MetLife 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

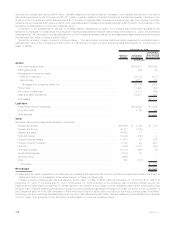

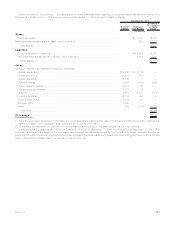

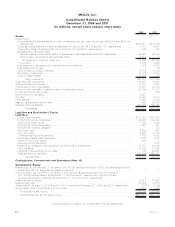

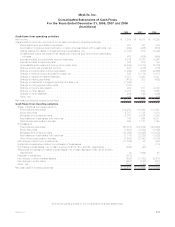

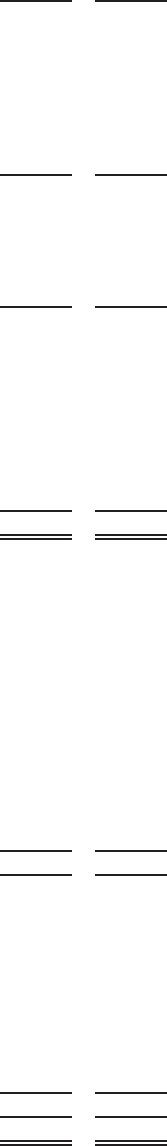

MetLife, Inc.

Consolidated Balance Sheets

December 31, 2008 and 2007

(In millions, except share and per share data)

2008 2007

Assets

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $209,508 and $229,354,

respectively) .............................................................. $188,251 $232,336

Equity securities available-for-sale, at estimated fair value (cost: $4,131 and $5,732, respectively) . . . . . . . . 3,197 5,911

Trading securities, at estimated fair value (cost: $1,107 and $768, respectively) . . . . . . . . . . . . . . . . . . . . 946 779

Mortgage and consumer loans:

Held-for-investment, at amortized cost (net of allowances for loan losses of $304 and $197, respectively) . . . . . . . . . . . 49,352 46,149

Held-for-sale,principallyatestimatedfairvalue........................................ 2,012 5

Mortgageandconsumerloans,net.............................................. 51,364 46,154

Policyloans................................................................ 9,802 9,326

Realestateandrealestatejointventuresheld-for-investment................................ 7,585 6,728

Realestateheld-for-sale........................................................ 1 39

Otherlimitedpartnershipinterests.................................................. 6,039 6,155

Short-terminvestments ........................................................ 13,878 2,544

Otherinvestedassets ......................................................... 17,248 8,076

Total investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 298,311 318,048

Cashandcashequivalents ....................................................... 24,207 9,961

Accruedinvestmentincome....................................................... 3,061 3,545

Premiumsandotherreceivables .................................................... 16,973 13,373

Deferredpolicyacquisitioncostsandvalueofbusinessacquired............................... 20,144 17,810

Currentincometaxrecoverable..................................................... — 334

Deferredincometaxassets ....................................................... 4,927 —

Goodwill ................................................................... 5,008 4,814

Otherassets................................................................. 7,262 8,239

Assetsofsubsidiariesheld-for-sale .................................................. 946 22,883

Separate account assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120,839 160,142

Totalassets............................................................ $501,678 $559,149

Liabilities and Stockholders’ Equity

Liabilities:

Futurepolicybenefits.......................................................... $130,555 $126,016

Policyholder account balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149,805 130,342

Otherpolicyholderfunds........................................................ 7,762 7,838

Policyholderdividendspayable ................................................... 1,023 991

Policyholderdividendobligation................................................... — 789

Short-termdebt ............................................................. 2,659 667

Long-termdebt.............................................................. 9,667 9,100

Collateralfinancingarrangements.................................................. 5,192 4,882

Juniorsubordinateddebtsecurities................................................. 3,758 4,075

Currentincometaxpayable...................................................... 342 —

Deferredincometaxliability...................................................... — 1,502

Payablesforcollateralundersecuritiesloanedandothertransactions .......................... 31,059 44,136

Otherliabilities .............................................................. 14,535 12,829

Liabilitiesofsubsidiariesheld-for-sale ............................................... 748 20,661

Separate account liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120,839 160,142

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 477,944 523,970

Contingencies, Commitments and Guarantees (Note 16)

Stockholders’ Equity:

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized; 84,000,000 shares issued and

outstanding;$2,100aggregateliquidationpreference..................................... 1 1

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 798,016,664 and

786,766,664 shares issued at December 31, 2008 and 2007, respectively; 793,629,070 and

729,223,440 shares outstanding at December 31, 2008 and 2007, respectively . . . . . . . . . . . . . . . . . . . 8 8

Additionalpaid-incapital......................................................... 15,811 17,098

Retainedearnings ............................................................. 22,403 19,884

Treasury stock, at cost; 4,387,594 and 57,543,224 shares at December 31, 2008 and 2007, respectively . . . . (236) (2,890)

Accumulatedothercomprehensiveincome(loss) ......................................... (14,253) 1,078

Totalstockholders’equity...................................................... 23,734 35,179

Totalliabilitiesandstockholders’equity............................................. $501,678 $559,149

See accompanying notes to the consolidated financial statements.

F-2 MetLife, Inc.