MetLife 2008 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

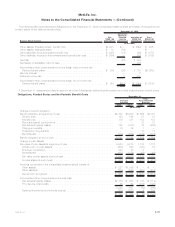

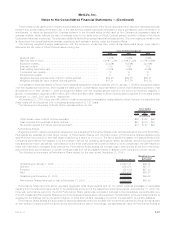

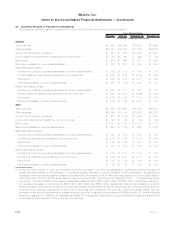

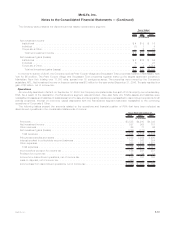

Dividend Restrictions

The table below sets forth the dividends permitted to be paid by the respective insurance subsidiary without insurance regulatory

approval and the respective dividends paid:

Company Permitted w/o

Approval(1) Paid(2) Permitted w/o

Approval(3) Paid(2) Permitted w/o

Approval(3)

2009 2008 2007

(In millions)

Metropolitan Life Insurance Company . . . . . . . . . . . . . . . . . $552 $1,318(4) $1,299 $500 $919

MetLife Insurance Company of Connecticut . . . . . . . . . . . . . $714 $ 500 $1,026 $690(6) $690

Metropolitan Tower Life Insurance Company . . . . . . . . . . . . $ 88 $ 277(5) $ 113 $ — $104

Metropolitan Property and Casualty Insurance Company . . . . . $ 9 $ 300 $ — $400 $ 16

(1) Reflects dividend amounts that may be paid during 2009 without prior regulatory approval. However, if paid before a specified date during

2009, some or all of such dividends may require regulatory approval.

(2) All amounts paid, including those requiring regulatory approval.

(3) Reflects dividend amounts that could have been paid during the relevant year without prior regulatory approval.

(4) As described in Note 2, consists of shares of RGA stock distributed by MLIC to the Holding Company as an in-kind dividend of

$1,318 million.

(5) Includes shares of an affiliate distributed to the Holding Company as an in-kind dividend in the amount of $164 million.

(6) Includes a return of capital of $404 million as approved by the applicable insurance department, of which $350 million was paid to the

Holding Company.

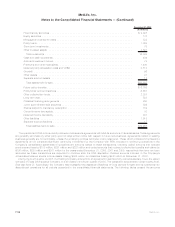

Under New York State Insurance Law, MLIC is permitted, without prior insurance regulatory clearance, to pay stockholder dividends to

the Holding Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the lesser of: (i) 10% of

its surplus to policyholders as of the end of the immediately preceding calendar year; or (ii) its statutory net gain from operations for the

immediately preceding calendar year (excluding realized capital gains). MLIC will be permitted to pay a cash dividend to the Holding

Company in excess of the lesser of such two amounts only if it files notice of its intention to declare such a dividend and the amount thereof

with the Superintendent and the Superintendent does not disapprove the distribution within 30 days of its filing. Under New York State

Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of a stock life insurance company

would support the payment of such dividends to its shareholders. The New York State Department of Insurance (the “Department”) has

established informal guidelines for such determinations. The guidelines, among other things, focus on the insurer’s overall financial

condition and profitability under statutory accounting practices.

Under Connecticut State Insurance Law, MICC is permitted, without prior insurance regulatory clearance, to pay shareholder dividends

to its parent as long as the amount of such dividends, when aggregated with all other dividends in the preceding 12 months, does not

exceed the greater of: (i) 10% of its surplus to policyholders as of the end of the immediately preceding calendar year; or (ii) its statutory net

gain from operations for the immediately preceding calendar year. MICC will be permitted to pay a cash dividend in excess of the greater of

such two amounts only if it files notice of its declaration of such a dividend and the amount thereof with the Connecticut Commissioner of

Insurance (the “Connecticut Commissioner”) and the Connecticut Commissioner does not disapprove the payment within 30 days after

notice. In addition, any dividend that exceeds earned surplus (unassigned funds, reduced by 25% of unrealized appreciation in value or

revaluation of assets or unrealized profits on investments) as of the last filed annual statutory statement requires insurance regulatory

approval. Under Connecticut State Insurance Law, the Connecticut Commissioner has broad discretion in determining whether the

financial condition of a stock life insurance company would support the payment of such dividends to its shareholders. The Connecticut

State Insurance Law requires prior approval for any dividends for a period of two years following a change in control. As a result of the

acquisition of MICC by the Holding Company on July 1, 2005, under Connecticut State Insurance Law, all dividend payments by MICC

through June 30, 2007 required prior approval of the Connecticut Commissioner.

Under Delaware State Insurance Law, Metropolitan Tower Life Insurance Company is permitted, without prior insurance regulatory

clearance, to pay a stockholder dividend to the Holding Company as long as the amount of the dividend when aggregated with all other

dividends in the preceding 12 months does not exceed the greater of: (i) 10% of its surplus to policyholders as of the end of the

immediately preceding calendar year; or (ii) its statutory net gain from operations for the immediately preceding calendar year (excluding

realized capital gains). MTL will be permitted to pay a cash dividend to the Holding Company in excess of the greater of such two amounts

only if it files notice of the declaration of such a dividend and the amount thereof with the Delaware Commissioner of Insurance (the

“Delaware Commissioner”) and the Delaware Commissioner does not disapprove the distribution within 30 days of its filing. In addition, any

dividend that exceeds earned surplus (defined as unassigned funds) as of the last filed annual statutory statement requires insurance

regulatory approval. Under Delaware State Insurance Law, the Delaware Commissioner has broad discretion in determining whether the

financial condition of a stock life insurance company would support the payment of such dividends to its shareholders.

Under Rhode Island State Insurance Law, MPC is permitted, without prior insurance regulatory clearance, to pay a stockholder dividend

to the Holding Company as long as the aggregate amount of all such dividends in any twelve-month period does not exceed the lesser of:

(i) 10% of its surplus to policyholders as of the end of the immediately preceding calendar year; or (ii) net income, not including realized

capital gains, for the immediately preceding calendar year, which may include carry forward net income from the second and third

preceding calendar years excluding realized capital gains and less dividends paid in the second and immediately preceding calendar

years. MPC will be permitted to pay a cash dividend to the Holding Company in excess of the lesser of such two amounts only if it files

notice of its intention to declare such a dividend and the amount thereof with the Rhode Island Commissioner of Insurance (the “Rhode

Island Commissioner”) and the Rhode Island Commissioner does not disapprove the distribution within 30 days of its filing. Under Rhode

F-89MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)