MetLife 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with the disposition of real estate property and other investment transactions. The Company’s recorded liabilities were $6 million at both

December 31, 2008 and 2007 for indemnities, guarantees and commitments.

In connection with synthetically created investment transactions, the Company writes credit default swap obligations that generally

require payment of principal outstanding due in exchange for the referenced credit obligation. If a credit event, as defined by the contract,

occurs the Company’s maximum amount at risk, assuming the value of all referenced credit obligations is zero, was $1.9 billion at

December 31, 2008. However, the Company believes that any actual future losses will be significantly lower than this amount. Additionally,

the Company can terminate these contracts at any time through cash settlement with the counterparty at an amount equal to the then

current estimated fair value of the credit default swaps. As of December 31, 2008, the Company would have paid $37 million to terminate

all of these contracts.

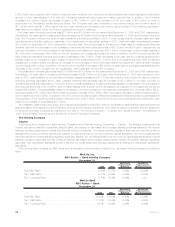

Other Commitments

MetLife Insurance Company of Connecticut is a member of the Federal Home Loan Bank of Boston (the “FHLB of Boston”) and holds

$70 million of common stock of the FHLB of Boston at both December 31, 2008 and 2007, which is included in equity securities. MICC has

also entered into funding agreements with the FHLB of Boston whereby MICC has issued such funding agreements in exchange for cash

and for which the FHLB of Boston has been granted a blanket lien on certain MICC assets, including residential mortgage-backed

securities, to collateralize MICC’s obligations under the funding agreements. MICC maintains control over these pledged assets, and may

use, commingle, encumber or dispose of any portion of the collateral as long as there is no event of default and the remaining qualified

collateral is sufficient to satisfy the collateral maintenance level. Upon any event of default by MICC, the FHLB of Boston’s recovery on the

collateral is limited to the amount of MICC’s liability to the FHLB of Boston. The amount of the Company’s liability for funding agreements

with the FHLB of Boston was $526 million and $726 million at December 31, 2008 and 2007, respectively, which is included in policyholder

account balances. In addition, at December 31, 2008, MICC had advances of $300 million from the FHLB of Boston with original maturities

of less than one year and therefore, such advances are included in short-term debt. These advances and the advances on these funding

agreements are collateralized by mortgage-backed securities with estimated fair values of $1.3 billion and $901 million at December 31,

2008 and 2007, respectively.

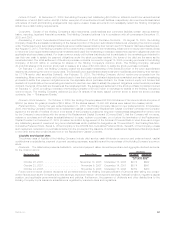

Metropolitan Life Insurance Company is a member of the FHLB of NY and holds $830 million and $339 million of common stock of the

FHLB of NY at December 31, 2008 and 2007, respectively, which is included in equity securities. MLIC has also entered into funding

agreements with the FHLB of NY whereby MLIC has issued such funding agreements in exchange for cash and for which the FHLB of NY

has been granted a lien on certain MLIC assets, including residential mortgage-backed securities to collateralize MLIC’s obligations under

the funding agreements. MLIC maintains control over these pledged assets, and may use, commingle, encumber or dispose of any portion

of the collateral as long as there is no event of default and the remaining qualified collateral is sufficient to satisfy the collateral maintenance

level. Upon any event of default by MLIC, the FHLB of NY’s recovery on the collateral is limited to the amount of MLIC’s liability to the FHLB

of NY. The amount of the Company’s liability for funding agreements with the FHLB of NY was $15.2 billion and $4.6 billion at December 31,

2008 and 2007, respectively, which is included in policyholder account balances. The advances on these agreements are collateralized by

mortgage-backed securities with estimated fair values of $17.8 billion and $4.8 billion at December 31, 2008 and 2007, respectively.

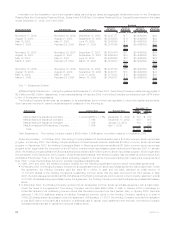

MetLife Bank is a member of the FHLB of NY and holds $89 million and $64 million of common stock of the FHLB of NY at December 31,

2008 and 2007, respectively, which is included in equity securities. MetLife Bank has also entered into repurchase agreements with the

FHLB of NY whereby MetLife Bank has issued repurchase agreements in exchange for cash and for which the FHLB of NY has been

granted a blanket lien on MetLife Bank’s residential mortgages and mortgage-backed securities to collateralize MetLife Bank’s obligations

under the repurchase agreements. MetLife Bank maintains control over these pledged assets, and may use, commingle, encumber or

dispose of any portion of the collateral as long as there is no event of default and the remaining qualified collateral is sufficient to satisfy the

collateral maintenance level. The repurchase agreements and the related security agreement represented by this blanket lien provide that

upon any event of default by MetLife Bank, the FHLB of NY’s recovery is limited to the amount of MetLife Bank’s liability under the

outstanding repurchase agreements. The amount of the Company’s liability for repurchase agreements with the FHLB of NY was

$1.8 billion and $1.2 billion at December 31, 2008 and 2007, respectively, which is included in long-term debt and short-term debt

depending on the original tenor of the advance. The advances on these repurchase agreements are collateralized by residential mortgage-

backed securities and residential mortgage loans with estimated fair values of $3.1 billion and $1.3 billion at December 31, 2008 and

2007, respectively.

Collateral for Securities Lending

The Company has non-cash collateral for securities lending on deposit from customers, which cannot be sold or repledged, and which

has not been recorded on its consolidated balance sheets. The amount of this collateral was $279 million and $40 million at December 31,

2008 and 2007, respectively.

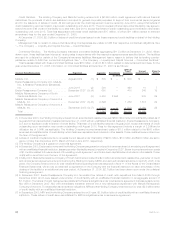

Goodwill

Goodwill is the excess of cost over the estimated fair value of net assets acquired. Goodwill is not amortized but is tested for impairment

at least annually or more frequently if events or circumstances, such as adverse changes in the business climate, indicate that there may

be justification for conducting an interim test. Impairment testing is performed using the fair value approach, which requires the use of

estimates and judgment, at the “reporting unit” level. A reporting unit is the operating segment or a business one level below the operating

segment, if discrete financial information is prepared and regularly reviewed by management at that level.

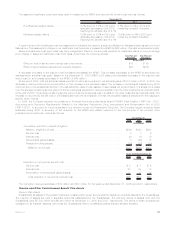

Information regarding changes in goodwill is as follows:

2008 2007 2006

December 31,

(In millions)

Balanceatbeginningoftheperiod,..................................... $4,814 $4,801 $4,701

Acquisitions(1).................................................. 256 2 93

Other,net(2) ................................................... (62) 11 7

Balanceattheendoftheperiod ...................................... $5,008 $4,814 $4,801

68 MetLife, Inc.