MetLife 2008 Annual Report Download - page 81

Download and view the complete annual report

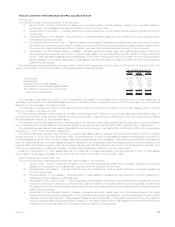

Please find page 81 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Financial Statements presents the estimated fair value of all assets and liabilities required to be measured at estimated fair

value as well as the expanded fair value disclosures required by SFAS 157.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities (“SFAS 159”).

SFAS 159 permits entities the option to measure most financial instruments and certain other items at fair value at specified election dates

and to recognize related unrealized gains and losses in earnings. The fair value option is applied on an instrument-by-instrument basis

upon adoption of the standard, upon the acquisition of an eligible financial asset, financial liability or firm commitment or when certain

specified reconsideration events occur. The fair value election is an irrevocable election. Effective January 1, 2008, the Company elected

the fair value option on fixed maturity and equity securities backing certain pension products sold in Brazil. Such securities will now be

presented as trading securities in accordance with SFAS 115 on the consolidated balance sheet with subsequent changes in estimated fair

value recognized in net investment income. Previously, these securities were accounted for as available-for-sale securities in accordance

with SFAS 115 and unrealized gains and losses on these securities were recorded as a separate component of accumulated other

comprehensive income (loss). The Company’s insurance joint venture in Japan also elected the fair value option for certain of its existing

single premium deferred annuities and the assets supporting such liabilities. The fair value option was elected to achieve improved

reporting of the asset/liability matching associated with these products. Adoption of SFAS 159 by the Company and its Japanese joint

venture resulted in an increase in retained earnings of $27 million, net of income tax, at January 1, 2008. The election of the fair value

option resulted in the reclassification of $10 million, net of income tax, of net unrealized gains from accumulated other comprehensive

income (loss) to retained earnings on January 1, 2008.

Effective January 1, 2008, the Company adopted FASB Staff Position (“FSP”) No. FAS 157-1, Application of FASB Statement No. 157 to

FASB Statement No. 13 and Other Accounting Pronouncements That Address Fair Value Measurements for Purposes of Lease Clas-

sification or Measurement under Statement 13 (“FSP 157-1”). FSP 157-1 amends SFAS 157 to provide a scope out exception for lease

classification and measurement under SFAS No. 13, Accounting for Leases. The Company also adopted FSP No. FAS 157-2, Effective

Date of FASB Statement No. 157 which delays the effective date of SFAS 157 for certain nonfinancial assets and liabilities that are

recorded at fair value on a nonrecurring basis. The effective date is delayed until January 1, 2009 and impacts balance sheet items

including nonfinancial assets and liabilities in a business combination and the impairment testing of goodwill and long-lived assets.

Effective September 30, 2008, the Company adopted FSP No. FAS 157-3, Determining the Fair Value of a Financial Asset When the

Market for That Asset is Not Active (“FSP 157-3”). FSP 157-3 provides guidance on how a company’s internal cash flow and discount rate

assumptions should be considered in the measurement of fair value when relevant market data does not exist, how observable market

information in an inactive market affects fair value measurement and how the use of market quotes should be considered when assessing

the relevance of observable and unobservable data available to measure fair value. The adoption of FSP 157-3 did not have a material

impact on the Company’s consolidated financial statements.

.

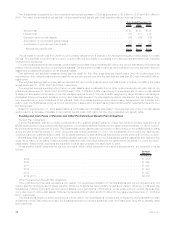

Investments

Effective December 31, 2008, the Company adopted FSP No. FAS 140-4 and FIN 46(r)-8, Disclosures by Public Entities (Enterprises)

about Transfers of Financial Assets and Interests in Variable Interest Entities (“FSP 140-4 and FIN 46(r)-8”). FSP 140-4 and FIN 46(r)-8

requires additional qualitative and quantitative disclosures about a transferors’ continuing involvement in transferred financial assets and

involvement in VIE. The exact nature of the additional required VIE disclosures vary and depend on whether or not the VIE is a qualifying

special purpose entity (“QSPE”). For VIEs that are QSPEs, the additional disclosures are only required for a non-transferor sponsor holding

a variable interest or a non-transferor servicer holding a significant variable interest. For VIEs that are not QSPEs, the additional disclosures

are only required if the Company is the primary beneficiary, and if not the primary beneficiary, only if the Company holds a significant

variable interest or is the sponsor. The Company provided all of the material required disclosures in its consolidated financial statements.

Effective December 31, 2008, the Company adopted FSP No. Emerging Issues Task Force (“EITF”) 99-20-1, Amendments to the

Impairment Guidance of EITF Issue No. 99-20 (“FSP EITF 99-20-1”). FSP EITF 99-20-1 amends the guidance in EITF Issue No. 99-20,

Recognition of Interest Income and Impairment on Purchased Beneficial Interests and Beneficial Interests That Continue to Be Held by a

Transferor in Securitized Financial Assets, to more closely align the guidance to determine whether an other-than-temporary impairment

has occurred for a beneficial interest in a securitized financial asset with the guidance in SFAS 115 for debt securities classified as

available-for-sale or held-to-maturity. The adoption of FSP EITF 99-20-1 did not have an impact on the Company’s consolidated financial

statements.

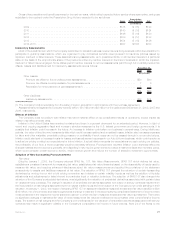

Derivative Financial Instruments

Effective December 31, 2008, the Company adopted FSP No. FAS 133-1 and FIN 45-4, Disclosures about Credit Derivatives and

Certain Guarantees — An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45; and Clarification of the Effective Date

of FASB Statement No. 161 (“FSP 133-1 and FIN 45-4”). FSP 133-1 and FIN 45-4 amends SFAS No. 133, Accounting for Derivative

Instruments and Hedging Activities (“SFAS 133”) to require certain enhanced disclosures by sellers of credit derivatives by requiring

additional information about the potential adverse effects of changes in their credit risk, financial performance, and cash flows. It also

amends FIN No. 45, Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness

of Others — An Interpretation of FASB Statements No. 5, 57, and 107 and Rescission of FASB Interpretation No. 34 (“FIN 45”), to require

an additional disclosure about the current status of the payment/performance risk of a guarantee. The Company provided all of the material

required disclosures in its consolidated financial statements.

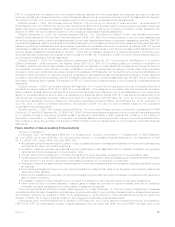

Effective January 1, 2008, the Company adopted SFAS 133 Implementation Issue No. E-23, Clarification of the Application of the

Shortcut Method (“Issue E-23”). Issue E-23 amended SFAS 133 by permitting interest rate swaps to have a non-zero fair value at inception

when applying the shortcut method of assessing hedge effectiveness, as long as the difference between the transaction price (zero) and

the fair value (exit price), as defined by SFAS 157, is solely attributable to a bid-ask spread. In addition, entities are not precluded from

applying the shortcut method of assessing hedge effectiveness in a hedging relationship of interest rate risk involving an interest bearing

asset or liability in situations where the hedged item is not recognized for accounting purposes until settlement date as long as the period

between trade date and settlement date of the hedged item is consistent with generally established conventions in the marketplace. The

adoption of Issue E-23 did not have an impact on the Company’s consolidated financial statements.

78 MetLife, Inc.