MetLife 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

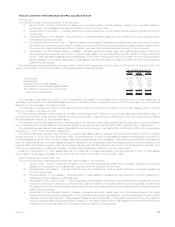

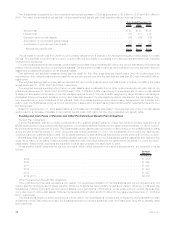

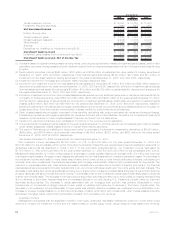

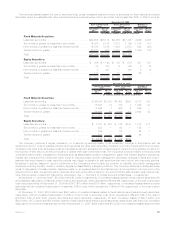

2008 2007 2006

December 31,

(In millions)

Grossinvestmentincome...................................... $ 16,764 $ 18,755 $ 17,020

Investmentfeesandexpenses .................................. (460) (427) (391)

Net Investment Income ..................................... $ 16,304 $ 18,328 $ 16,629

Endingcarryingvalue ........................................ $322,518 $328,009 $314,836

Grossinvestmentgains....................................... $ 2,575 $ 1,386 $ 5,731

Grossinvestmentlosses(8)..................................... (2,005) (1,710) (2,008)

Writedowns(8)............................................. (2,042) (140) (134)

Subtotal................................................. $ (1,472) $ (464) $ 3,589

Derivativesnotqualifyingforhedgeaccounting(8),(9).................... 3,243 (380) (472)

Investment Gains (Losses) ................................... $ 1,771 $ (844) $ 3,117

Investmentgains(losses)incometaxbenefit(provision) .................. (671) 280 (1,114)

Investment Gains (Losses), Net of Income Tax ..................... $ 1,100 $ (564) $ 2,003

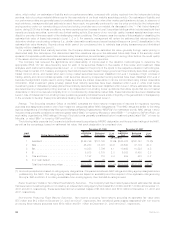

(1) Yields are based on quarterly average asset carrying values, excluding recognized and unrealized investment gains (losses), and for yield

calculation purposes, average assets exclude collateral received from counterparties associated with the Company’s securities lending

program.

(2) Fixed maturity securities include $946 million, $779 million and $759 million at estimated fair value related to trading securities at

December 31, 2008, 2007 and 2006, respectively. Fixed maturity securities include ($193) million, $50 million and $71 million of

investment income (loss) related to trading securities for the years ended December 31, 2008, 2007 and 2006, respectively.

(3) Investment income from mortgage and consumer loans includes prepayment fees.

(4) Included in net investment income from real estate and real estate joint ventures is $3 million, $12 million and $92 million related to

discontinued operations for the years ended December 31, 2008, 2007 and 2006, respectively. Included in investment gains (losses)

from real estate and real estate joint ventures is $8 million, $13 million and $4,795 million of gains related to discontinued operations for

the years ended December 31, 2008, 2007 and 2006, respectively.

(5) Included in investment income from other invested assets are scheduled periodic settlement payments on derivative instruments that do

not qualify for hedge accounting under SFAS 133 of $5 million, $253 million and $290 million for the years ended December 31, 2008,

2007 and 2006, respectively. These amounts are excluded from investment gains (losses). Additionally, excluded from investment gains

(losses) is $44 million, $25 million and $6 million for the years ended December 31, 2008, 2007 and 2006, respectively, related to

settlement payments on derivatives used to hedge interest rate and currency risk on policyholder account balances that do not qualify for

hedge accounting. Such amounts are included within interest credited to policyholder account balances.

(6) Other invested assets are principally comprised of free standing derivatives with positive estimated fair values and leveraged leases.

Freestanding derivatives with negative estimated fair values are included within other liabilities. As yield is not considered a meaningful

measure of performance for other invested assets it has been excluded from the table above.

(7) Certain prior period amounts have been reclassified to conform to the current period presentation.

(8) The components of investment gains (losses) for the year ended December 31, 2008 are shown net of a realized gain under purchased

credit default swaps that offsets losses incurred on certain fixed maturity securities.

(9) The caption “Derivatives not qualifying for hedge accounting” is comprised of amounts for freestanding derivatives of $5,893 million,

($59) million, and ($674) million; and embedded derivatives of ($2,650) million, ($321) million, and $202 million for the years ended

December 31, 2008, 2007 and 2006, respectively.

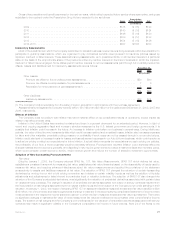

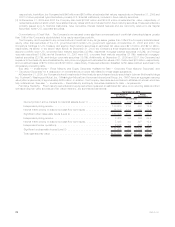

Year Ended December 31, 2008 compared with the Year Ended December 31, 2007

Net investment income decreased by $2,024 million, or 11%, to $16,304 million for the year ended December 31, 2008 from

$18,328 million for the comparable 2007 period. Excluding the impacts of discontinued operations and periodic settlement payments on

derivatives instruments as described in notes 4 and 5 of the yield table presented above, net investment income decreased by

$1,767 million, or 10%, to $16,296 million for the year ended December 31, 2008 from $18,063 million for the comparable 2007 period.

Management attributes $3,141 million of this change to a decrease in yields, partially offset by an increase of $1,374 million due to growth

in average invested assets. Average invested assets are calculated on the cost basis without unrealized gains and losses. The decrease in

net investment income attributable to lower yields was primarily due to lower returns on other limited partnership interests, real estate joint

ventures, short-term investments, fixed maturity securities, and mortgage loans partially offset by improved securities lending results. The

reduction in yields associated with other limited partnership interests were primarily due to the lack of liquidity and credit in the financial

markets as well as unprecedented investor redemptions in an environment with steep declines in the public equity and debt markets. The

decrease in real estate joint ventures yields was primarily due to a slow down in lease and related sales activities in a period with declining

property values as well as fund investment write-downs. The decrease in short-term investment yields was primarily attributable to declines

in short-term interest rates. The decrease in the fixed maturity securities’ yield was primarily due to lower yields on floating rate securities

due to declines in short-term interest rates and an increased allocation to lower yielding U.S. Treasuries, partially offset by improved

securities lending results. The decrease in yields associated with our mortgage loan portfolio was primarily attributable to lower

prepayments on commercial mortgage loans and lower yields on variable rate loans due to declines in short-term interest rates. The

decrease in net investment income attributable to lower yields was partially offset by increased net investment income attributable to an

increase in average invested assets on an amortized cost basis, primarily within short-term investments, other invested assets including

derivatives, mortgage loans, other limited partnership interests, and real estate joint ventures.

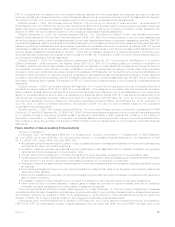

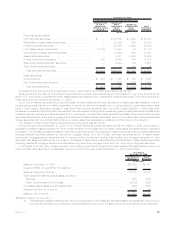

Investment Outlook

Management anticipates that the significant volatility in the equity, credit and real estate markets will continue in 2009 which could

continue to impact net investment income and the related yields on private equity funds, hedge funds and real estate joint ventures,

84 MetLife, Inc.