MetLife 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

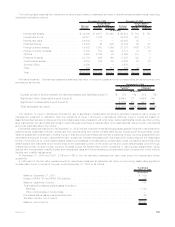

primary return on investment is in the form of tax credits, and which are accounted for under the equity method. Funding agreements

represent arrangements where the Company has long-term interest bearing amounts on deposit with third parties and are generally stated

at amortized cost. Funds withheld represent amounts contractually withheld by ceding companies in accordance with reinsurance

agreements.

Leveraged Leases

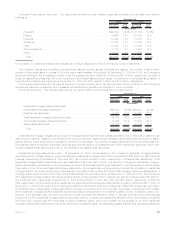

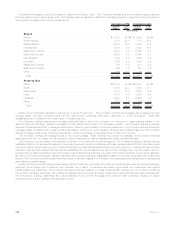

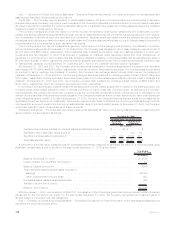

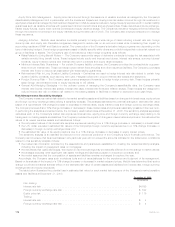

Investment in leveraged leases, included in other invested assets, consisted of the following:

2008 2007

December 31,

(In millions)

Rentalreceivables,net .................................................. $1,486 $1,491

Estimatedresidualvalues................................................. 1,913 1,881

Subtotal............................................................ 3,399 3,372

Unearnedincome...................................................... (1,253) (1,313)

Investmentinleveragedleases ............................................. $2,146 $2,059

The Company’s deferred income tax liability related to leveraged leases was $1.2 billion and $1.0 billion at December 31, 2008 and

2007, respectively. The rental receivables set forth above are generally due in periodic installments. The payment periods range from one

to 15 years, but in certain circumstances are as long as 30 years.

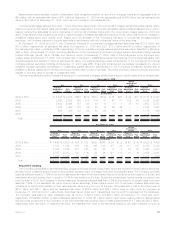

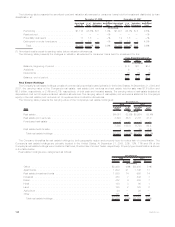

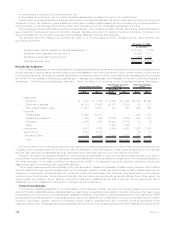

The components of net income from investment in leveraged leases are as follows:

2008 2007 2006

Years Ended

December 31,

(In millions)

Income from investment in leveraged leases (included in net investment income) . . . . . . . . . . $116 $ 68 $ 55

Less:Incometaxexpenseonleveragedleases................................ (40) (24) (18)

Netincomefrominvestmentinleveragedleases............................... $ 76 $44 $37

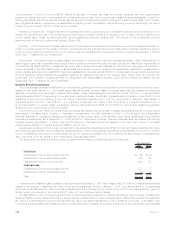

Mortgage Servicing Rights

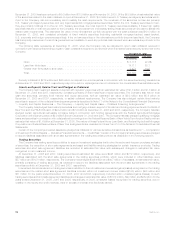

The following table presents the changes in capitalized mortgage servicing rights for the year ended December 31, 2008:

Carrying Value

(In millions)

Fair value on December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ —

Acquisitionofmortgageservicingrights ......................................... 350

Reductionduetoloanpayments.............................................. (10)

Reductionduetosales.................................................... —

Changes in fair value due to:

Changesinvaluationmodelinputsorassumptions................................. (149)

Otherchangesinfairvalue................................................ —

Fair value on December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 191

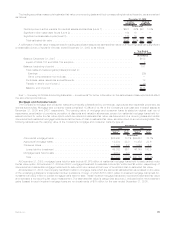

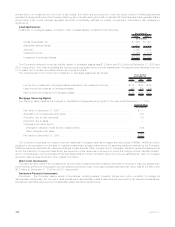

The Company recognizes the rights to service residential mortgage loans as mortgage servicing rights (“MSRs”). MSRs are either

acquired or are generated from the sale of originated residential mortgage loans where the servicing rights are retained by the Company.

MSRs are carried at estimated fair value and changes in estimated fair value, primarily due to changes in valuation inputs and assumptions

and to the collection of expected cash flows, are reported in other revenues in the period in which the change occurs. See also Notes 1

and 18 of the Notes to the Consolidated Financial Statements for further information about the how the estimated fair value of mortgage

servicing rights is determined and other related information.

Short-term Investments

The carrying value of short-term investments, which include investments with remaining maturities of one year or less, but greater than

three months, at the time of acquisition and are stated at amortized cost, which approximates estimated fair value, was $13.9 billion and

$2.5 billion at December 31, 2008 and 2007, respectively.

Derivative Financial Instruments

Derivatives. The Company uses a variety of derivatives, including swaps, forwards, futures and option contracts, to manage its

various risks. Additionally, the Company uses derivatives to synthetically create investments as permitted by its insurance subsidiaries’

Derivatives Use Plans approved by the applicable state insurance departments.

104 MetLife, Inc.