MetLife 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

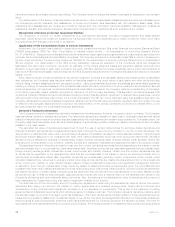

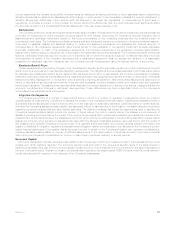

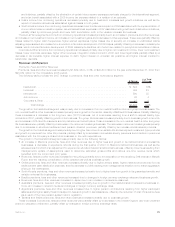

The following table provides the change from the prior year in other expenses by segment: $Change

(In millions)

Institutional................................................................ $ (31)

Individual................................................................. 1,140

International............................................................... (78)

Auto&Home .............................................................. (25)

Corporate&Other........................................................... 489

Totalchange .......................................................... $1,495

The Institutional segment’s decrease in other expenses was principally due to a decrease in DAC amortization primarily due to a charge

associated with the impact of DAC and VOBA amortization from the implementation of SOP 05-1 in the prior year and a decrease mainly

due to the impact of amortization refinements in the current year. This decrease was offset by increases in non-deferrable volume-related

expenses and corporate support expenses. Also offsetting this decrease was the impact of revisions to certain pension and postretirement

liabilities in the current year.

The Individual segment’s increase in other expenses included higher DAC amortization primarily related to lower expected future gross

profits due to separate account balance decreases resulting from recent market declines, higher net investment gains primarily due to net

derivative gains and the reduction in expected cumulative earnings of the closed block partially offset by a reduction in actual earnings of

the closed block and changes in assumptions used to estimate future gross profits and margins. There was an additional increase due to

the impact of revisions to certain pension and postretirement liabilities in the current year. The increases in other expenses were offset by a

decrease in nondeferrable volume-related expenses and by the write-off of a receivable from a joint-venture partner in the prior year.

The International segment’s decrease in other expenses was driven mainly by Argentina’s prior year pension liability and the favorable

impact of foreign currency exchange rates. The decrease in Argentina’s other expenses was primarily due to the establishment in the prior

year of a liability for pension servicing obligations due to pension reform, the elimination of the liability for pension servicing obligations and

the elimination of DAC for the pension business in the current year as a result of the nationalization of the pension system, as well as the

elimination of contingent liabilities for certain cases due to recent court decisions related to the pesification of insurance contracts by the

government in 2002. This decrease was offset primarily by an increase in other expenses in South Korea, the United Kingdom, and other

countries. South Korea’s other expenses increased primarily due to an increase in DAC amortization related to market performance, as well

as higher spending on advertising and marketing, offset by a refinement in DAC capitalization. The United Kingdom’s other expenses

increased due to business growth as well as lower DAC amortization in the prior year resulting from calculation refinements partially offset

by foreign currency transaction gains. Other expenses increased in India, Chile and Mexico primarily due to growth initiatives. Contributions

from the other countries accounted for the remainder of the change in other expenses.

The Auto & Home segment’s decrease in other expenses was principally as a result of lower commissions, decrease in surveys and

underwriting reports and other sales-related expenses, partially offset by an unfavorable change in DAC capitalization, net of amortization.

The increase in other expenses in Corporate & Other was primarily due to higher MetLife Bank costs, higher post-employment related

costs in the current period associated with the implementation of an enterprise-wide cost reduction and revenue enhancement initiative,

higher corporate support expenses including incentive compensation, rent, advertising and information technology costs. Corporate

expenses also increased from lease impairments for Company use space that is currently vacant and higher costs from MetLife Foundation

contributions, partially offset by a reduction in deferred compensation expenses. Interest expense was higher due to issuances of junior

subordinated debt in December 2007 and April 2008 and collateral financing arrangements in May 2007 and December 2007, partially

offset by rate reductions on variable rate collateral financing arrangements in 2008, the prepayment of shares subject to mandatory

redemption in October 2007 and the reduction of commercial paper outstanding. Higher legal costs were principally driven by costs

associated with the commutation of three asbestos-related excess insurance policies and decreases in prior year legal liabilities partially

offset by current year decreases resulting from the resolution of certain matters. These increases were partially offset by a reduction in

decreases in interest credited on bankholder deposits and interest on uncertain tax positions.

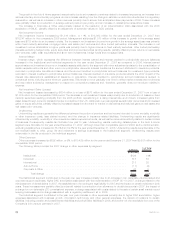

Net Income

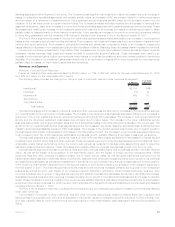

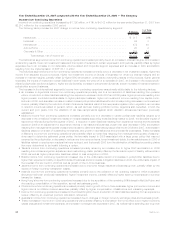

Income tax expense for the year ended December 31, 2008 was $1,580 million, or 31% of income from continuing operations before

provision for income tax, versus $1,660 million, or 29% of such income, for the comparable 2007 period. The 2008 and 2007 effective tax

rates differ from the corporate tax rate of 35% primarily due to the impact of non-taxable investment income and tax credits for investments

in low income housing. In addition, the decrease in the effective tax rate is primarily attributable to changes in the ratio of permanent

differences to income before income taxes.

Income (loss) from discontinued operations, net of income tax, decreased by $516 million to a loss of $301 million for the year ended

December 31, 2008 from income of $215 million for the comparable 2007 period. The decrease was primarily the result of the split-off of

substantially all of the Company’s interest in RGA in September 2008 whereby stockholders of the Company were offered the ability to

exchange their MetLife shares for shares of RGA Class B common stock. This resulted in a loss on disposal of discontinued operations of

$458 million, net of income tax. Income from discontinued operations related to RGA’s operations also decreased by $54 million, net of

income tax, for the year ended December 31, 2008. During the fourth quarter of 2008, the Holding Company entered into an agreement to

sell its wholly-owned subsidiary, Cova, which resulted in a gain on disposal of discontinued operations of $37 million, net of income tax.

Income from discontinued operations related to Cova also decreased by $14 million, net of income tax, for the year ended December 31,

2008. As compared to the prior year, there was a reduction in income from discontinued operations of $15 million related to the sale of

SSRM and of $5 million related to the sale of MetLife Australia’s annuities and pension businesses to a third party. There was also a

decrease in income from discontinued real estate operations of $7 million.

23MetLife, Inc.