MetLife 2008 Annual Report Download - page 69

Download and view the complete annual report

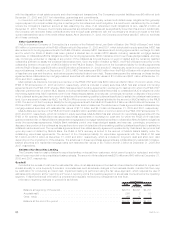

Please find page 69 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.solvency ratio of at least 400%, as calculated in accordance with the Insurance Business Law of Japan, and to make such loans to MSMIC

as may be necessary to ensure that MSMIC has sufficient cash or other liquid assets to meet its payment obligations as they fall due.

The Holding Company has guaranteed the obligations of its subsidiary, Exeter Reassurance Company, Ltd., under a reinsurance

agreement with MSMIC, under which Exeter reinsures variable annuity business written MSMIC.

Management anticipates that to the extent that these arrangements place significant demands upon the Holding Company, there will be

sufficient liquidity and capital to enable the Holding Company to meet these demands.

Based on management’s analysis and comparison of its current and future cash inflows from the dividends it receives from subsidiaries

that are permitted to be paid without prior insurance regulatory approval, its asset portfolio and other cash flows and anticipated access to

the capital markets, management believes there will be sufficient liquidity and capital to enable the Holding Company to make payments on

debt, make cash dividend payments on its common and preferred stock, contribute capital to its subsidiaries, pay all operating expenses

and meet its cash needs.

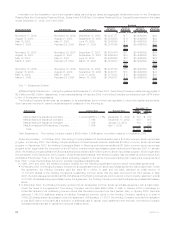

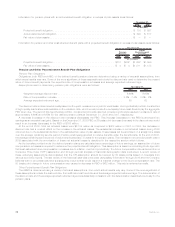

Holding Company Cash Flows. Net cash provided by operating activities, primarily the result of subsidiary dividends, was similar at

$1.2 billion for the years ending December 31, 2008 and 2007. The net cash generated from operating activities was used to meet the

Holding Company’s liquidity and capital needs such as debt servicing, dividend payments, capital contributions to subsidiaries, stock

buybacks and acquisitions, as well as other corporate uses.

Net cash provided by operating activities decreased by $2.7 billion for the year ended December 31, 2007 from $3.9 billion for the year

ended December 31, 2006 primarily due to $3.0 billion lower dividends from subsidiaries. The 2006 operating activities included

$2.2 billion of extraordinary dividends in conjunction with the sale of Peter Cooper Village and Stuyvesant Town.

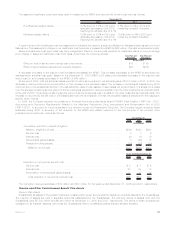

Net cash provided by financing activities was $50 million for the year ended December 31, 2008 compared to $2.9 billion of net cash

used for the year ended December 31, 2007. Accordingly, net cash provided by financing activities increased by $2.9 billion for the year

ended December 31, 2008 compared to the prior year. In 2008 net cash paid related to collateral financing arrangements was $800 million

resulting from the incurrence of price return payments compared to zero outflows for this purpose in 2007. Finally, in order to strengthen its

capital base, in 2008 the Holding Company reduced its level of common stock repurchase activity by $500 million compared to the prior

year and issued $3.3 billion of common stock compared with zero issuance in 2007.

Net cash used by financing activities was $2.9 billion for the years ended December 31, 2007, compared to $239 million of net cash

provided for the year ended December 31, 2006. Accordingly, net cash provided by financing activities decreased by $3.1 billion for the

year ended December 31, 2007 compared to the prior year primarily due to increased stock repurchase of $1.2 billion and a net decrease

in debt issuance of $748 million. Financing activity results are the result of the Holding Company’s debt and equity financing activities, as

well as changes due to the needs of securities lending and collateral financing arrangements.

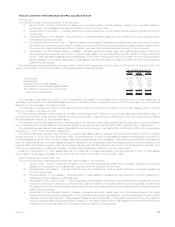

Net cash used in investing activities was $1.2 billion for the year ended December 31, 2008 compared to $742 million provided for the

year ended December 31, 2007. Accordingly, net cash provided by investing activities decreased by $1.9 billion for the year ended

December 31, 2008 compared to the prior year primarily due to increases in capital contributions to subsidiaries and changes in short-term

investments.

Net cash provided by investing activities was $742 million for the year ended December 31, 2007 compared to $2.8 billion of net cash

used for the year ended December 31, 2006. Accordingly, net cash provided by investing activities increased by $3.5 billion for the year

ended December 31, 2007 compared to the prior year primarily due to a decrease in net purchases of fixed maturity securities. Investing

activity results are generally due to the Holding Company’s management of its capital, as well as the needs of its subsidiaries and any

business development opportunities.

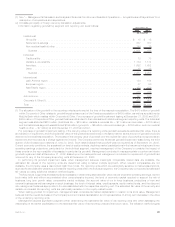

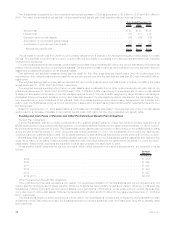

As it relates to cash flows during 2009, the Holding Company anticipates it will pay $30 million in dividends on its Series A and Series B

preferred shares in March 2009 as announced in February 2009 and the Holding Company received $1,035 million in cash in connection

with the settlement of the stock purchase contracts as described more fully in “Remarketing of Junior Subordinated Debentures and

Settlement of Stock Purchase Contracts.”

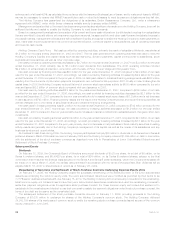

Subsequent Events

Dividends

On February 18, 2009, the Company’s Board of Directors announced dividends of $0.25 per share, for a total of $6 million, on its

Series A preferred shares, and $0.40625 per share, for a total of $24 million, on its Series B preferred shares, subject to the final

confirmation that it has met the financial tests specified in the Series A and Series B preferred shares, which the Company anticipates will

be made on or about March 5, 2009, the earliest date permitted in accordance with the terms of the securities. Both dividends will be

payable March 16, 2009 to shareholders of record as of February 28, 2009.

Remarketing of Securities and Settlement of Stock Purchase Contracts Underlying Common Equity Units

On February 17, 2009, the Holding Company closed the successful remarketing of the Series B portion of the junior subordinated

debentures underlying the common equity units. The junior subordinated debentures were modified as permitted by their terms to be

7.717% senior debt securities Series B, due February 15, 2019. The Holding Company did not receive any proceeds from the remarketing.

Most common equity unit holders chose to have their junior subordinated debentures remarketed and used the remarketing proceeds to

settle their payment obligations under the applicable stock purchase contract. For those common equity unit holders that elected not to

participate in the remarketing and elected to use their own cash to satisfy the payment obligations under the stock purchase contract, the

terms of the debt are the same as the remarketed debt.

The subsequent settlement of the stock purchase contracts occurred on February 17, 2009, providing proceeds to the Holding

Company of $1,035 million in exchange for shares of the Holding Company’s common stock. The Holding Company delivered

24,343,154 shares of its newly issued common stock to settle the remaining stock purchase contracts issued as part of the common

equity units sold in June 2005.

66 MetLife, Inc.