MetLife 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

business associated with the acquisition of Travelers, principally in the structured settlement, pension closeout and general account

businesses.

Higher other expenses of $126 million included an increase in non-deferrable volume-related expenses and corporate support

expenses of $110 million. Non-deferrable volume-related expenses included those expenses associated with direct departmental

spending, information technology, commissions and premium taxes. Corporate support expenses included advertising, corporate over-

head and consulting fees. The increase in other expenses was also attributable to higher DAC amortization of $67 million, primarily due to a

$61 million charge as a result of the ongoing impact of DAC and VOBA amortization resulting from the implementation of SOP 05-1 in 2007.

In addition, a charge of $14 million related to the reimbursement of certain dental claims and a $15 million charge related to the

establishment of a contingent legal liability in 2007 contributed to the increase in other expenses. The impact of certain revisions in both

years also contributed to a net increase in other expenses of $2 million. These increases were partially offset by a $13 million benefit

related to a reduction of an allowance for doubtful accounts in 2007. Additionally, 2006 included the impact of a $22 million charge for non-

deferrable LTC commissions expense, a charge of $24 million associated with costs related to the sale of certain small market

recordkeeping businesses and $24 million related to a regulatory settlement, which reduced other expenses in 2007.

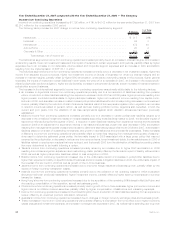

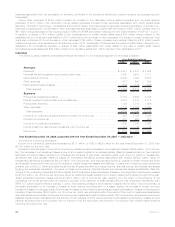

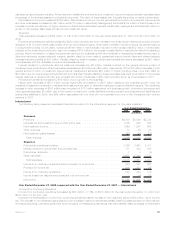

Individual

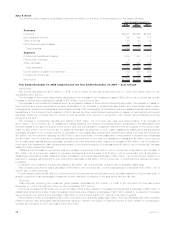

The following table presents consolidated financial information for the Individual segment for the years indicated:

2008 2007 2006

Years Ended December 31,

(In millions)

Revenues

Premiums................................................... $ 4,481 $ 4,481 $ 4,502

Universallifeandinvestment-typeproductpolicyfees...................... 3,400 3,441 3,131

Netinvestmentincome.......................................... 6,509 7,025 6,863

Otherrevenues............................................... 571 600 524

Netinvestmentgains(losses)...................................... 665 (112) (591)

Totalrevenues .............................................. 15,626 15,435 14,429

Expenses

Policyholderbenefitsandclaims.................................... 5,779 5,665 5,335

Interestcreditedtopolicyholderaccountbalances ........................ 2,028 2,013 2,018

Policyholderdividends .......................................... 1,739 1,715 1,696

Otherexpenses............................................... 5,143 4,003 3,485

Totalexpenses.............................................. 14,689 13,396 12,534

Incomefromcontinuingoperationsbeforeprovisionforincometax.............. 937 2,039 1,895

Provisionforincometax ......................................... 307 698 653

Incomefromcontinuingoperations .................................. 630 1,341 1,242

Income(loss)fromdiscontinuedoperations,netofincometax ................ (11) 16 22

Netincome ................................................. $ 619 $ 1,357 $ 1,264

Year Ended December 31, 2008 compared with the Year Ended December 31, 2007 — Individual

Income from Continuing Operations

Income from continuing operations decreased by $711 million, or 53%, to $630 million for the year ended December 31, 2008 from

$1,341 million for the prior year.

Included in this decrease in income from continuing operations was a decrease in net investment losses of $505 million, net of income

tax. The decrease in net investment losses is due to an increase in gains on derivatives partially offset by losses primarily on fixed maturity

securities, including losses resulting from intersegment transfers of securities. Derivative gains were driven by gains on freestanding

derivatives that were partially offset by losses on embedded derivatives primarily associated with variable annuity riders. Gains on

freestanding derivatives increased by $2,308 million, net of income tax, and were primarily driven by: i) gains on certain interest rate floors

and financial futures which were economic hedges of certain investment assets and liabilities, ii) gains from foreign currency derivatives

primarily due to the U.S. dollar strengthening as well as, iii) gains primarily from equity options, financial futures, and interest rate swaps

hedging the embedded derivatives. The gains on these equity options, financial futures, and interest rate swaps substantially offset the

change in the underlying embedded derivative liability that is hedged by these derivatives. Losses on the embedded derivatives increased

by $1,023 million, net of income tax, and were driven by declining interest rates and poor equity market performance throughout the year.

These embedded derivative losses include an $870 million, net of income tax, gain resulting from the effect of the widening of the

Company’s own credit spread which is required to be used in the valuation of these variable annuity rider embedded derivatives under

SFAS 157, which became effective January 1, 2008. The remaining change in net investment losses of $780 million, net of income tax, is

principally attributable to an increase in losses on fixed maturity securities and, to a lesser degree, an increase in foreign currency

transaction losses on mortgage loans. The increase in losses on fixed maturity securities is primarily attributable to losses on intersegment

transfers of approximately $350 million, net of income tax, which are eliminated within Corporate & Other and to impairments associated

with financial services industry holdings which experienced losses as a result of bankruptcies, FDIC receivership, and federal government

assisted capital infusion transactions in the third and fourth quarters of 2008, as well as other credit related impairments or losses on fixed

maturity securities where the Company did not intend to hold the securities until recovery in conjunction with overall market declines

occurring throughout the year.

32 MetLife, Inc.