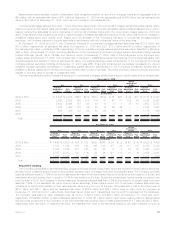

MetLife 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

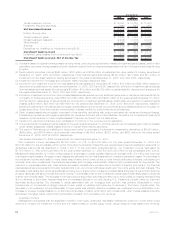

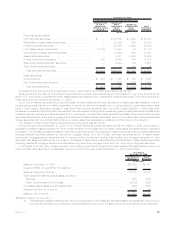

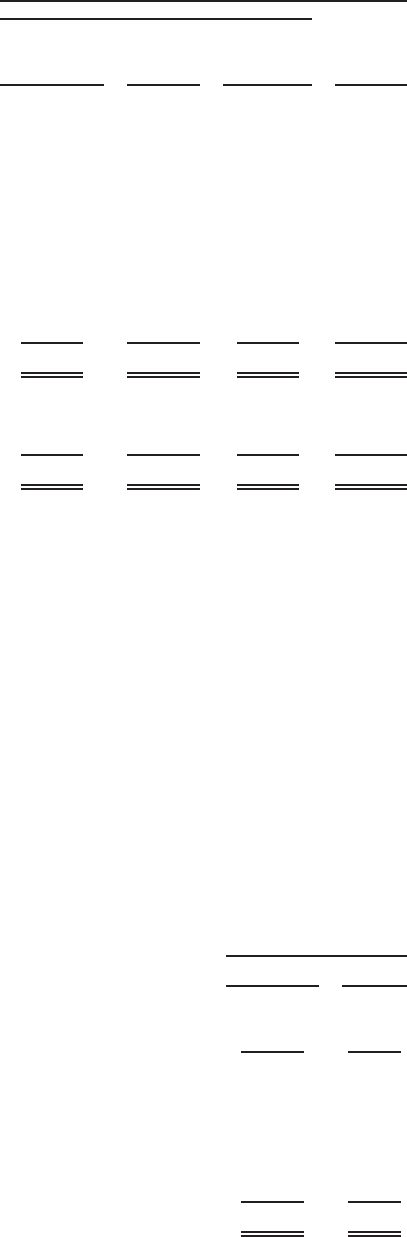

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair Value

Fair Value Measurements at Reporting Date Using

December 31, 2008

(In millions)

Fixed maturity securities:

U.S.corporatesecurities ......................... $ — $ 55,805 $ 7,498 $ 63,303

Residential mortgage-backed securities . . . . . . . . . . . . . . . . — 35,433 595 36,028

Foreigncorporatesecurities ....................... — 23,735 5,944 29,679

U.S. Treasury/agency securities . . . . . . . . . . . . . . . . . . . . . 10,132 11,090 88 21,310

Commercial mortgage-backed securities . . . . . . . . . . . . . . . — 12,384 260 12,644

Asset-backedsecurities.......................... — 8,071 2,452 10,523

Foreigngovernmentsecurities...................... 282 9,463 408 10,153

State and political subdivision securities . . . . . . . . . . . . . . . — 4,434 123 4,557

Otherfixedmaturitysecurities ...................... — 14 40 54

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . $10,414 $160,429 $17,408 $188,251

Equity securities:

Commonstock................................ $ 413 $ 1,167 $ 105 $ 1,685

Non-redeemablepreferredstock .................... — 238 1,274 1,512

Totalequitysecurities.......................... $ 413 $ 1,405 $ 1,379 $ 3,197

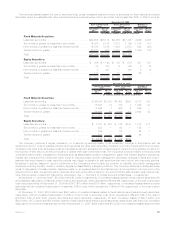

Composition and pricing source for significant Level 3 fixed maturity and equity securities are as follows:

As shown above, the majority of the Level 3 fixed maturity and equity securities (91%) are concentrated in four of the sectors shown

above, U.S. and foreign corporate securities, asset-backed securities and non-redeemable preferred securities. The pricing sources for

these sectors are as follows at December 31, 2008:

Level 3 fixed maturity securities are priced principally through independent broker quotations or market standard valuation method-

ologies using inputs that are not market observable or cannot be derived principally from or corroborated by observable market data.

Level 3 fixed maturity securities consists of less liquid fixed maturity securities with very limited trading activity or where less price

transparency exists around the inputs to the valuation methodologies including below investment grade private placements and less liquid

investment grade corporate securities (included in U.S. and foreign corporate securities) and less liquid asset-backed securities including

securities supported by sub-prime mortgage loans (included in asset-backed securities). Level 3 non-redeemable preferred securities

include securities with very limited trading activity or where less price transparency exists around the inputs to the valuation.

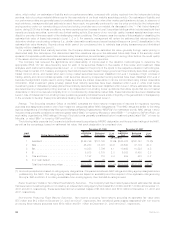

The change in Level 3 fixed maturity securities during the period was as follows:

During the year ended December 31, 2008, Level 3 fixed maturity securities decreased by $5,910 million or 25%, due primarily to

increased unrealized losses recognized in other comprehensive income (loss) and to a lesser extent sales and settlements in excess of

purchases. The increased unrealized losses in fixed maturity securities were concentrated in asset-backed securities (including residential

mortgage-backed securities backed by sub-prime mortgage loans), U.S. and foreign corporate securities and to a lesser extent

commercial mortgage-backed securities due to current market conditions including less liquidity and increased spreads for such

securities. Net sales and settlements in excess of purchases of fixed maturity securities were concentrated in asset-backed securities

(including residential mortgage-backed securities backed by sub-prime mortgage loans) and U.S. and foreign corporate securities.

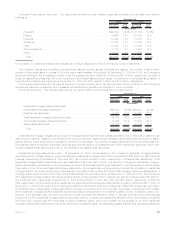

A rollforward of the fair value measurements for fixed maturity securities and equity securities measured at estimated fair value on a

recurring basis using significant unobservable (Level 3) inputs for the year ended December 31, 2008 is as follows:

Fixed Maturity

Securities Equity

Securities

Year Ended

December 31, 2008

(In millions)

Balance, December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $23,326 $2,371

ImpactofSFAS157andSFAS159adoption ................................ (8) —

Balance,beginningofperiod........................................... 23,318 2,371

Total realized/unrealized gains (losses) included in:

Earnings....................................................... (881) (197)

Othercomprehensiveincome(loss)..................................... (6,272) (478)

Purchases,sales,issuancesandsettlements................................ (596) (288)

Transferinand/oroutofLevel3......................................... 1,839 (29)

Balance,endofperiod............................................... $17,408 $1,379

Transfers in and/or out of Level 3 —

a) Total gains and losses (in earnings and other comprehensive income (loss)) are calculated assuming transfers in (out) of Level 3

occurred at the beginning of the period. Items transferred in and out in the same period are excluded from the rollforward.

89MetLife, Inc.