MetLife 2008 Annual Report Download - page 68

Download and view the complete annual report

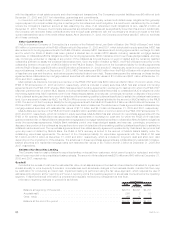

Please find page 68 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• In November 2007, the Holding Company repurchased 11,559,803 shares of its outstanding common stock at an initial cost of

$750 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the stock sold to the

Holding Company from third parties and purchased the common stock in the open market to return to such third parties. Also, in

November 2007, the Holding Company received a cash adjustment of $19 million based on the trading price of the common stock

during the repurchase period, for a final purchase price of $731 million. The Holding Company recorded the shares initially

repurchased as treasury stock and recorded the amount received as an adjustment to the cost of the treasury stock.

• In March 2007, the Holding Company repurchased 11,895,321 shares of its outstanding common stock at an aggregate cost of

$750 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the common stock

sold to the Holding Company from third parties and purchased common stock in the open market to return to such third parties. In

June 2007, the Holding Company paid a cash adjustment of $17 million for a final purchase price of $767 million. The Holding

Company recorded the shares initially repurchased as treasury stock and recorded the amount paid as an adjustment to the cost of

the treasury stock.

• In December 2006, the Holding Company repurchased 3,993,024 shares of its outstanding common stock at an aggregate cost of

$232 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the common stock

sold to the Holding Company from third parties and purchased the common stock in the open market to return to such third parties. In

February 2007, the Holding Company paid a cash adjustment of $8 million for a final purchase price of $240 million. The Holding

Company recorded the shares initially repurchased as treasury stock and recorded the amount paid as an adjustment to the cost of

the treasury stock.

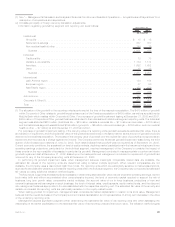

In connection with the split-off of RGA as described in Note 2 of the Notes to the Consolidated Financial Statements, the Company

received from MetLife stockholders 23,093,689 shares of the Company’s common stock with a market value of $1,318 million and, in

exchange, delivered 29,243,539 shares of RGA Class B common stock with a net book value of $1,716 million resulting in a loss on

disposition, including transaction costs, of $458 million.

The Company also repurchased 1,550,000 and 3,171,700 shares through open market purchases for $88 million and $200 million,

respectively, during the years ended December 31, 2008 and 2007, respectively.

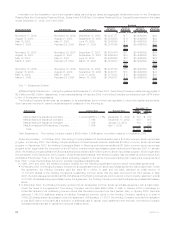

Cumulatively, the Company repurchased 21,266,418, 26,626,824 and 8,608,824 shares of its common stock for $1,250 million,

$1,705 million and $500 million during the years ended December 31, 2008, 2007 and 2006, respectively. During the years ended

December 31, 2008, 2007 and 2006, 97,515,737, 3,864,894 and 3,056,559 shares of common stock were issued from treasury stock for

$5,221 million, $172 million and $102 million, respectively. In addition, 11,250,000 new shares were issued during the year ended

December 31, 2008 in connection with the October 2008 common stock offering.

At December 31, 2006, the Company had $216 million remaining on the October 2004 common stock repurchase program which was

subsequently reduced by $8 million to $208 million after the February 2007 cash adjustment to the December 2006 accelerated common

stock repurchase agreement. The February 2007 stock repurchase program authorization was fully utilized during 2007. At December 31,

2007, $511 million remained on the Company’s September 2007 common stock repurchase program. The $511 million remaining on the

September 2007 common stock repurchase program was reduced by $450 million to $61 million upon settlement of the accelerated stock

repurchase agreement executed during December 2007 but for which no settlement occurred until January 2008. Subsequent to the April

2008 authorization, the amount remaining under these repurchase programs was $1,261 million.

Future common stock repurchases will be dependent upon several factors, including the Company’s capital position, its financial

strength and credit ratings, general market conditions and the price of MetLife, Inc.’s common stock. The Company does not intend to

make any purchases under the common stock repurchase program in 2009.

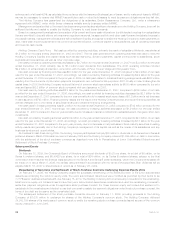

Support Agreements. In October 2007, the Holding Company, in connection with MRV’s reinsurance of certain universal life and term

life insurance risks, committed to the Vermont Department of Banking, Insurance, Securities and Health Care Administration to take

necessary action to cause each of the two initial protected cells of MRV to maintain total adjusted capital equal to or greater than 200% of

such protected cell’s authorized control level risk-based capital (“RBC”), as defined in state insurance statutes. This transaction is more

fully described in Note 10, Long-term and Short-term Debt, of the Notes to the Consolidated Financial Statements. See “The Company —

Liquidity and Capital Sources — Committed Facilities.”

In December 2007, the Holding Company, in connection with the collateral financing arrangement associated with MRC’s reinsurance of

a portion of the liabilities associated with the closed block, committed to the South Carolina Department of Insurance to make capital

contributions, if necessary, to MRC so that MRC may at all times maintain its total adjusted capital at a level of not less than 200% of the

company action level RBC, as defined in state insurance statutes as in effect on the date of determination or December 31, 2007,

whichever calculation produces the greater capital requirement, or as otherwise required by the South Carolina Department of Insurance.

This collateral financing arrangement is more fully described in Note 11 of the Notes to the Consolidated Financial Statements. See “The

Company — Liquidity and Capital Sources — Debt Issuances.”

In May 2007, the Holding Company, in connection with the collateral financing arrangement associated with MRSC’s reinsurance of

universal life secondary guarantees, committed to the South Carolina Department of Insurance to take necessary action to cause MRSC to

maintain total adjusted capital equal to the greater of $250,000 or 100% of MRSC’s authorized control level RBC, as defined in state

insurance statutes. This collateral financing arrangement is more fully described in Note 11 of the Notes to the Consolidated Financial

Statements. See “The Company — Liquidity and Capital Sources — Debt Issuances.”

The Holding Company has net worth maintenance agreements with two of its insurance subsidiaries, MetLife Investors Insurance

Company and First MetLife Investors Insurance Company. Under these agreements, as subsequently amended, the Holding Company

agreed, without limitation as to the amount, to cause each of these subsidiaries to have a minimum capital and surplus of $10 million, total

adjusted capital at a level not less than 150% of the company action level RBC, as defined by state insurance statutes, and liquidity

necessary to enable it to meet its current obligations on a timely basis.

The Holding Company entered into a net worth maintenance agreement with Mitsui Sumitomo MetLife Insurance Company Limited

(“MSMIC”), an investment in Japan of which the Holding Company owns 50% of the equity. Under the agreement, the Holding Company

agreed, without limitation as to amount, to cause MSMIC to have the amount of capital and surplus necessary for MSMIC to maintain a

65MetLife, Inc.