MetLife 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letters of Credit. At December 31, 2008, the Holding Company had outstanding $2.8 billion in letters of credit from various financial

institutions, of which $500 million and $2.3 billion were part of committed and credit facilities, respectively. As commitments associated

with letters of credit and financing arrangements may expire unused, these amounts do not necessarily reflect the Holding Company’s

actual future cash funding requirements.

Covenants. Certain of the Holding Company’s debt instruments, credit facilities and committed facilities contain various adminis-

trative, reporting, legal and financial covenants. The Holding Company believes it is in compliance with all covenants at December 31,

2008 and 2007.

Remarketing of Junior Subordinated Debentures and Settlement of Stock Purchase Contracts. On August 15, 2008, the Holding

Company closed the successful remarketing of the Series A portion of the junior subordinated debentures underlying the common equity

units. The Series A junior subordinated debentures were modified as permitted by their terms to be 6.817% senior debt securities Series A,

due August 15, 2018. The Holding Company did not receive any proceeds from the remarketing. Most common equity unit holders chose

to have their junior subordinated debentures remarketed and used the remarketing proceeds to settle their payment obligations under the

applicable stock purchase contract. For those common equity unit holders that elected not to participate in the remarketing and elected to

use their own cash to satisfy the payment obligations under the stock purchase contract, the terms of the debt are the same as the

remarketed debt. The initial settlement of the stock purchase contracts occurred on August 15, 2008, providing proceeds to the Holding

Company of $1,035 million in exchange for shares of the Holding Company’s common stock. The Holding Company delivered

20,244,549 shares of its common stock held in treasury at a value of $1,064 million to settle the stock purchase contracts.

On February 17, 2009, the Holding Company closed the successful remarketing of the Series B portion of the junior subordinated

debentures underlying the common equity units. The Series B junior subordinated debentures were modified as permitted by their terms to

be 7.717% senior debt securities Series B, due February 15, 2019. The Holding Company did not receive any proceeds from the

remarketing. Most common equity unit holders chose to have their junior subordinated debentures remarketed and used the remarketing

proceeds to settle their payment obligations under the applicable stock purchase contract. For those common equity unit holders that

elected not to participate in the remarketing and elected to use their own cash to satisfy the payment obligations under the stock purchase

contract, the terms of the debt are the same as the remarketed debt. The subsequent settlement of the stock purchase contracts occurred

on February 17, 2009, providing proceeds to the Holding Company of $1,035 million in exchange for shares of the Holding Company’s

common stock. The Holding Company delivered 24,343,154 shares of its newly issued common stock to settle the stock purchase

contracts. See — “Subsequent Events.”

Common Stock Issuance. On October 8, 2008, the Holding Company issued 86,250,000 shares of its common stock at a price of

$26.50 per share for gross proceeds of $2.3 billion. Of the shares issued, 75,000,000 shares were issued from treasury stock.

Preferred Stock. During the year ended December 31, 2008, the Holding Company issued no new preferred stock. In December

2008, the Holding Company entered into a replacement capital covenant (the “Replacement Capital Covenant”) whereby the Company

agreed for the benefit of holders of one or more series of the Company’s unsecured long-term indebtedness designated from time to time

by the Company in accordance with the terms of the Replacement Capital Covenant (“Covered Debt”), that the Company will not repay,

redeem or purchase and will cause its subsidiaries not to repay, redeem or purchase, on or before the termination of the Replacement

Capital Covenant on December 31, 2018 (or earlier termination by agreement of the holders of Covered Debt or when there is no longer

any outstanding series of unsecured long-term indebtedness which qualifies for designation as “Covered Debt”), the Floating Rate Non-

Cumulative Preferred Stock, Series A, of the Company or the 6.500% Non-Cumulative Preferred Stock, Series B, of the Company, unless

such repayment, redemption or purchase is made from the proceeds of the issuance of certain replacement capital securities and pursuant

to the other terms and conditions set forth in the Replacement Capital Covenant.

Liquidity and Capital Uses

The primary uses of liquidity of the Holding Company include debt service, cash dividends on common and preferred stock, capital

contributions to subsidiaries, payment of general operating expenses, acquisitions and the repurchase of the Holding Company’s common

stock.

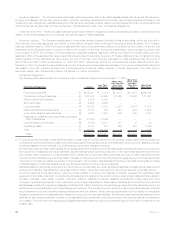

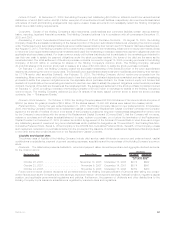

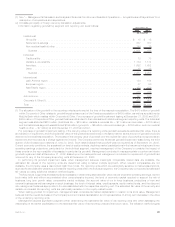

Dividends. The table below presents declaration, record and payment dates, as well as per share and aggregate dividend amounts,

for the common stock:

Declaration Date Record Date Payment Date Per Share Aggregate

Dividend

(In millions, except

per share data)

October 28, 2008 . . . . . . . . . . . . . . . . . . . . . . November 10, 2008 December 15, 2008 $0.74 $592

October 23, 2007 . . . . . . . . . . . . . . . . . . . . . . November 6, 2007 December 14, 2007 $0.74 $541

October 24, 2006 . . . . . . . . . . . . . . . . . . . . . . November 6, 2006 December 15, 2006 $0.59 $450

Future common stock dividend decisions will be determined by the Holding Company’s Board of Directors after taking into consid-

eration factors such as the Company’s current earnings, expected medium- and long-term earnings, financial condition, regulatory capital

position, and applicable governmental regulations and policies. Furthermore, the payment of dividends and other distributions to the

Holding Company by its insurance subsidiaries is regulated by insurance laws and regulations.

63MetLife, Inc.