MetLife 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

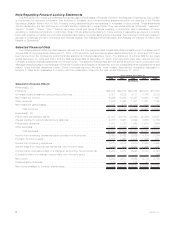

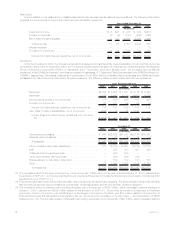

Real Estate

Income related to real estate sold or classified as held-for-sale is presented as discontinued operations. The following information

presents the components of income from discontinued real estate operations:

2008 2007 2006 2005 2004

Years Ended December 31,

(In millions)

Investmentincome................................... $ 6 $21 $ 243 $ 405 $658

Investmentexpense .................................. (3) (9) (151) (246) (392)

Netinvestmentgains(losses)............................ 8 13 4,795 2,125 146

Totalrevenues .................................... 11 25 4,887 2,284 412

Interestexpense .................................... — — — — 13

Provisionforincometax ............................... 4 11 1,725 812 140

Income from discontinued operations, net of income tax . . . . . . . . . $ 7 $14 $3,162 $1,472 $ 259

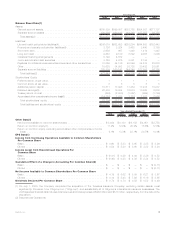

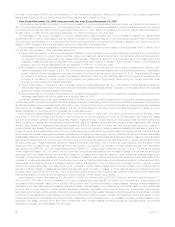

Operations

In the fourth quarter of 2008, the Company entered into an agreement to sell its wholly-owned subsidiary, Cova, to a third party to be

completed in early 2009. In September 2008, the Company completed a tax-free split-off of its majority-owned subsidiary, Reinsurance

Group of America, Incorporated (“RGA”). In September 2007, September 2005 and January 2005, the Company sold its MetLife

Insurance Limited (“MetLife Australia”) annuities and pension businesses, P.T. Sejahtera (“MetLife Indonesia”) and SSRM Holdings, Inc.

(“SSRM”), respectively. The assets, liabilities and operations of Cova, RGA, MetLife Australia, MetLife Indonesia and SSRM have been

reclassified into discontinued operations for all years presented. The following tables present these discontinued operations:

2008 2007 2006 2005 2004

Years Ended December 31,

(In millions)

Revenues ................................... $4,086 $ 5,932 $ 5,467 $ 4,776 $ 4,492

Expenses ................................... 3,915 5,640 5,179 4,609 4,286

Income before provision for income tax . . . . . . . . . . . . . . . . 171 292 288 167 206

Provisionforincometax.......................... 57 101 99 60 74

Income from discontinued operations, net of income tax . . . . 114 191 189 107 132

Gain (loss) on sale of subsidiaries, net of income tax . . . . . . . (422) 10 32 187 —

Income (loss) from discontinued operations, net of income

tax..................................... $ (308) $ 201 $ 221 $ 294 $ 132

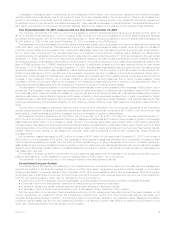

2008 2007 2006 2005 2004

December 31,

(In millions)

Generalaccountassets.......................... $ 946 $22,866 $21,918 $20,150 $16,852

Separateaccountassets ......................... — 17 16 14 14

Totalassets ................................ $ 946 $22,883 $21,934 $20,164 $16,866

Life and health policyholder liabilities(4) . . . . . . . . . . . . . . . . 721 15,780 15,557 15,109 12,210

Debt ...................................... — 528 307 401 425

Collateralfinancingarrangements.................... — 850 850 — —

Juniorsubordinateddebtsecurities................... — 399 399 399 —

Shares subject to mandatory redemption . . . . . . . . . . . . . . . — 159 159 159 158

Other...................................... 27 2,945 2,676 2,195 2,179

Totalliabilities ............................... $ 748 $20,661 $19,948 $18,263 $14,972

(3) The cumulative effect of a change in accounting, net of income tax, of $86 million for the year ended December 31, 2004, resulted from

the adoption of SOP 03-1, Accounting and Reporting by Insurance Enterprises for Certain Nontraditional Long-Duration Contracts and for

Separate Account (“SOP 03-1”).

(4) Policyholder liabilities include future policy benefits, other policyholder funds and bank deposits. The life and health policyholder liabilities

also include policyholder account balances, policyholder dividends payable and the policyholder dividend obligation.

(5) The cumulative effect of changes in accounting principles, net of income tax, of $329 million, which decreased retained earnings at

January 1, 2007, resulted from $292 million related to the adoption of SOP 05-1, Accounting by Insurance Enterprises for Deferred

Acquisition Costs in Connection with Modifications or Exchanges of Insurance Contracts, and $37 million related to the adoption of

Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes — An Interpretation of FASB

Statement No. 109. The cumulative effect of changes in accounting principles, net of income tax, of $27 million, which increased retained

4MetLife, Inc.