MetLife 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• investments are directed by the contractholder; and

• all investment performance, net of contract fees and assessments, is passed through to the contractholder.

The Company reports separate account assets meeting such criteria at their estimated fair value. Investment performance (including net

investment income, net investment gains (losses) and changes in unrealized gains (losses)) and the corresponding amounts credited to

contractholders of such separate accounts are offset within the same line in the consolidated statements of income.

The Company’s revenues reflect fees charged to the separate accounts, including mortality charges, risk charges, policy administration

fees, investment management fees and surrender charges. Separate accounts not meeting the above criteria are combined on a

line-by-line basis with the Company’s general account assets, liabilities, revenues and expenses.

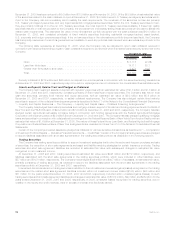

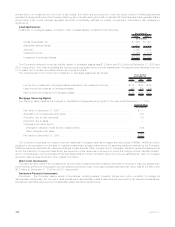

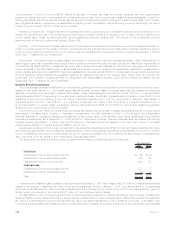

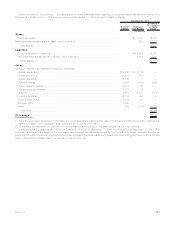

The separate accounts measured at estimated fair value on a recurring basis and their corresponding fair value hierarchy, are

summarized as follows:

December 31, 2008

(In millions)

Quotedpricesinactivemarketsforidenticalassets(Level1).......................... $ 85,886 71.0%

Significantotherobservableinputs(Level2)..................................... 33,195 27.5

Significantunobservableinputs(Level3)....................................... 1,758 1.5

Total estimated fair value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $120,839 100.0%

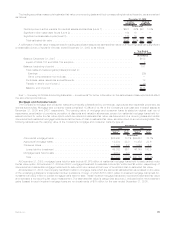

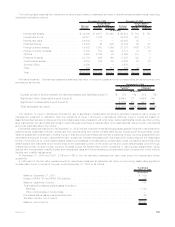

Policyholder Liabilities

The Company establishes, and carries as liabilities, actuarially determined amounts that are calculated to meet policy obligations when

a policy matures or is surrendered, an insured dies or becomes disabled or upon the occurrence of other covered events, or to provide for

future annuity payments. Amounts for actuarial liabilities are computed and reported in the consolidated financial statements in conformity

with GAAP. For more details on Policyholder Liabilities see “— Management’s Discussion and Analysis of Financial Condition and Results of

Operations — Critical Accounting Estimates.” Also see — Note 1 and Note 7 of the Notes to the Consolidated Financial Statements.

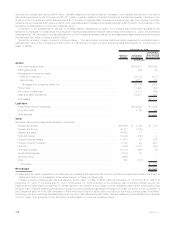

2008 2007 2008 2007 2008 2007

December 31,

Future Policy Benefits Policyholder Account

Balances Other Policyholder

Funds

(In millions)

Institutional

Group life . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,346 $ 3,326 $ 14,044 $ 13,997 $2,532 $2,364

Retirement & savings . . . . . . . . . . . . . . . . . 40,320 37,947 60,787 51,585 58 213

Non-medical health & other . . . . . . . . . . . . . 11,619 10,617 501 501 609 597

Individual

Traditional life . . . . . . . . . . . . . . . . . . . . . . 52,968 52,378 1 1 1,423 1,478

Variable & universal life . . . . . . . . . . . . . . . . 1,129 949 15,062 14,583 1,452 1,417

Annuities . . . . . . . . . . . . . . . . . . . . . . . . . 3,655 3,055 44,282 37,785 88 76

Other ........................... 2 — 2,524 2,398 1 1

International . . . . . . . . . . . . . . . . . . . . . . . . . 9,241 9,825 5,654 4,961 1,227 1,296

Auto&Home........................ 3,083 3,273 — — 43 51

Corporate & Other . . . . . . . . . . . . . . . . . . . . . 5,192 4,646 6,950 4,531 329 345

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . $130,555 $126,016 $149,805 $130,342 $7,762 $7,838

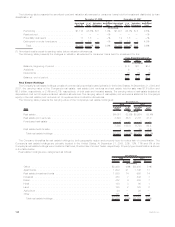

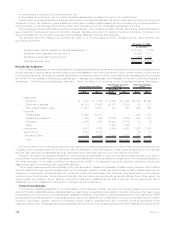

Due to the nature of the underlying risks and the high degree of uncertainty associated with the determination of actuarial liabilities, the

Company cannot precisely determine the amounts that will ultimately be paid with respect to these actuarial liabilities, and the ultimate

amounts may vary from the estimated amounts, particularly when payments may not occur until well into the future.

However, we believe our actuarial liabilities for future benefits are adequate to cover the ultimate benefits required to be paid to

policyholders. We periodically review our estimates of actuarial liabilities for future benefits and compare them with our actual experience.

We revise estimates, to the extent permitted or required under GAAP, if we determine that future expected experience differs from

assumptions used in the development of actuarial liabilities.

The Company has experienced, and will likely in the future experience, catastrophe losses and possibly acts of terrorism, and turbulent

financial markets that may have an adverse impact on our business, results of operations, and financial condition. Catastrophes can be

caused by various events, including pandemics, hurricanes, windstorms, earthquakes, hail, tornadoes, explosions, severe winter weather

(including snow, freezing water, ice storms and blizzards), fires and man-made events such as terrorist attacks. Due to their nature, we

cannot predict the incidence, timing, severity or amount of losses from catastrophes and acts of terrorism, but we make broad use of

catastrophic and non-catastrophic reinsurance to manage risk from these perils.

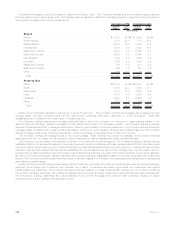

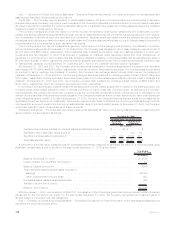

Future Policy Benefits

The Company establishes liabilities for amounts payable under insurance policies. Generally, amounts are payable over an extended

period of time and related liabilities are calculated as the present value of expected future benefits to be paid, reduced by the present value

of expected future net premiums. Such liabilities are established based on methods and underlying assumptions in accordance with GAAP

and applicable actuarial standards. Principal assumptions used in the establishment of liabilities for future policy benefits include mortality,

morbidity, policy lapse, renewal, retirement, investment returns, inflation, expenses and other contingent events as appropriate to the

respective product type. These assumptions are established at the time the policy is issued and are intended to estimate the experience for

108 MetLife, Inc.