MetLife 2008 Annual Report Download - page 58

Download and view the complete annual report

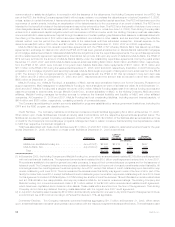

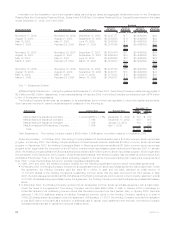

Please find page 58 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The sum of the estimated cash flows shown for all years in the table of $316.2 billion exceeds the liability amount of $130.6 billion included

on the consolidated balance sheet principally due to the time value of money, which accounts for at least 80% of the difference, as well as

differences in assumptions, most significantly mortality, between the date the liabilities were initially established and the current date.

For the majority of the Company’s insurance operations, estimated contractual obligations for future policy benefits and policyholder

account balance liabilities as presented in the table above are derived from the annual asset adequacy analysis used to develop actuarial

opinions of statutory reserve adequacy for state regulatory purposes. These cash flows are materially representative of the cash flows

under generally accepted accounting principles.

Actual cash payments to policyholders may differ significantly from the liabilities as presented in the consolidated balance sheet and the

estimated cash payments as presented in the table above due to differences between actual experience and the assumptions used in the

establishment of these liabilities and the estimation of these cash payments.

(2) Policyholder account balances include liabilities related to conventional guaranteed investment contracts, guaranteed investment

contracts associated with formal offering programs, funding agreements, individual and group annuities, total control accounts, bank

deposits, individual and group universal life, variable universal life and company-owned life insurance.

Included within policyholder account balances are contracts where the amount and timing of the payment is essentially fixed and

determinable. These amounts relate to policies where the Company is currently making payments and will continue to do so, as well as

those where the timing of the payments has been determined by the contract. Other contracts involve payment obligations where the

timing of future payments is uncertain and where the Company is not currently making payments and will not make payments until the

occurrence of an insurable event, such as death, or where the occurrence of the payment triggering event, such as a surrender of or

partial withdrawal on a policy or deposit contract, is outside the control of the Company. The Company has estimated the timing of the

cash flows related to these contracts based on historical experience, as well as its expectation of future payment patterns.

Excess interest reserves representing purchase accounting adjustments of $692 million have been excluded from amounts presented in

the table above as they represent an accounting convention and not a contractual obligation.

Amounts presented in the table above represent the estimated cash payments to be made to policyholders undiscounted as to interest

and including assumptions related to the receipt of future premiums and deposits; withdrawals, including unscheduled or partial

withdrawals; policy lapses; surrender charges; annuitization; mortality; future interest credited; policy loans and other contingent events

as appropriate to the respective product type. Such estimated cash payments are also presented net of estimated future premiums on

policies currently in-force and gross of any reinsurance recoverable. For obligations denominated in foreign currencies, cash payments

have been estimated using current spot rates.

The sum of the estimated cash flows shown for all years in the table of $202.0 billion exceeds the liability amount of $149.8 billion included

on the consolidated balance sheet principally due to the time value of money, which accounts for at least 80% of the difference, as well as

differences in assumptions between the date the liabilities were initially established and the current date. See the comments under

footnote 1 regarding the source and uncertainties associated with the estimation of the contractual obligations related to future

policyholder benefits and policyholder account balances. See also “Extraordinary Market Conditions.”

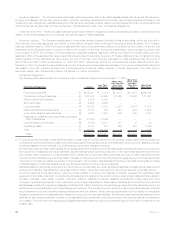

(3) Other policyholder liabilities are comprised of other policyholder funds, policyholder dividends payable and the policyholder dividend

obligation. Amounts included in the table above related to these liabilities are as follows:

a. Other policyholder funds includes liabilities for incurred but not reported claims and claims payable on group term life, long-term

disability, LTC and dental; policyholder dividends left on deposit and policyholder dividends due and unpaid related primarily to

traditional life and group life and health; and premiums received in advance. Liabilities related to unearned revenue of $1.9 billion have

been excluded from the cash payments presented in the table above because they reflect an accounting convention and not a

contractual obligation. With the exception of policyholder dividends left on deposit, and those items excluded as noted in the

preceding sentence, the contractual obligation presented in the table above related to other policyholder funds is equal to the liability

reflected in the consolidated balance sheet. Such amounts are reported in the less than one year category due to the short-term nature

of the liabilities. Contractual obligations on policyholder dividends left on deposit are projected based on assumptions of policyholder

withdrawal activity.

b. Policyholder dividends payable consists of liabilities related to dividends payable in the following calendar year on participating

policies. As such, the contractual obligation related to policyholder dividends payable is presented in the table above in the less than

one year category at the amount of the liability presented in the consolidated balance sheet.

c. The nature of the policyholder dividend obligation is described in Note 9 of the Notes to Consolidated Financial Statements. Because

the exact timing and amount of the ultimate policyholder dividend obligation is subject to significant uncertainty and the amount of the

policyholder dividend obligation is based upon a long-term projection of the performance of the closed block, management has

reflected the obligation at the amount of the liability, if any, presented in the consolidated balance sheet in the more than five years

category. This was done to reflect the long-duration of the liability and the uncertainty of the ultimate cash payment.

(4) Amounts presented in the table above for short-term debt, long-term debt, collateral financing arrangements and junior subordinated debt

securities differ from the balances presented on the consolidated balance sheet as the amounts presented in the table above do not

include premiums or discounts upon issuance or purchase accounting fair value adjustments. The amounts presented above also include

interest on such obligations as described below.

Short-term debt consists of borrowings with original maturities of less than one year carrying fixed interest rates. The contractual

obligation for short-term debt presented in the table above represents the amounts due upon maturity plus the related interest for the

period from January 1, 2009 through maturity.

Long-term debt bears interest at fixed and variable interest rates through their respective maturity dates. Interest on fixed rate debt was

computed using the stated rate on the obligations through maturity. Interest on variable rate debt is computed using prevailing rates at

December 31, 2008 and, as such, does not consider the impact of future rate movements. Long-term debt also includes payments under

capital lease obligations of $14 million, $5 million, $1 million and $28 million, in the less than one year, one to three years, three to five years

and more than five years categories, respectively.

Collateral financing arrangements bear interest at fixed and variable interest rates through their respective maturity dates. Interest on fixed

rate debt was computed using the stated rate on the obligations through maturity. Interest on variable rate debt is computed using

prevailing rates at December 31, 2008 and, as such, does not consider the impact of future rate movements. Pursuant to these collateral

55MetLife, Inc.