MetLife 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Insurance Liabilities. The Company’s principal cash outflows primarily relate to the liabilities associated with its various life insurance,

property and casualty, annuity and group pension products, operating expenses and income tax, as well as principal and interest on its

outstanding debt obligations. Liabilities arising from its insurance activities primarily relate to benefit payments under the aforementioned

products, as well as payments for policy surrenders, withdrawals and loans. See “Contractual Obligations.”

Investment and Other. Additional cash outflows include those related to obligations of securities lending activities, investments in real

estate, limited partnerships and joint ventures, as well as litigation-related liabilities.

Securities Lending. The Company participates in a securities lending program whereby blocks of securities, which are included in

fixed maturity and equity securities, are loaned to third parties, primarily major brokerage firms and commercial banks. The Company

requires collateral equal to 102% of the current estimated fair value of the loaned securities to be obtained at the inception of a loan, and

maintained at a level greater than or equal to 100% for the duration of the loan. During the extraordinary market events occurring in the

fourth quarter of 2008, the Company, in limited instances, accepted collateral less than 102% at the inception of certain loans, but never

less than 100%, of the estimated fair value of such loaned securities. These loans involved U.S. Treasury Bills which are considered to have

limited variation in their estimated fair value during the term of the loan. The Company was liable for cash collateral under its control of

$23.3 billion and $43.3 billion at December 31, 2008 and 2007, respectively. During the unprecedented market disruption since mid-

September 2008, the demand for securities loans from the Company’s counterparties has decreased. The volume of securities lending has

decreased in line with reduced demand from counterparties and reduced trading capacity of certain segments of the fixed income

securities market. See “Extraordinary Market Conditions” for further information.

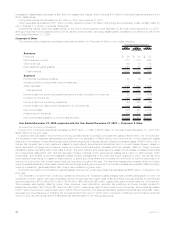

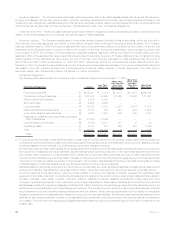

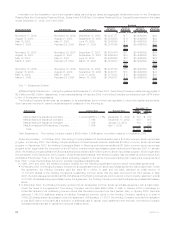

Contractual Obligations

The following table summarizes the Company’s major contractual obligations at December 31, 2008:

Contractual Obligations Total Less Than

One Year

More Than

One Year and

Less Than

Three Years

More Than

Three Years

and Less

Than Five

Years More Than

Five Years

(In millions)

Future policy benefits . . . . . . . . . . . . . . . . . . . (1) $316,201 $ 7,116 $11,013 $11,278 $286,794

Policyholder account balances . . . . . . . . . . . . . (2) 201,975 38,562 27,362 18,690 117,361

Other policyholder liabilities . . . . . . . . . . . . . . . (3) 5,890 5,890 — — —

Short-termdebt.......................(4) 2,662 2,662 — — —

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . (4) 16,703 1,072 2,232 2,091 11,308

Collateral financing arrangements . . . . . . . . . . . (4) 8,138 122 243 243 7,530

Junior subordinated debt securities . . . . . . . . . . (4) 9,637 1,278 409 409 7,541

Payables for collateral under securities loaned and

othertransactions ....................(5) 31,059 31,059 — — —

Commitments to lend funds . . . . . . . . . . . . . . . (6) 8,196 8,011 147 6 32

Operating leases . . . . . . . . . . . . . . . . . . . . . . (7) 2,141 278 460 323 1,080

Other..............................(8) 10,515 10,161 6 3 345

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $613,117 $106,211 $41,872 $33,043 $431,991

(1) Future policyholder benefits include liabilities related to traditional whole life policies, term life policies, closeout and other group annuity

contracts, structured settlements, master terminal funding agreements, single premium immediate annuities, long-term disability policies,

individual disability income policies, LTC policies and property and casualty contracts.

Included within future policyholder benefits are contracts where the Company is currently making payments and will continue to do so until

the occurrence of a specific event such as death, as well as those where the timing of a portion of the payments has been determined by

the contract. Also included are contracts where the Company is not currently making payments and will not make payments until the

occurrence of an insurable event, such as death or illness, or where the occurrence of the payment triggering event, such as a surrender

of a policy or contract, is outside the control of the Company. The Company has estimated the timing of the cash flows related to these

contracts based on historical experience as well as its expectation of future payment patterns.

Liabilities related to accounting conventions or which are not contractually due, such as shadow liabilities, excess interest reserves and

property and casualty loss adjustment expenses of $303 million, have been excluded from amounts presented in the table above.

Amounts presented in the table above, excluding those related to property and casualty contracts, represent the estimated cash

payments for benefits under such contracts including assumptions related to the receipt of future premiums and assumptions related to

mortality, morbidity, policy lapse, renewal, retirement, inflation, disability incidence, disability terminations, policy loans and other

contingent events as appropriate to the respective product type. Payments for case reserve liabilities and incurred but not reported

liabilities associated with property and casualty contracts of $1.5 billion have been included using an estimate of the ultimate amount to be

settled under the policies based upon historical payment patterns. The ultimate amount to be paid under property and casualty contracts

is not determined until the Company reaches a settlement with the claimant, which may vary significantly from the liability or contractual

obligation presented above especially as it relates to incurred but not reported liabilities. All estimated cash payments presented in the

table above are undiscounted as to interest, net of estimated future premiums on policies currently in-force and gross of any reinsurance

recoverable. The more than five years category displays estimated payments due for periods extending for more than 100 years from the

present date.

54 MetLife, Inc.