MetLife 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note Regarding Forward-Looking Statements

This Annual Report, including the Management’s Discussion and Analysis of Financial Condition and Results of Operations, may contain

or incorporate by reference information that includes or is based upon forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements

can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,”

“expect,” “project,” “intend,” “plan,” “believe” and other words and terms of similar meaning in connection with a discussion of future

operating or financial performance. In particular, these include statements relating to future actions, prospective services or products,

future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such

as legal proceedings, trends in operations and financial results. See “Management’s Discussion and Analysis of Financial Condition and

Results of Operations.”

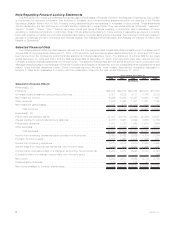

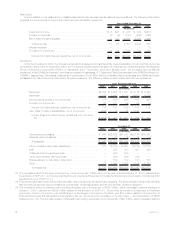

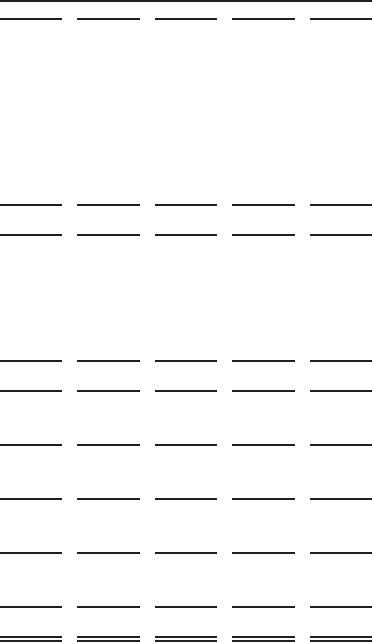

Selected Financial Data

The following selected financial data has been derived from the Company’s audited consolidated financial statements. The statement of

income data for the years ended December 31, 2008, 2007 and 2006, and the balance sheet data at December 31, 2008 and 2007 have

been derived from the Company’s audited financial statements included elsewhere herein. The statement of income data for the years

ended December 31, 2005 and 2004, and the balance sheet data at December 31, 2006, 2005 and 2004 have been derived from the

Company’s audited financial statements not included herein. The selected financial data set forth below should be read in conjunction with

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and

related notes included elsewhere herein. Some previously reported amounts, most notably discontinued operations discussed in

footnote 2, have been reclassified to conform with the presentation at and for the year ended December 31, 2008.

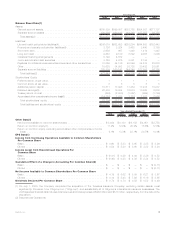

2008 2007 2006 2005 2004

Years Ended December 31,

(In millions)

Statement of Income Data(1)

Revenues(2), (3):

Premiums ................................................ $25,914 $22,970 $22,052 $20,979 $18,842

Universal life and investment-type product policy fees . . . . . . . . . . . . . . . . . . . . 5,381 5,238 4,711 3,775 2,819

Netinvestmentincome........................................ 16,296 18,063 16,247 14,064 11,627

Otherrevenues............................................. 1,586 1,465 1,301 1,221 1,152

Netinvestmentgains(losses).................................... 1,812 (578) (1,382) (112) 114

Totalrevenues ......................................... 50,989 47,158 42,929 39,927 34,554

Expenses(2), (3):

Policyholderbenefitsandclaims.................................. 27,437 23,783 22,869 22,236 19,907

Interest credited to policyholder account balances . . . . . . . . . . . . . . . . . . . . . . 4,787 5,461 4,899 3,650 2,766

Policyholderdividends ........................................ 1,751 1,723 1,698 1,678 1,664

Otherexpenses............................................. 11,924 10,429 9,537 8,259 6,833

Totalexpenses......................................... 45,899 41,396 39,003 35,823 31,170

Income from continuing operations before provision for income tax . . . . . . . . . . . . 5,090 5,762 3,926 4,104 3,384

Provisionforincometax(2)...................................... 1,580 1,660 1,016 1,156 931

Incomefromcontinuingoperations ................................ 3,510 4,102 2,910 2,948 2,453

Income (loss) from discontinued operations, net of income tax(2) . . . . . . . . . . . . . (301) 215 3,383 1,766 391

Income before cumulative effect of a change in accounting, net of income tax . . . . 3,209 4,317 6,293 4,714 2,844

Cumulative effect of a change in accounting, net of income tax(3) . . . . . . . . . . . . — — — — (86)

Netincome ............................................... 3,209 4,317 6,293 4,714 2,758

Preferredstockdividends ...................................... 125 137 134 63 —

Netincomeavailabletocommonshareholders......................... $ 3,084 $ 4,180 $ 6,159 $ 4,651 $ 2,758

2MetLife, Inc.