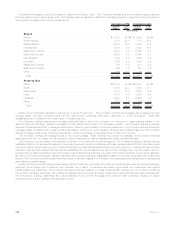

The changes in net unrealized investment gains (losses) are as follows:

2008 2007 2006

Years Ended December 31,

(In millions)

Balance,endofpriorperiod........................................ $ 971 $1,864 $1,942

Cumulative effect of change in accounting principles, net of income tax . . . . . . . . . . . (10) — —

Balance,beginningofperiod....................................... 961 1,864 1,942

Unrealizedinvestmentgains(losses)duringtheyear........................ (25,377) (2,140) (706)

Unrealizedinvestmentlossesofsubsidiariesatthedateofdisposal.............. 130 — —

Unrealized investment gains (losses) relating to:

Insuranceliabilitygain(loss)recognition .............................. 650 541 261

DACandVOBA .............................................. 3,370 (138) (110)

DACandVOBAofsubsidiariesatdateofdisposal........................ (18) — —

Policyholderdividendobligation.................................... 789 273 430

Deferredincometax ........................................... 6,991 571 47

Deferredincometaxofsubsidiariesatdateofdisposal..................... (60) — —

Balance, end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(12,564) $ 971 $1,864

Change in net unrealized investment gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . $(13,525) $ (893) $ (78)

90 MetLife, Inc.