MetLife 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.“— Investments — Assets on Deposit, Held in Trust and Pledged as Collateral.” The Holding Company did not pledge any liquid assets at

December 31, 2007.

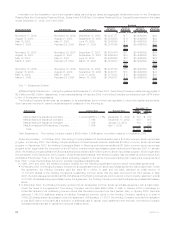

Global Funding Sources. Liquidity is also provided by a variety of short-term instruments, including commercial paper. Capital is

provided by a variety of long-term instruments, including medium- and long-term debt, junior subordinated debt securities, collateral

financing arrangements, capital securities and stockholders’ equity. The diversity of the Holding Company’s funding sources enhances

funding flexibility and limits dependence on any one source of funds and generally lowers the cost of funds. Other sources of the Holding

Company’s liquidity include programs for short- and long-term borrowing, as needed.

During this extraordinary market environment, management is continuously monitoring and adjusting its liquidity and capital plans for the

Holding Company and its subsidiaries in light of changing needs and opportunities. The dislocation in the credit markets has limited the

access of financial institutions to long-term debt and hybrid capital. While, in general, yields on benchmark U.S. Treasury securities were

historically low during 2008, related spreads on debt instruments, in general, and those of financial institutions, specifically, were as high as

they have been in our history as a public company.

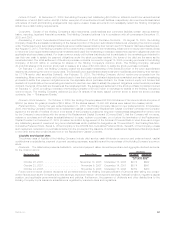

This shift resulted in a relative increase in the cost of new debt capital and new credit. For example, in August 2008, MetLife remarketed

senior unsecured debt with a ten-year maturity at a 6.817% coupon. At December 31, 2008, the average coupon on ten-year senior

unsecured debt of the Holding Company, excluding the debt remarketed in August 2008 is 5.4%, or 1.4% less than that of the debt

remarketed in August 2008.

MetLife has issued $600 million in a single series of LIBOR-based preferred stock with a 4% floor. This series represents a small portion

of MetLife’s fixed charges. At current levels, LIBOR would have to increase by 180 basis points (over 145% increase) to have any impact on

the dividend for these preferred securities.

MetLife amended and restated certain of its credit agreements in December 2008. These changes included increases in pricing for

these agreements compared to the original rates.

In February 2009, the Holding Company closed the successful remarketing of the Series B portion of the junior subordinated

debentures underlying the common equity units. The Series B junior subordinated debentures were modified as permitted by their terms

to be 7.717% senior debt securities, Series B, due February 15, 2019. See “— Subsequent Events.” This issuance reflects a moderate

increase in the Company’s cost of borrowing.

MetLife has no current plans to raise additional capital.

The Company is participating in certain economic stabilization programs established by various government institutions. See “— The

Company — Liquidity and Capital Sources.”

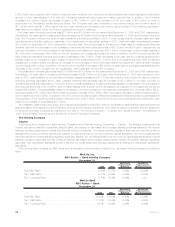

At December 31, 2008 and 2007, the Holding Company had $300 million and $310 million in short-term debt outstanding, respectively.

At December 31, 2008 and 2007, the Holding Company had $7.7 billion and $7.0 billion of unaffiliated long-term debt outstanding,

respectively. At both December 31, 2008 and 2007, the Holding Company had $500 million of affiliated long-term debt outstanding,

respectively. At December 31, 2008 and 2007, the Holding Company had $2.3 billion and $3.4 billion of junior subordinated debt securities

outstanding. At December 31, 2008 and 2007, the Holding Company had $2.7 billion and $2.4 billion in collateral financing arrangements

outstanding, respectively.

In November 2007, the Holding Company filed a shelf registration statement (the “2007 Registration Statement”) with the SEC, which

was automatically effective upon filing, in accordance with SEC rules which also allow for pay-as-you-go fees and the ability to add

securities by filing automatically effective amendment for companies, such as the Holding Company, which qualify as “Well-Known

Seasoned Issuers.” The 2007 Registration Statement registered an unlimited amount of debt and equity securities and supersedes the

shelf registration statement that the Holding Company filed in April 2005. The terms of any offering will be established at the time of the

offering.

Debt Issuances. As described more fully in “Remarketing of Junior Subordinated Debentures and Settlement of Stock Purchase

Contracts” the Holding Company sold senior notes in August 2008 and February 2009.

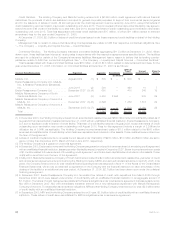

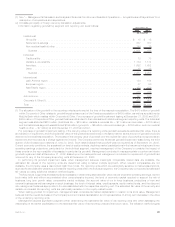

As described more fully in “The Company — Liquidity and Capital Sources — Debt Issuances,” during April 2008, Trust X issued 2008

Trust Securities with a face amount of $750 million, and a fixed rate of interest of 9.25% up to, but not including, April 8, 2038, the

scheduled redemption date. The beneficial interest in Trust X held by the Holding Company is not represented by an investment in Trust X

but rather by a financing agreement between the Holding Company and Trust X. The assets of Trust X are $750 million of 8.595% surplus

notes of MICC, which are scheduled to mature April 8, 2038, and rights under the financing agreement. Under the financing agreement,

the Holding Company has the obligation to make payments (i) semiannually at a fixed rate of 0.655% of the surplus notes outstanding and

owned by Trust X or if greater (ii) equal to the difference between the 2008 Trust Securities interest payment and the interest received by

Trust X on the surplus notes. The ability of MICC to make interest and principal payments on the surplus notes to the Trust is contingent

upon regulatory approval. The 2008 Trust Securities will be exchanged into a like amount of Holding Company junior subordinated

debentures on April 8, 2038, the scheduled redemption date; mandatorily under certain circumstances; and at any time upon the Holding

Company exercising its option to redeem the securities. The 2008 Trust Securities will be exchanged for junior subordinated debentures

prior to repayment and the Holding Company is ultimately responsible for repayment of the junior subordinated debentures. The Holding

Company’s other rights and obligations as it relates to the deferral of interest, redemption, replacement capital obligation and RCC

associated with the issuance of the 2008 Trust Securities are more fully described in “The Company — Liquidity and Capital Sources —

Debt Issuances.”

During December 2007, Trust IV issued 2007 Trust Securities with a face amount of $700 million and a discount of $6 million

($694 million) and a fixed rate of interest of 7.875% up to, but not including, December 15, 2037, the scheduled redemption date. The

beneficial interest of Trust IV held by the Holding Company is not represented by an investment in Trust IV but rather by a financing

agreement between the Holding Company and Trust IV. The assets of Trust IV are $700 million of 7.375% surplus notes of MLIC, which are

scheduled to mature December 15, 2037, and rights under the financing agreement. Under the financing agreement, the Holding

Company has the obligation to make payments (i) semiannually at a fixed rate of 0.50% of the surplus notes outstanding and owned by

Trust IV or if greater (ii) equal to the difference between the 2007 Trust Securities interest payment and the interest received by Trust IV on

the surplus notes. The ability of MLIC to make interest and principal payments on the surplus notes to the Holding Company is contingent

60 MetLife, Inc.