MetLife 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

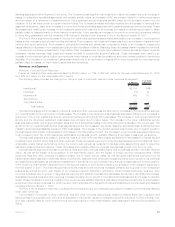

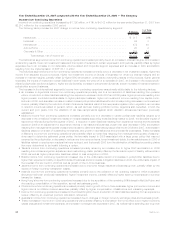

Results of Operations

Discussion of Results

The following table presents consolidated financial information for the Company for the years indicated:

2008 2007 2006

Years Ended December 31,

(In millions)

Revenues

Premiums................................................... $25,914 $22,970 $22,052

Universallifeandinvestment-typeproductpolicyfees...................... 5,381 5,238 4,711

Netinvestmentincome.......................................... 16,296 18,063 16,247

Otherrevenues............................................... 1,586 1,465 1,301

Netinvestmentgains(losses)...................................... 1,812 (578) (1,382)

Totalrevenues ........................................... 50,989 47,158 42,929

Expenses

Policyholderbenefitsandclaims.................................... 27,437 23,783 22,869

Interestcreditedtopolicyholderaccountbalances ........................ 4,787 5,461 4,899

Policyholderdividends .......................................... 1,751 1,723 1,698

Otherexpenses............................................... 11,924 10,429 9,537

Totalexpenses........................................... 45,899 41,396 39,003

Incomefromcontinuingoperationsbeforeprovisionforincometax.............. 5,090 5,762 3,926

Provisionforincometax ......................................... 1,580 1,660 1,016

Incomefromcontinuingoperations .................................. 3,510 4,102 2,910

Income(loss)fromdiscontinuedoperations,netofincometax ................ (301) 215 3,383

Netincome ................................................. 3,209 4,317 6,293

Preferredstockdividends ........................................ 125 137 134

Netincomeavailabletocommonshareholders........................... $ 3,084 $ 4,180 $ 6,159

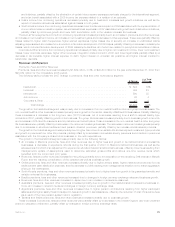

Year Ended December 31, 2008 compared with the Year Ended December 31, 2007 — The Company

Income from continuing operations decreased by $592 million, or 14%, to $3,510 million for the year ended December 31, 2008 from

$4,102 million for the comparable 2007 period.

The following table provides the change from the prior year in income from continuing operations by segment:

Change

(In millions)

Institutional................................................................ $423

Individual................................................................. (711)

International............................................................... (64)

Auto&Home .............................................................. (161)

Corporate&Other........................................................... (79)

Total change, net of income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(592)

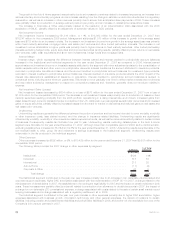

The Institutional segment’s income from continuing operations increased primarily due to a decrease in net investment losses and a

decrease in policyholder benefits due to investment losses shared by policyholders. There was also a decrease in other expenses due in

part to lower expenses related to DAC amortization which is primarily due to the impact of the implementation of SOP 05-1, Accounting by

Insurance Enterprises for Deferred Acquisition Costs in Connection with Modifications or Exchanges of Insurance Contracts (“SOP 05-1”) in

the prior year and amortization refinements in the current year. These increases were offset by lower underwriting results in retirement &

savings, non-medical health & other, and group life businesses. There was also a decrease in interest margins within the retirement &

savings and non-medical health & other businesses, partially offset by an increase in the group life business.

The Individual segment’s income from continuing operations decreased due to higher DAC amortization partially offset by a decrease in

net investment losses due to an increase in gains on freestanding derivatives partially offset by losses primarily relating to embedded

derivatives and fixed maturity securities including those resulting from intersegment transfers of securities. The embedded derivative losses

are net of gains relating to the effect of the widening of the Company’s own credit spread. Income from continuing operations also

decreased due to decreases in interest margins, unfavorable underwriting results in life products, an increase in interest credited to

policyholder account balances, higher annuity benefits, lower universal life and investment-type product policy fees combined with other

revenues, and an increase in policyholder dividends. These decreases were partially offset by a decrease in other expenses as well as an

increase in net investment income on blocks of business not driven by interest margins.

The International segment’s decrease in income from continuing operations was primarily due to a decrease in income from continuing

operations relating to Argentina and Japan. The decrease in Argentina’s income from continuing operations was due to the negative impact

the 2007 pension reform had on current year income from continuing operations. The decrease was partially offset by the net impact

resulting from the Argentine nationalization of the private pension system as well as refinements to certain contingent and insurance

20 MetLife, Inc.